Bitcoin Holds Steady at $88,000 — Is a Break Above $89,000 on the Horizon?

Jakarta, Pintu News – Bitcoin (BTC) prices have been flat for most of December, leaving both optimistic and pessimistic investors frustrated. Despite the short-term volatility, the overall market structure remained within the same range as the end of the year approached.

In the last 30 days, Bitcoin is up about 5%, but the movement over the past week has been flat. This lack of direction suggests indecision in the market. However, the latest on-chain data indicates a change, especially in the spot market.

Buying pressure is increasing sharply, raising an important question: could this increased demand finally help Bitcoin break through its strongest resistance level in the short term?

Bitcoin Price Drops 0.31% in 24 Hours

On December 23, 2025, Bitcoin was trading at $88,264, equivalent to IDR 1,490,359,133, marking a 0.31% decline over the past 24 hours. During this period, BTC reached a low of IDR 1,481,047,760 and a high of IDR 1,517,410,063.

At the time of writing, Bitcoin’s market capitalization stands at approximately IDR 29,432 trillion, while its 24-hour trading volume has surged by 54%, reaching IDR 425 trillion.

Read also: The Crypto Market Turns Green — Analyst Ali Martinez Highlights 3 Altcoins Poised to Shine

Increased Whale Activity & Withdrawals from Exchanges

Two prominent on-chain signals in recent days are whale behavior andexchange outflows.

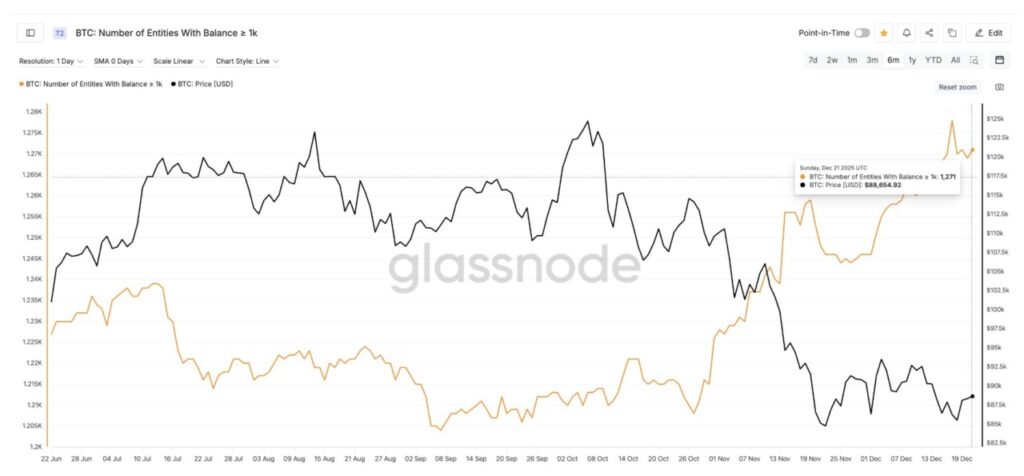

First, the number of entities holding at least 1,000 BTC started to rise again after a sharp drop on December 17. This metric tracks large holders often called whales. When this number increases, it indicates that large players are accumulating, not distributing.

Since December 20, the number of such large entities has slowly increased. While still slightly below the six-month high, the direction is important – whales appear cautious about adding exposure as BTC prices begin to stabilize.

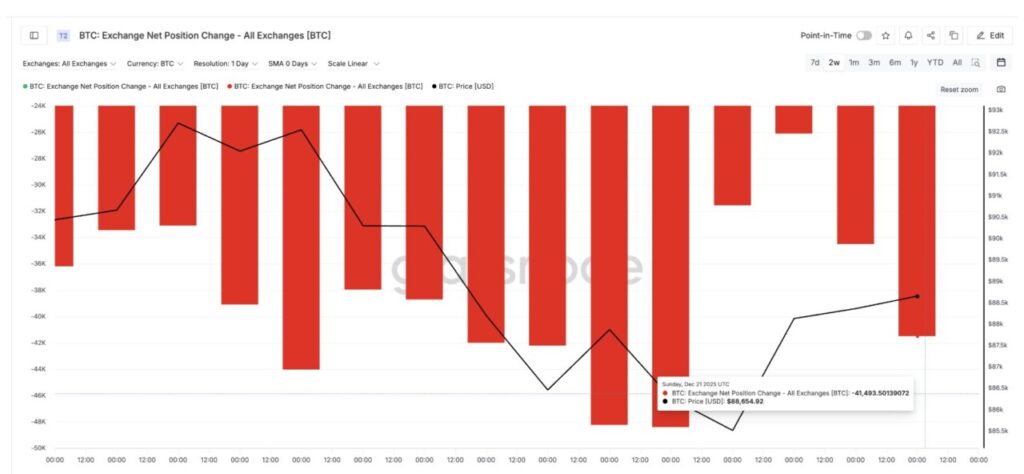

Second, the net change in position on the exchange indicates a strong surge in buying activity. This metric measures how much coin is entering or exiting a centralized exchange. When more coins exit an exchange, it usually means that buyers are moving BTC toself-custody wallets, which reduces short-term selling pressure.

On December 19, Bitcoin outflows from exchanges reached around 26,098 BTC. Two days later, on December 21, that number jumped to 41,493 BTC – a 59% increase in just two days.

This gap is important. Accumulation by whales is steady but still moderate, while outflows from the exchanges are increasing much faster. This indicates that medium-sized retail and institutional buyers are also jumping in with the whales, thereby increasing spot demand in the market.

Overall, these two signals suggest that buying pressure in the spot market continues to increase, even though Bitcoin price has yet to break through a major resistance level.

Read also: Wall Street Reveals Tesla Stock Price Predictions for the Next 12 Months!

Bitcoin Price Levels that Determine the Next Direction

Whether the current buying pressure will have a real impact depends largely on Bitcoin’s key price levels.

The most important resistance level (wall) is around $89,250. This level has been the upper limit of price movement since mid-December and coincides with several failures to break higher. Until Bitcoin is able to close the daily price convincingly above this level, the market is still consideredrange-bound.

If buyers manage to push the price past $89,250, Bitcoin could potentially try to rise towards around $96,700, which is one of the strongest resistance zones on the chart. The level has rejected price increases several times and will be the next big test.

On the downside, $87.590 becomes a key short-term support area. If the price breaks this level clearly, then the next downside risk is around $83.550, and if selling pressure increases, the downside potential could extend to $80.530.

In summary, Bitcoin is now in a tightening phase between increasing buying pressure and a strong wall of resistance. Whales are starting to add holdings cautiously, outflows from exchanges are increasing, and the price is approaching a decisive point.

The next direction will depend on one thing: is this surge in demand strong enough to break $89,250, or will the flat move last into the new year?

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Buying Pressure Jumps 59% – Can It Finally Break the $89,000 Wall? Accessed on December 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.