Will Bitcoin Surge Soon? Watch Binance Move!

Jakarta, Pintu News – Binance investors may be signaling an upcoming Bitcoin price hike. In recent weeks, Bitcoin (BTC) market sentiment has been bearish, with the latest drop pushing the price to the $86,000 level. However, trading activity on Binance, the world’s largest crypto exchange according to CoinMarketCap, is showing different indications that are worth keeping an eye on.

Binance Capital Flows Reach Record High

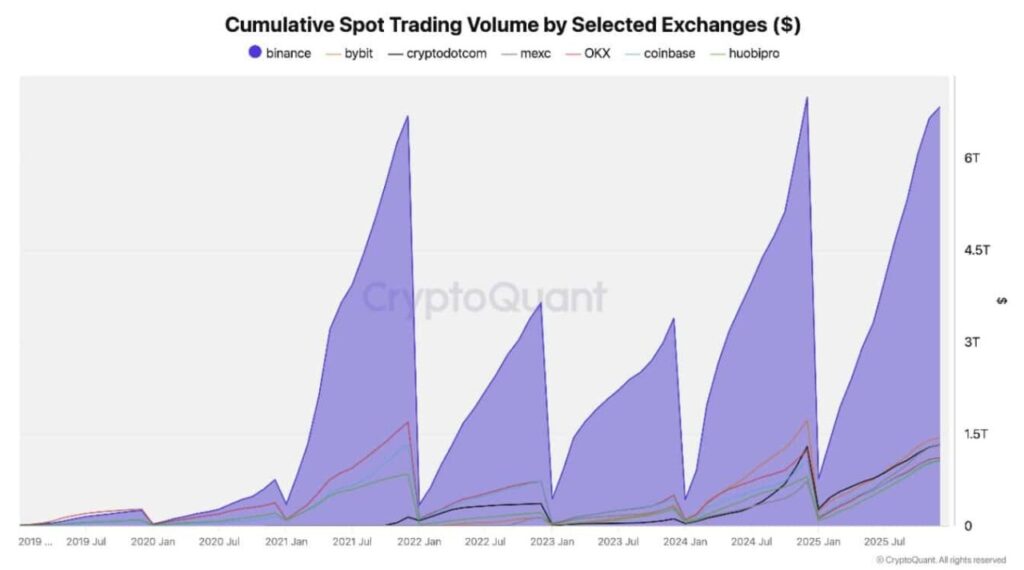

Capital inflows to Binance hit a record high. The latest report from CryptoQuant shows that capital inflow into Binance has reached $1.17 trillion, a 31% increase from the previous year. This is the highest inflow recorded among all exchanges. In the perpetual Spot and Futures markets, where investors are showing their confidence, activity has increased significantly.

Spot trading volume has reached a new peak, totaling $7 trillion so far this year. This surge confirms strong investor participation and shows a significant difference compared to Bybit, Binance’s closest competitor, which recorded a Spot trading volume almost five times lower. The perpetual Futures market also shows a similar pattern, with Binance leading the way with a cumulative volume of $24.5 trillion.

Also Read: How Crypto is Remaking the Financial System, AI, and Privacy Until 2026 According to a16z Crypto

Binance Market Bullish Pattern

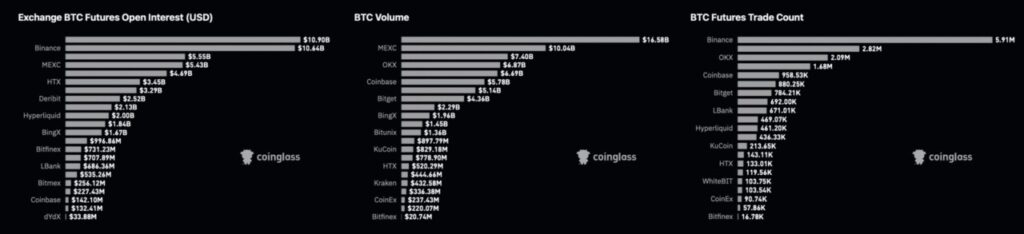

The bullish position in the Binance market is increasing. Currently, Binance holds the largest portion of Bitcoin Open Interest, which is worth $10.90 billion, while the total market Open Interest is $58.63 billion. This imbalance highlights Binance’s influence on price direction. Trading data shows that volume is largely driven by bullish positions, with investors preferring long trades.

The Buyer/Seller Taker Ratio, also known as the Long/Short Ratio, shows buyer dominance with a current ratio of 2.2, a strong number and well above the neutral level of 1. If Binance’s Open Interest continues to increase along with the trading volume leaning bullish, the market may be nearing a rebound point.

Market Sentiment

The overall Bitcoin market is still hesitant. Nonetheless, in the Spot market, sentiment seems to be constructive. Investors have bought about $83 million worth of Bitcoin in the past day. Cumulative net transactions show that about $315 million worth of Bitcoin has been accumulated since the beginning of the week. Meanwhile, the overall Bitcoin perpetuation Futures market is still slightly bearish.

The Buyer/Seller Taker ratio in the broader market is 0.98, indicating marginal seller dominance. Although readings below 1 favor sellers, the narrow gap indicates weak bearish conviction. Other market indicators, including Funding Rate and Open Interest Weighted Funding Rate, continue to show a bullish bias.

Conclusion

Bitcoin investors seem to be getting more optimistic, with the market gradually starting to pick up on bullish signals from Binance investors. A sustained accumulation phase could provide the momentum needed to push Bitcoin back towards $90,000. However, as always, any investment decision should be based on in-depth research and personal judgment.

Also Read: 7 XRP Facts on Institutional Finance via VivoPower’s $900 Million Exposure Structure

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Bitcoin (BTC)?

A1: Bitcoin (BTC) is a digital currency or cryptocurrency created in 2009, which uses peer-to-peer technology to operate without a central authority or bank.

Q2: Why is activity on Binance important for Bitcoin price?

A2: Binance is the world’s largest cryptocurrency exchange, so trading activity on the platform is often considered an important indicator of broader market sentiment.

Q3: What was the Spot trading volume on Binance this year?

A3: Spot trading volume on Binance has reached a record $7 trillion so far this year.

Q4: What is Open Interest?

A4: Open Interest is the number of derivative contracts, such as futures or options, that have not been settled and are still open in the market.

Q5: What is the current market sentiment towards Bitcoin?

A5: Despite bearish tendencies in the broader market, data from Binance suggests that investors may be gearing up for a bullish rebound, with increased activity and predominantly bullish positions.

Reference

- AMB Crypto. Bitcoin’s fate may be tied to Binance’s growing bullish bias – Here’s how. Accessed on December 19, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.