BlackRock Sets Bitcoin ETF as One of Its Key Investments Amid Price Uncertainty

Jakarta, Pintu News – Bitcoin (BTC) price movements have remained volatile in recent sessions, with recovery efforts struggling to gain momentum. BTC has attempted to stabilize after the latest drop, but demand from exchange-traded fund (ETF) investors appears uneven.

Despite these doubts, BlackRock continues to assert that Bitcoin is a core part of their long-term investment allocation, demonstrating a confidence that extends beyond short-term price fluctuations.

Bitcoin seems to be BlackRock’s favorite

BlackRock has included its spot Bitcoin ETF in its three key investment themes for 2025. This decision reflects long-term conviction, rather than simply short-term trading momentum. Despite sharp fluctuations in the price of Bitcoin so far this year, capital flows into the ETF have remained significant.

Read also: Trump Media Buys $40 Million Worth of Bitcoin, CFTC Chair Prepares Clear Steps for Crypto Rules!

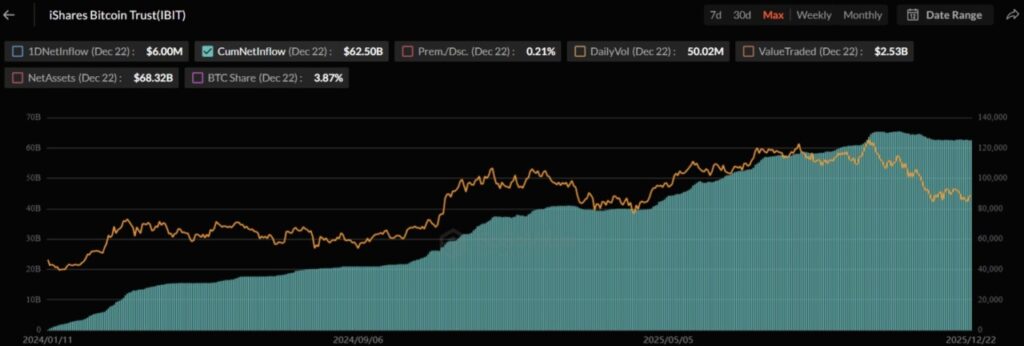

To date, net inflows into BlackRock’s Bitcoin ETF have amounted to about $29.6 billion over the course of the year. Since its launch, the total net inflows have reached $62.5 billion.

These figures show continued institutional interest, which explains why BlackRock continues to highlight Bitcoin in its strategic outlook despite the still-volatile market.

Bitcoin Performs Well in the Futures Market

The ETF’s short-term trend shows the opposite picture. In the past month, Bitcoin ETFs recorded outflows on almost half of the trading days. This pattern suggests declining demand from some investors, especially those with a short-term orientation.

On Monday, the overall Bitcoin ETF recorded a net outflow of $142 million. This decline reflects indecision amid price uncertainty. While long-term capital remains intact, short-term capital flows suggest that investors are still cautious and waiting for clearer signals before adding to their exposure.

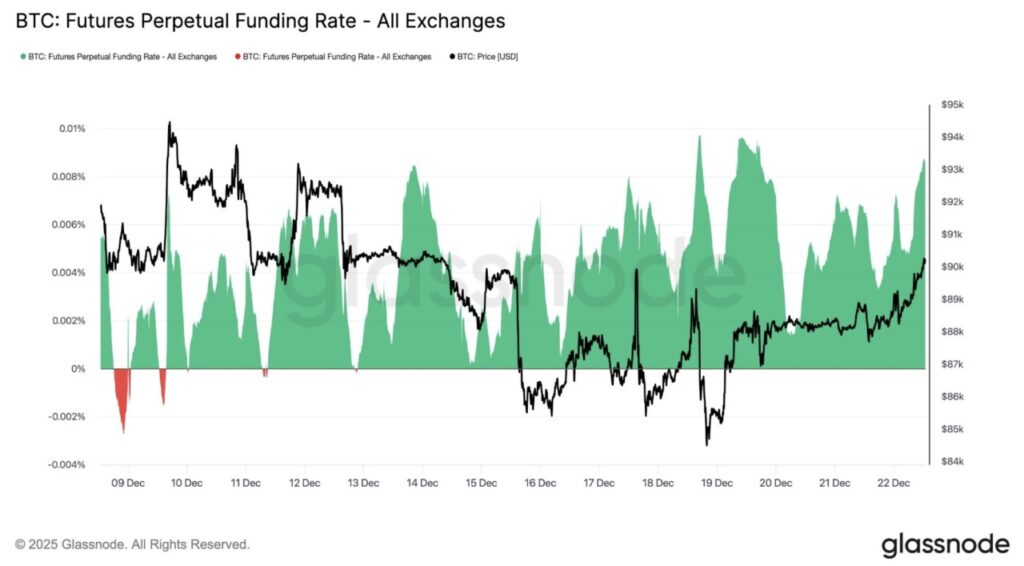

Derivatives data adds another dimension to the market outlook. While demand in the spot market was uneven, positions in the perpetual futures market increased. With Bitcoin prices again trading above $90,000, open interest in perpetual contracts rose from 304,000 BTC to 310,000 BTC, or about a 2% increase.

The funding rate also increased, from 0.04% to 0.09%. This combination suggests an increase in leveraged long positions. Traders seem to be preparing for potential price movements later in the year, taking higher risks despite mixed demand in the spot market.

A rise in open interest accompanied by higher funding rates usually signals increased market optimism. However, it also increases sensitivity to volatility – if price momentum weakens, leveraged positions can quickly unwind, magnifying short-term fluctuations.

Read also: Bitcoin Price Hovering at $87,000 Level: Can BTC Reach $100K Before 2025 Ends?

BTC price has the potential to record a rise in the short term

At the time of writing (23/12), Bitcoin is trading around $87,400, slightly below the $88,210 resistance level. The technical structure suggests room for further upside movement. Short-term momentum could improve if buyers are able to sustain current levels and general market sentiment stabilizes.

Seasonal factors can also affect price movements. The Christmas trading week historically tends to be accompanied by increased inflows and decreased liquidity. If demand increases, Bitcoin could potentially rise towards $90,308, supported by leveraged positions and renewed investor interest.

However, downside risks remain if market optimism does not materialize. A break below the $86,247 level will weaken the recovery structure. In that scenario, Bitcoin could drop towards $84,698.

Such a move would invalidate the bullish view and reinforce the cautious stance in the short term, although long-term institutional support is still strong.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. BlackRock Bitcoin ETF: Top Investment Despite Price Uncertainty. Accessed on December 24, 2025

- Cointelegraph. BlackRock Bitcoin ETF: Major Investment Theme with T-Bills, Tech Stocks. Accessed on December 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.