Top 3 World Stocks by Market Cap in 2025

Jakarta, Pintu News – The global stock market is currently dominated by technology companies with the largest market capitalization and significant influence on the world economy. Based on market cap, the world’s top 3 stocks are NVIDIA (NVDA), Apple (AAPL), and Google (GOOG), which represent the power of innovation, global business scale, and long-term investor confidence.

Interestingly, exposure to these global stocks is now also accessible through tokenized stock on Pintu, which allows investors to participate in the world’s stock price movements more flexibly through blockchain technology.

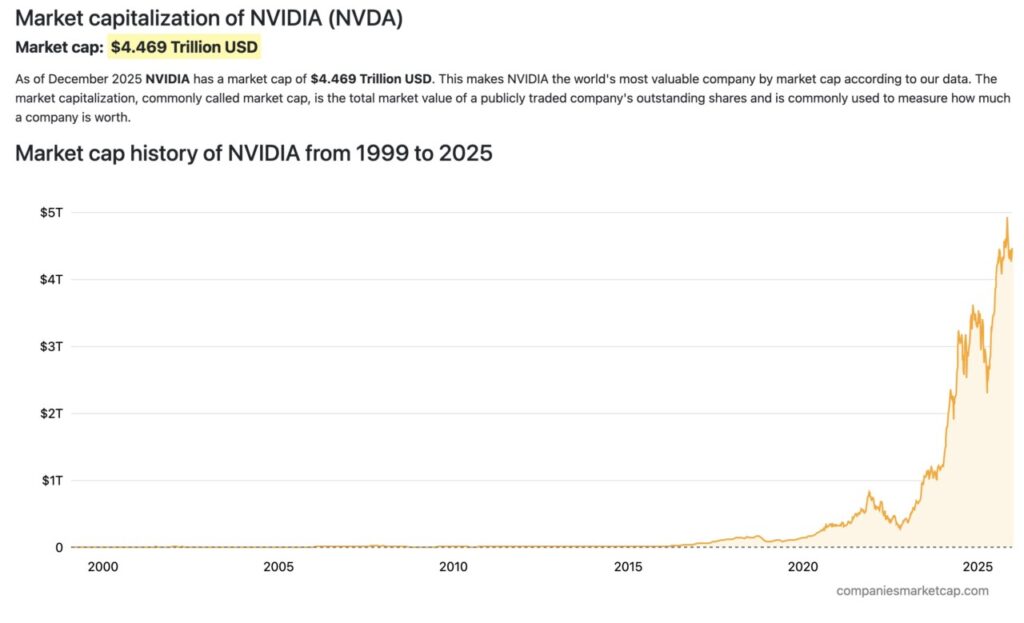

NVIDIA (NVDA) – $4.469 Trillion

The chart shows the development of NVIDIA’s market capitalization (NVDAX) from 1999 to 2025, with very significant spikes in recent years. For the first decade-plus, NVIDIA’s market cap was relatively small and steady, reflecting its position as a semiconductor company with a primary focus on GPUs for graphics and gaming needs. Changes started to take place in the mid-2010s, when parallel computing and GPU acceleration technologies were increasingly adopted across various industry sectors.

Growth peaks from 2020 to 2025, as the explosive adoption of artificial intelligence, data centers, and machine learning makes NVIDIA products a crucial infrastructure for the global AI ecosystem. By December 2025, NVIDIA’s market capitalization reached approximately USD 4.469 trillion, making it the highest valued company in the world. This trend confirms NVIDIA’s transformation from a graphics hardware company to the backbone of next-generation AI and computing technologies.

Also read: These 3 Crypto are Predicted to Set New Record Highs in 2026!

