Bitwise Chief Predicts Bitcoin Could Set New Records in 2026 and Break the 4-Year Cycle!

Jakarta, Pintu News – Major asset managers project that Bitcoin (BTC) will break its traditional four-year cycle and reach a new all-time high price in 2026, driven by large institutional capital flows and regulatory clarity.

Bitcoin Predicted to Surpass Previous Peaks

Matt Hougan, Bitwise’s Chief Investment Officer, and Grayscale Research both project that BTC will surpass its previous peak although many believe that 2026 should be the year of decline.

Read also: Bitcoin Price Stuck at $85,000 Today: Crypto Whale Buys $4.6 Billion BTC in a Week!

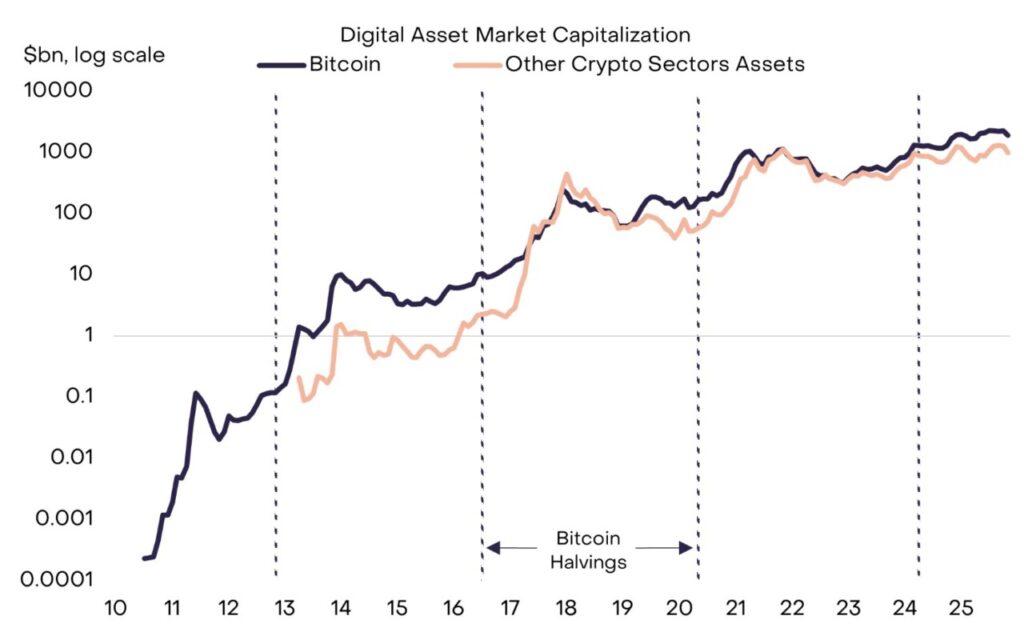

Historically, Bitcoin follows a four-year cycle associated with halving events, with three years of significant gains followed by a sharp correction.

Since the most recent halving occurred in April 2024, more than 18 months ago, traditional cycle theory would predict 2026 as the year of the decline.

However, Hougan argues that the factors that drove the previous cycle have weakened substantially, while new structural dynamics are taking shape.

