Norway’s $2T Sovereign Wealth Fund Backs Metaplanet, How Will It Impact Crypto Markets?

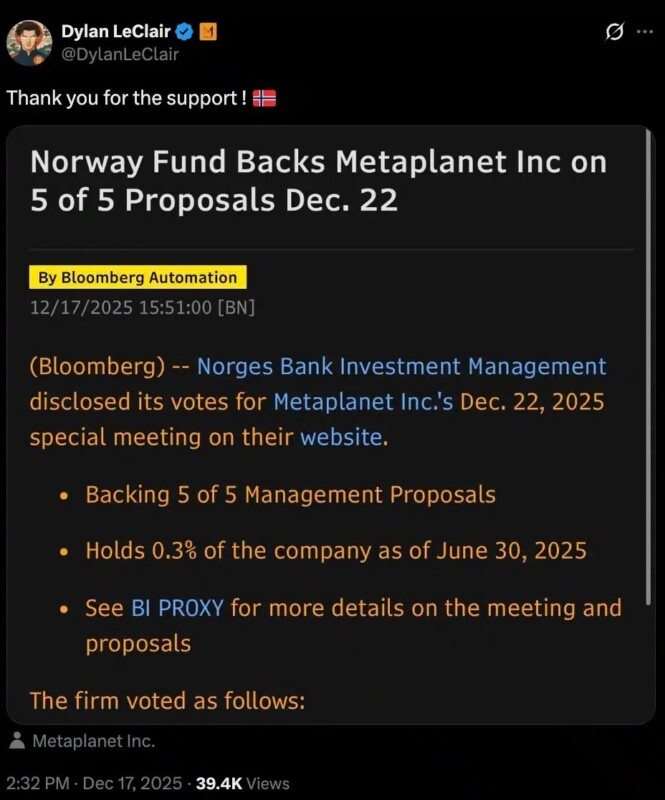

Jakarta, Pintu News – Metaplanet, a company focused on Bitcoin (BTC) accumulation strategies, recently received significant support from Norges Bank Investment Management (NBIM), Norway’s $2 trillion sovereign wealth fund. This support comes ahead of the General Meeting scheduled for December 22, where NBIM showed its full support of Metaplanet’s aggressive strategy.

Strategic Support from NBIM

NBIM, which owns around 0.3% stake in Metaplanet, has publicly supported a Bitcoin-focused treasury strategy. This decision was made after seeing the long-term potential of investing in this cryptocurrency. With the backing of one of the world’s largest sovereign wealth funds, Metaplanet now has more resources to accelerate their Bitcoin accumulation strategy.

In the upcoming General Meeting, five proposals will be discussed, including some major structural changes aimed at strengthening Metaplanet’s capital base. These proposals are expected to provide the impetus needed to continue purchasing large amounts of Bitcoin.

Also Read: How Crypto is Remaking the Financial System, AI, and Privacy Until 2026 According to a16z Crypto

Michael Saylor’s Role and the Bitcoin Treasury Model

NBIM is no stranger to the Bitcoin treasury model, especially through their investment in Strategy, where they own around a 1.05% stake. This position, which is worth over $1.1 billion by the end of 2025, demonstrates NBIM’s serious commitment to this strategy.

Michael Saylor, a known Bitcoin supporter, may have had some influence in this strategy, although his specific role in the context of the NBIM is unclear. This investment suggests that NBIM sees long-term value in Bitcoin as a digital asset. With the backing of an institution as large as NBIM, Metaplanet may be more confident in executing their strategy, despite the valuation pressure.

Bitcoin Purchase Whale by Metaplanet

Since September 29, Metaplanet has stopped buying Bitcoin. This decision was taken after the company’s market value to net asset value (mNAV) fell below 1x. This suggests that Metaplanet is re-evaluating their strategy to ensure that they are not overly exposed to risk in Bitcoin price fluctuations.

This purchase may be a strategic move to stabilize the company’s finances before proceeding with further purchases. This suggests a more cautious approach and may influence the decision in the upcoming General Meeting.

Conclusion

NBIM’s endorsement of Metaplanet marks an important moment in the institutional adoption of Bitcoin. Despite the challenges and valuation pressures, this move may be a catalyst for further changes in the way large corporations manage their digital assets. Going forward, the industry may be closely watching the outcome of this strategy and its effect on the crypto market as a whole.

Also Read: 7 XRP Facts on Institutional Finance via VivoPower’s $900 Million Exposure Structure

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is a Metaplanet?

A1: Metaplanet is a company that focuses on Bitcoin (BTC) accumulation as part of its treasury strategy.

Q2: Why does NBIM support Metaplanets?

A2: NBIM supports Metaplanet as it sees the long-term potential of investing in Bitcoin (BTC) and wants to accelerate the company’s Bitcoin accumulation strategy.

Q3: What are the proposals discussed at the Metaplanet General Meeting?

A3: Proposals discussed included major structural changes to strengthen the capital base and accelerate Bitcoin (BTC) purchases.

Q4: Why did Metaplanet stop buying Bitcoin?

A4: Metaplanet stopped buying Bitcoin as the company’s market value to net asset value (mNAV) fell below 1x, indicating the need for a strategy evaluation.

Q5: What impact has NBIM support had on Metaplanet?

A5: NBIM’s support could give Metaplanet the confidence and resources it needs to continue and expand their Bitcoin (BTC) accumulation strategy.

Reference

- AMB Crypto. Norway’s $2T Fund just backed MetaPlanet, what’s happening?. Accessed on December 19, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.