Grayscale Files S-1 Document Update for Avalanche ETF with the US SEC!

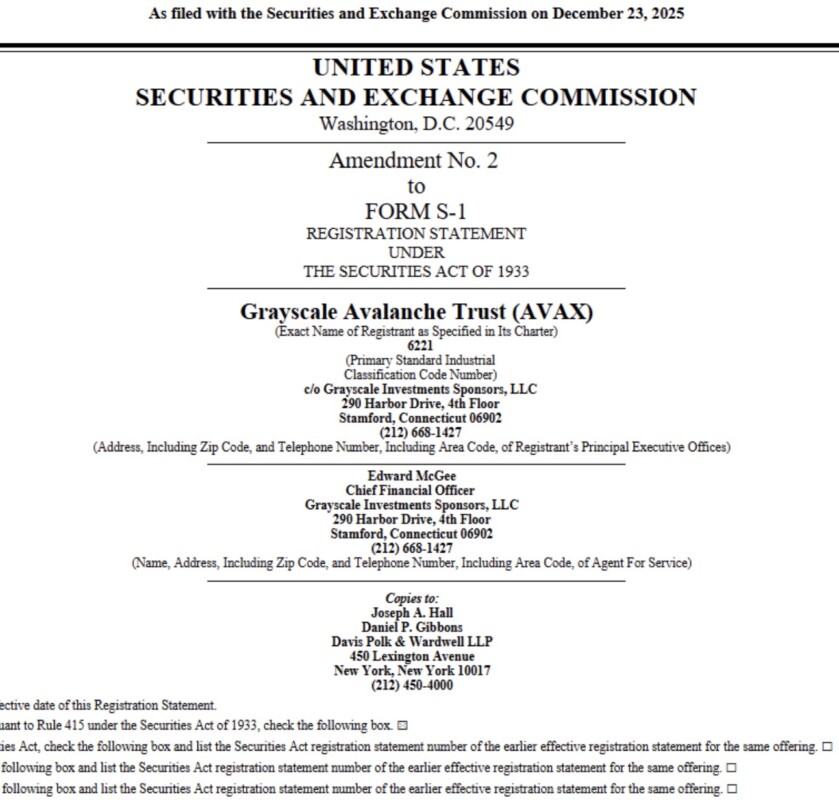

Jakarta, Pintu News – Crypto asset manager Grayscale has filed an updated S-1 document for its Avalanche ETF (AVAX) with the US Securities and Exchange Commission (SEC), signaling a step closer towards listing on Nasdaq.

Meanwhile, the price of AVAX rose by more than 9% over the past week, driven by growing anticipation of the launch of the Avalanche ETF.

Grayscale Updates Spot Chainlink ETF Document for Automatic Approval

Based on recent filings with the US Securities and Exchange Commission (SEC), Grayscale has filed a second amendment to its S-1 document regarding the planned conversion of Avalanche Trust into the Avalanche spot ETF.

Read also: Bitcoin Whale Doubles Short Investments in BTC, ETH, and SOL Worth $243 Million!

In this latest filing, the issuer did not include a management fee, staking fee, or fee waiver. Instead, the updated document features some important updates, such as the in-kind asset creation and redemption mechanism, risk and tax disclosures, and updated financial data.

In addition, the issuer also updated the sponsor details section, confirming that Grayscale Investments Sponsors LLC is the sole sponsor of the trust. These changes are believed to be in response to feedback from the SEC during the review process.

Grayscale Avalanche Trust ETF is currently awaiting SEC approval to list its shares on Nasdaq under the ticker code “GAVX.” Currently, the trust’s shares are still traded on the OTC market under the ticker AVAXFUN.

In comparison, the VanEck Avalanche ETF (VAVX) last week disclosed a management fee of 0.30% as well as staking details, including the appointment of Coinbase Crypto Services as the staking service provider.

AVAX Price Declines Amid Low Trading Volume

The price of AVAX has fallen 2.50% in the last 24 hours, after rallying more than 10% in the week following VanEck’s filing of the Avalanche ETF. Currently, the price of AVAX is trading around $12.08, with a daily low of $11.88 and a high of $12.34.

Read also: Dogecoin ETF is Getting Closer! 21Shares Files Official Update with SEC

In addition, the daily trading volume has also decreased by almost 18% in the last 24 hours. This indicates waning investor interest, along with the uncertainty plaguing the crypto market as a whole.

The US SEC Crypto Task Force recently held a meeting with representatives from Ava Labs, Blockchain Association, and The Digital Chamber. An update to the S-1 document for the Avalanche ETF filed by several issuers is expected after the meeting.

Meanwhile, data from CoinGlass showed that selling sentiment dominated the derivatives market. The total open interest of AVAX futures decreased by 2.09% to $489.38 million. In detail, AVAX futures open interest decreased by 1.93% on Binance, 2.10% on OKX, and 0.68% on Bybit in the last four hours.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Breaking: Grayscale Files Updated S-1 for its Avalanche ETF with the US SEC. Accessed on December 24, 2025

- Coinpedia. Grayscale Files Updated S-1 for Spot Avalanche ETF. Accessed on December 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.