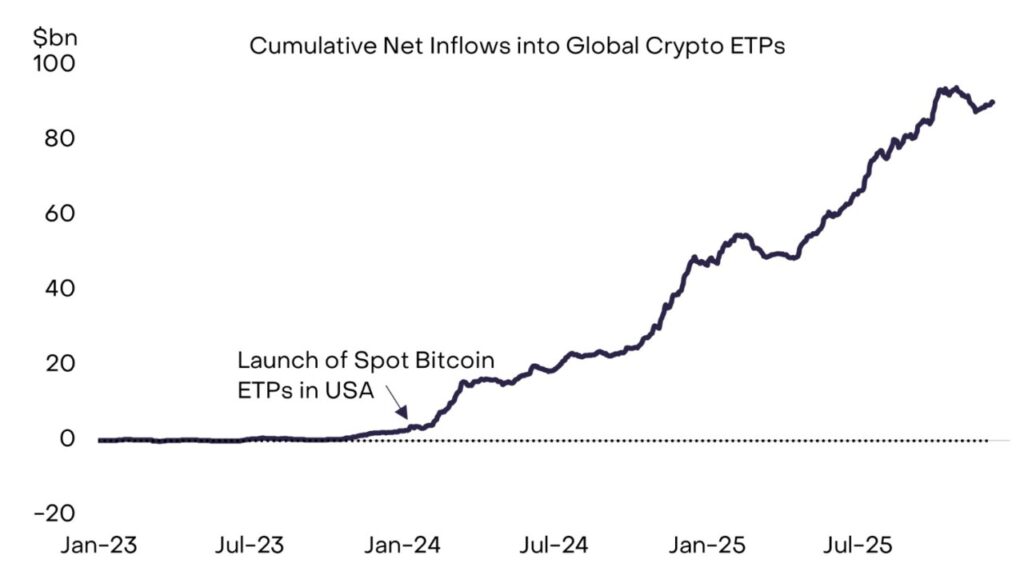

“We believe that the wave of institutional capital that began entering the market with the approval of spot bitcoin ETFs in 2024 will accelerate in 2026, when platforms such as Morgan Stanley, Wells Fargo, and Merrill Lynch begin making allocations,” Hougan wrote in Bitwise’s annual predictions report.

He predicts Bitcoin will reach an all-time high, burying the four-year cycle in history.

Institutional Era Replaces Retail-Driven Volatility

Grayscale’s outlook for 2026 reflects this transformation, with projections that Bitcoin will set a new record in the first half of next year as the market moves into what they call the institutional era.

This asset manager identified two pillars that support this view:

- Macro demand for alternative store of value amid rising public debt.

- Fiat currency risk, coupled with improved regulatory clarity that deepens the integration of blockchain with traditional finance.

This change in market structure is already affecting Bitcoin’s price behavior. The previous bull market witnessed gains of more than 1,000% in a year, while the biggest increase in this cycle only reached 240% until March 2024.

Grayscale attributes this moderation to more stable institutional buying, rather than a boost in retail momentum, arguing that the likelihood of a large and prolonged downturn has been significantly reduced.

Grayscale expects rising valuations in the crypto sector in 2026, and as a result, Bitcoin could surpass its previous high in the first half of that year.

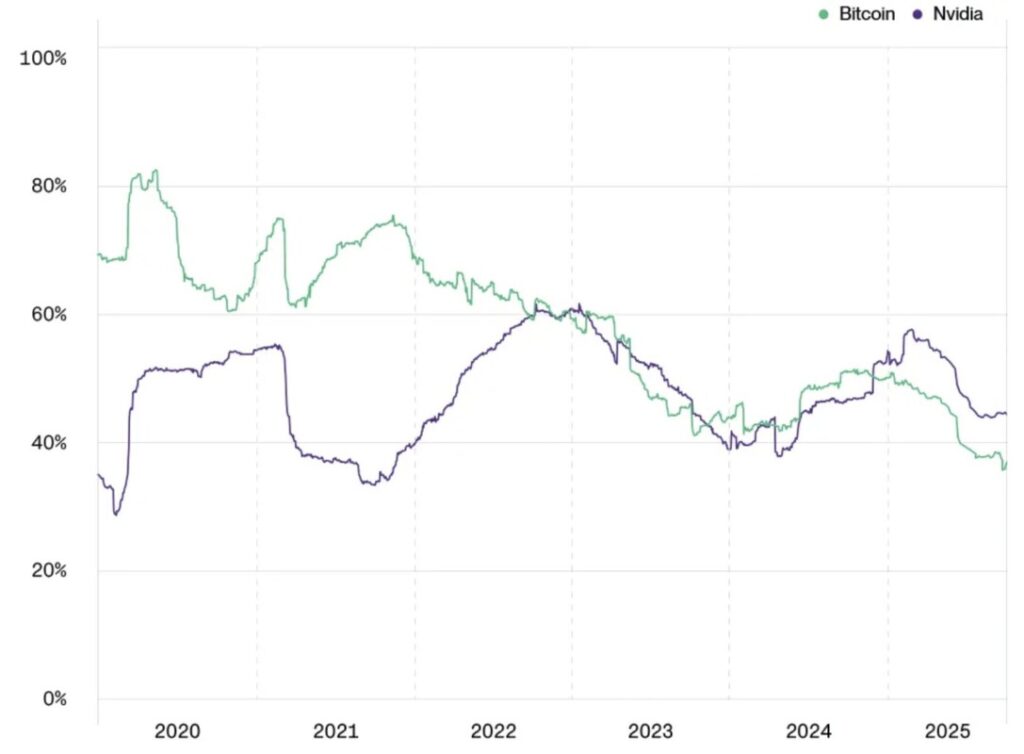

Bitwise’s analysis also highlights how Bitcoin’s volatility has reduced steadily over the past decade, with BTC now less volatile than Nvidia throughout 2025.