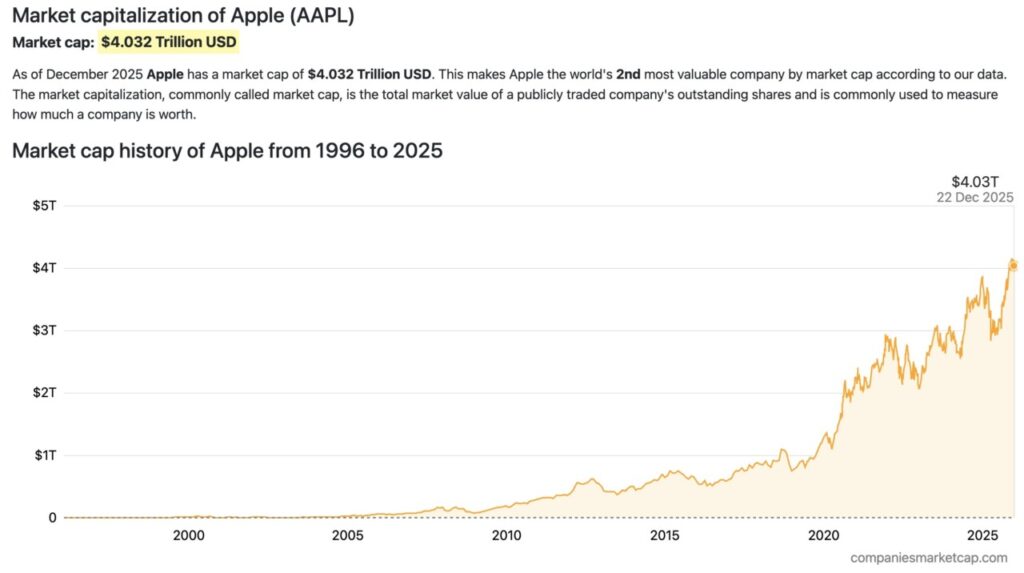

Apple (AAPL) – $4.032 Trillion

The chart illustrates the development of Apple’s (AAPLX) market capitalization from 1996 to 2025, showing a long-term upward trend with some correction phases. In the early period, Apple’s market cap was relatively small and flat, reflecting the company’s recovery phase before the launch of iconic products such as the iPod and iPhone. Growth began to accelerate from the mid-2000s, as Apple transformed into a consumer technology company with an integrated ecosystem of products and services.

The biggest acceleration was seen after 2019, when the expansion of digital services, growth in premium device sales, and the loyalty of the global user base pushed Apple’s valuation into the trillions of US dollars. By December 2025, Apple’s market capitalization will reach approximately USD 4.032 trillion, making it the second-largest market cap company in the world. This pattern confirms Apple’s position as a company with strong fundamentals, recurring revenue, and high business resilience over the long term.

Read also: 10 Cheap Crypto Under $0.1 Worth Monitoring Ahead of 2026

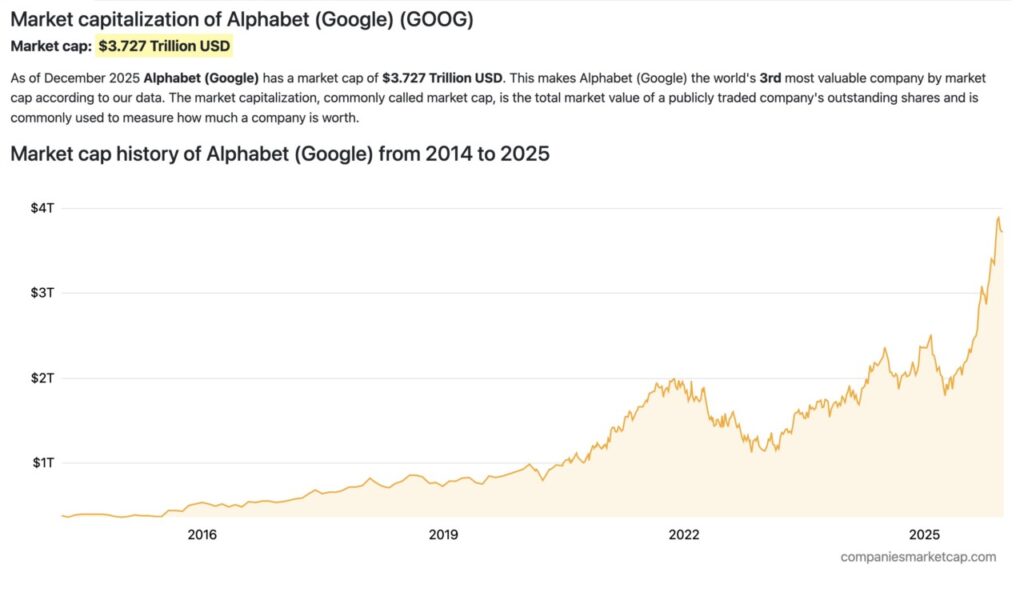

Google (GOOG)

The chart shows the development of Google’s (GOOGX) market capitalization from 2014 to 2025, with a long-term growth trend accompanied by volatility in some periods. In the initial phase, Alphabet’s market cap increased gradually as Google dominated the search engine and digital advertising business. This growth reflects the company’s ability to maintain global market share and monetize digital traffic through an ecosystem of products such as Search, YouTube, and Android.

Fluctuations were evident around 2022, when global macroeconomic pressures and a slowdown in digital ad spending triggered a valuation correction. However, from 2023 to 2025, Alphabet’s market capitalization again experienced significant acceleration, driven by the expansion of the cloud business, integration of artificial intelligence, and optimization of the data-driven advertising business model. As of December 2025, Alphabet’s market cap reached approximately USD 3.727 trillion, placing it as the company with the third largest valuation in the world.

FAQ

What is a stock’s market cap?

Market capitalization (market cap) is the total value of the company in the stock market calculated from the share price multiplied by the number of shares outstanding, and is used as an indicator of the size and valuation of the company.

Why are NVIDIA, Apple, and Google in the world’s top 3 stocks?

These three companies have the highest market cap globally because they are supported by technological innovation, global-scale business models, and strong long-term investor confidence.

Does a large market cap mean a stock is safer?

A large market cap generally reflects stability and strong fundamentals, but still does not guarantee risk-free as stock prices are still influenced by market conditions and macroeconomic factors.

What is tokenized stock in Pintu?

Tokenized stock on Pintu is a blockchain-based digital representation of world stocks that allows investors to gain exposure to global stock price movements more flexibly through Pintu.

Is tokenized stock the same as owning real shares?

Not quite. Tokenized stock provides stock price exposure, but usually does not provide direct ownership rights such as voting rights or dividends, depending on the product structure.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Companiesmarketcap

- Featured Image: Generated by Ai

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.