6 Bitcoin Futures 2025 Facts: The Bulls Structure & Short Liquidation that Crypto Traders Hunt for

Jakarta, Pintu News – The Bitcoin (BTC) futures market is the talk of the town in 2025 as the market structure, which is now dominated by the liquidation of short positions, reflects the complex dynamics of the crypto market amid price volatility and high leverage.

Recent data analysis shows that the dominance of short position liquidation and structural market pressures give different signals to market risk and momentum. This article summarizes the key facts that are widely discussed and helps to understand this phenomenon in an informative way.

1. The Dominance of Short Liquidation in the Bitcoin Futures Market

According to derivatives market data, liquidation of short positions dominated activity in the Bitcoin futures market over recent periods, suggesting that bearish bets were forced to close. These short liquidation events reflect market pressure on traders taking positions against the price direction. This dominance of liquidation is monitored as it often creates mechanical buying pressure on the market.

The liquidation of short positions occurred not only in Bitcoin but also in other cryptocurrency futures contracts, showing that high leverage magnifies risks for overleveraged traders. In this phase, the Bitcoin futures market showed that the forced close mechanism can wipe out bearish contracts substantially. This got the attention of institutional and retail traders in managing risk.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

2. Market Structure Shows Tactical Bullish Sentiment

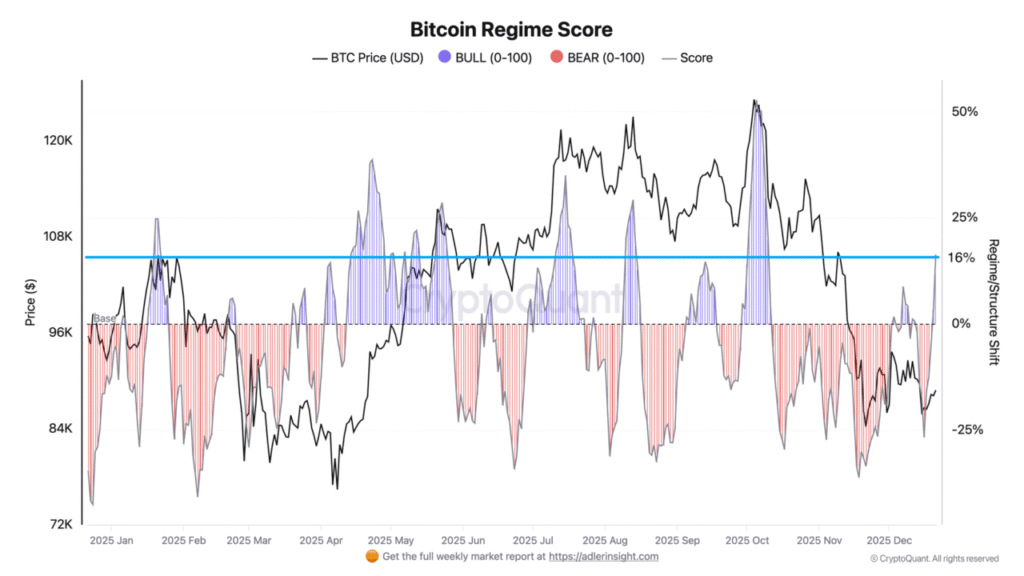

Analysis of the Bitcoin futures market structure indicates that there is greater pressure on short positions than long, which can be interpreted as a bullish tactical signal in the short term. The regime score data processed by analysts shows that the indicator value is in a zone that is historically associated with positive average returns over a certain period of time. This trend has been widely discussed as it indicates a shift in market risk.

However, it is important to note that these bullish signals are tactical in nature and do not necessarily reflect a long-term trend change, as the fundamental pressures of the market are still influenced by macro variables and global sentiment. This kind of market structure often emerges after a period of high volatility when short positions are erased. This phenomenon is of interest to analysts as it can influence short-term trading decisions.

3. Large Liquidation Volume Marks Leverage Risk

Large liquidation events in the futures market often occur when prices move sharply, especially if many traders use high leverage to open short positions. This can create a domino effect that speeds up contract closures and increases market volatility. Such liquidation activity is the talk of the town as it shows that leverage risk remains a big issue in the crypto market.

Large liquidations are also one of the important metrics monitored by market analysts to understand the supply-demand conditions of derivatives contracts. Forcibly liquidated positions can create temporary price pressure in the short term. This trend illustrates the complexity of the Bitcoin futures market, which is highly dependent on the leverage behavior of traders.

4. Open Interest and Liquidity Become Key Metrics

Open interest, which reflects the number of open contracts in the futures market, is often used to assess liquidity and overall crypto market sentiment. High levels of open interest can reflect traders’ high involvement in Bitcoin futures contracts on both the long and short side. Open interest variations often come under the scrutiny of analysts as they indicate the amount of risk exposure in the market.

High open interest along with liquidation pressure can help identify price areas where liquidity bodies are gathering, potentially triggering sharp price action if these levels are broken. This makes open interest one of the important metrics chosen to gauge medium-term market sentiment.

5. Leverage and Volatility Risks Remain Prominent

While the dominance of short liquidation is sometimes interpreted as short-term bullish momentum, leverage risk remains a significant factor in the Bitcoin futures market. Traders using high margins are more susceptible to forced liquidation if the price reverses. This market structure keeps high cryptocurrency price volatility under scrutiny by market participants.

The decrease in volatility indicated by some analysts also suggests that the market may be entering a consolidation phase, reducing the likelihood of large liquidations in a short period of time. However, price dynamics can still change quickly in the event of a sudden change in market sentiment. This remains a key focus in derivatives risk management strategies.

6. Implications for Crypto Trader Strategy

Traders active in the Bitcoin futures market need to understand that the dominance of short liquidation and the changing market structure demand a cautious approach to risk. Leverage management strategies as well as monitoring metrics such as open interest and liquidity are key in making trading decisions. Understanding this market structure is of interest as it is directly related to volatility and short-term risk exposure.

The combination of liquidation data and market structure helps traders recognize tactical market phases, although decisions should always be backed by a thorough risk analysis. This is an important part of managing a derivatives portfolio in a dynamic trading environment.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is short liquidation in the Bitcoin futures market?

Short liquidation occurs when a bearish position is forced to close as the price moves in the opposite direction, causing the trader to incur an automatic loss.

How does liquidation affect Bitcoin price?

Large liquidations can trigger forced buying that temporarily suppresses price drops and creates short-term market volatility.

Why is open interest important in the crypto futures market?

Open interest reflects the number of contracts that have not yet closed, helping to gauge liquidity and market sentiment.

Does the dominance of short liquidation mean a long-term bullish trend?

Short dominance can be a signal of bullish tactical momentum, but it does not necessarily signify a change in the long-term trend.

What risks do futures traders need to be aware of?

Traders should pay attention to high leverage and price fluctuations, and use risk management to avoid forced liquidation.

Reference

– Bitcoinist.com. Bitcoin Futures Structure Favors Bulls as Short Liquidations Accelerate. Accessed December 23, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.