Hougan predicts Bitcoin’s correlation with stocks will decline by 2026, as crypto-specific factors such as regulatory progress and institutional adoption will drive the asset higher even as stocks struggle.

Regulatory Clarity and Monetary Policy Adjustments

Katherine Dowling, president of Bitcoin Standard Treasury Company, recently predicted that Bitcoin will reach $150,000 by the end of 2026, citing “a trifecta of a positive regulatory environment, quantitative easing, and institutional capital flows.”

President Trump recently signed the GENIUS Act, which establishes a regulatory framework for stablecoins, while the Office of the Comptroller of the Currency granted national banks permission to offer crypto-brokerage services.

This month, Bank of America is now allowing its financial advisors to recommend Bitcoin ETFs, potentially directing some of the bank’s $3.5 trillion in client assets into the digital asset.

Read also: Bitwise Predicts Solana Price to Hit a Record in 2026: Big Rally to $250 Awaits?

The Federal Reserve cut interest rates three times in 2025 and is expected to continue easing next year.

Interestingly, Grayscale predicts that bipartisan crypto market structure legislation will be passed in the US by 2026, which will strengthen blockchain-based finance in the capital markets.

Since the launch of the US Bitcoin ETP in January 2024, global crypto ETPs have attracted net inflows of $87 billion, despite less than 0.5% of wealth under management in the US being allocated to crypto.

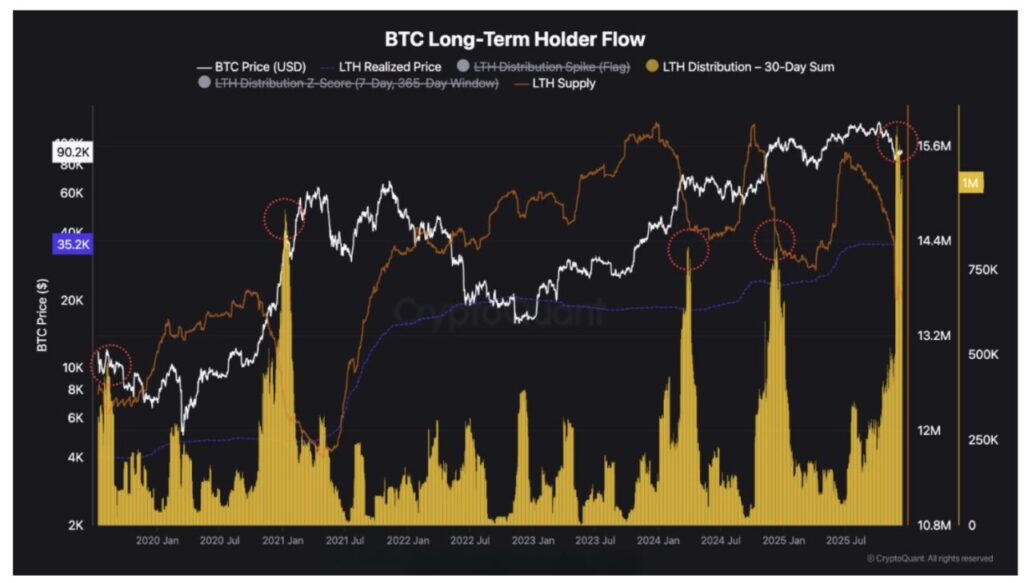

On a technical level, according to CryptoQuant analysts, on-chain data shows long-term holders distributing coins at one of the largest 30-day distribution rates in the last 5 years, which generally indicates end-of-cycle behavior.

However, CryptoQuant data also shows that short-term holders are facing pressure, as Bitcoin has been trading below their cost basis of $104,000 since October 30, resulting in an average unrealized loss of 12.6%.

As reported by Cryptonews today, Bitcoin fell nearly 4% to around $85,940 amid risk reduction by investors ahead of important US economic data.

Despite short-term volatility, like other major players, Bitfinex remains of the opinion that the foundation for BTC to reach all-time high prices by 2026 is being built, supported by looser monetary policies and steady adoption by ETFs, corporations, and state entities that absorb several times the annual supply mined.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Bitwise Chief: Bitcoin to Hit Fresh Records in 2026 and Break Four-Year Cycle. Accessed on December 19, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.