World’s Top 3 Stocks by Earnings in 2025

Jakarta, Pintu News – Earnings is one of the main indicators to assess a company’s profitability and financial performance in real terms. In 2025, the world’s top 3 stocks by earnings are Saudi Aramco (2222.SR), Google (GOOG), and Apple (AAPL), which represent the dominance of the energy and technology sectors in generating profits on a global scale.

Interestingly, exposure to these large-cap stocks can now also be accessed through tokenized stocks on Pintu, allowing investors to follow global stock price movements more flexibly through blockchain technology.

Saudi Aramco (2222.SR)

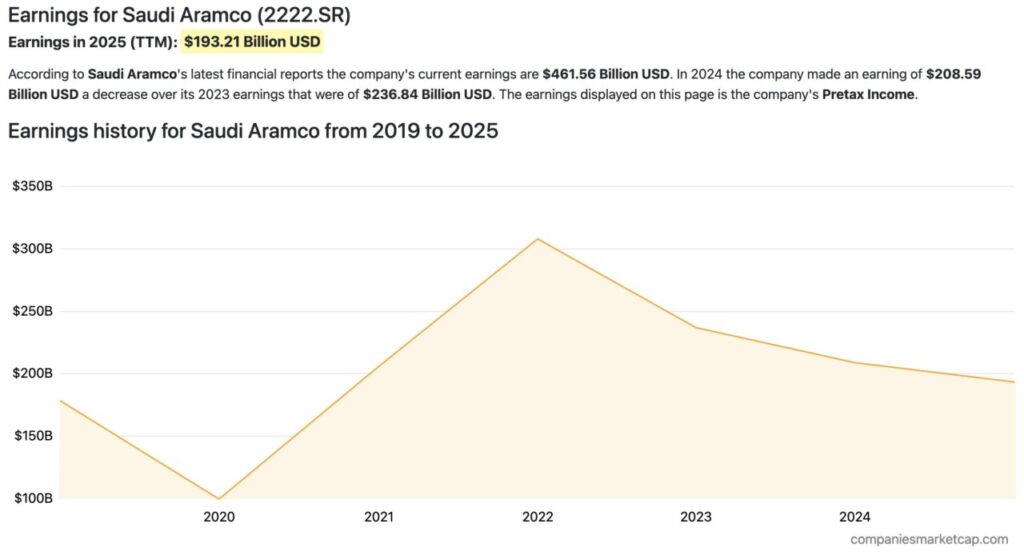

The chart displays the earnings development of Saudi Aramco (2222.SR) from 2019 to 2025, which shows a fluctuating pattern in line with the dynamics of the global energy industry. In 2020, earnings experienced a significant decline to close to USD 100 billion, reflecting the impact of declining energy demand and global oil price pressures. After this period, Saudi Aramco’s financial performance recovered strongly in 2021 and peaked in 2022, when earnings exceeded the USD 300 billion range.

From 2023 to 2025, Saudi Aramco’s earnings show a gradual downward trend, although they remain at historically high levels. As of December 2025 (TTM), earnings stood at around USD 193.21 billion, reflecting the normalization of oil prices as well as the adjustment of global demand after the previous surge. This trend confirms the cyclical nature of the energy business, where corporate profitability is heavily influenced by commodity market conditions and global geopolitical factors.

Read also: Bitcoin Failed to Break $100,000? Mike Novogratz reveals why the crypto market is still on hold

Google (GOOG)

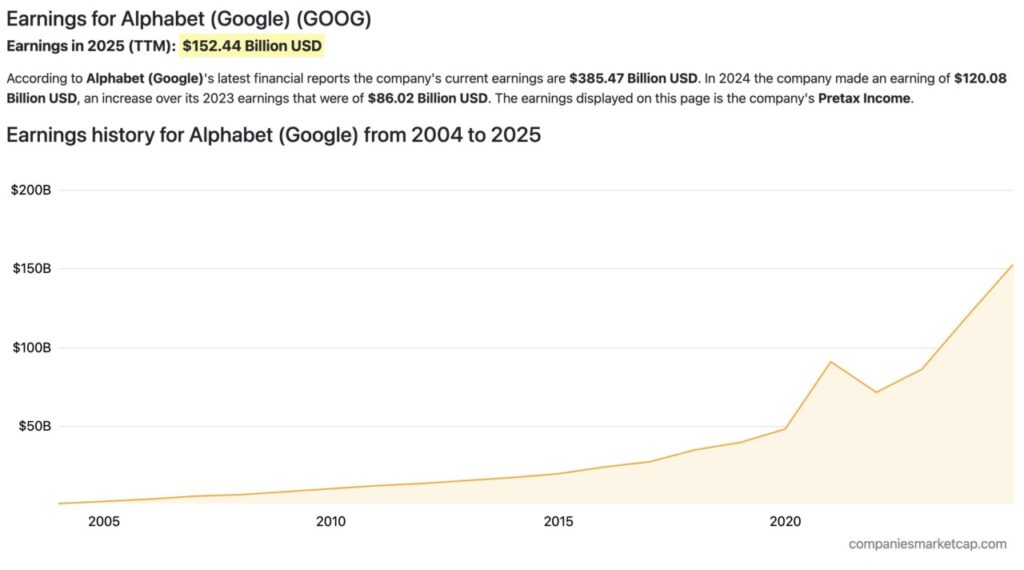

The chart shows the earnings development of Google (GOOGX) from 2004 to 2025 with a consistent long-term growth trend. In the early phase, earnings increased gradually as Google expanded as a global search engine and grew digital advertising revenue. This steady increase reflects Alphabet’s ability to build a business model based on data and massive user traffic.

Significant spikes began to appear after 2019, especially in 2021 when earnings jumped sharply before experiencing a correction in 2022. However, the trend strengthens again in the following period as ad spending recovers and the cloud business grows. Until 2025 (TTM), Alphabet’s earnings are recorded at around USD 152.44 billion, reflecting the company’s large scale of profitability as well as continued contributions from key business lines such as digital advertising and cloud services.

Read also: LINK vs XRP: Who Will Dominate the Next Decade?

Apple (AAPL)

The chart depicts the earnings development of Apple (AAPLX) from 1996 to 2025, showing a long-term upward trend with some periods of fluctuation. In the early phase, Apple’s earnings were relatively small and flat, reflecting the company’s condition before the business transformation in the early 2000s. Growth started to become more pronounced from the mid-2000s, as the launch of key products such as iPod and iPhone significantly increased the company’s revenue scale and profitability.

The increase in earnings was stronger after 2010, with some correction phases in the middle of the decade and the pandemic period. A significant spike was seen after 2020, when earnings broke above the USD 100 billion level. Until 2025 (TTM), Apple’s earnings are recorded at around USD 133.05 billion, reflecting the continued contribution of device sales as well as the expansion of digital services in the company’s revenue structure.

FAQ

What is earnings in stocks?

Earnings are a company’s profit in a given period after deducting expenses, taxes, and other charges, reflecting the level of profitability of the business.

Why are earnings important to investors?

Earnings are used to assess a company’s financial health and are often the basis for stock valuation and investment decision-making.

Why are Saudi Aramco, Google, and Apple in the top 3 earnings 2025?

All three have global business scale and business models capable of consistently generating large profits in the energy and technology sectors.

Do high earnings always mean a stock is worth buying?

Not always. Earnings need to be analyzed alongside other metrics such as growth, cash flow, and valuation to get a fuller picture.

What is tokenized stock in Pintu?

Tokenized stock in Pintu is a blockchain-based digital asset that provides exposure to global stock price movements without direct stock ownership.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Companiesmarketcap

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.