Antam Gold Breaks All-Time High, Safe Haven Most Hunted Amid Global Turmoil?

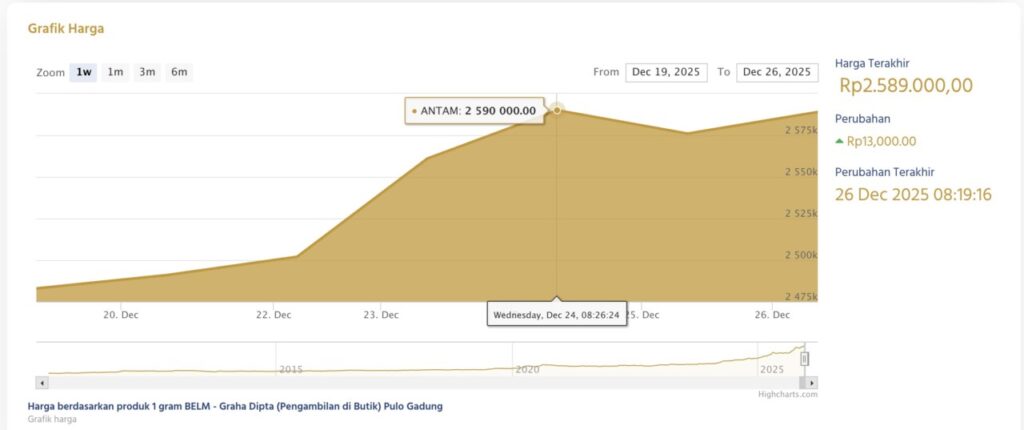

Jakarta, Pintu News – The price of gold in the domestic market has once again set a new history. On December 24, 2025, the price of gold bars produced by PT Aneka Tambang Tbk (Antam) jumped sharply and broke an all-time record high.

The surge comes amid rising global economic uncertainty that has prompted investors to turn to safe haven assets, as interest in riskier assets including stocks and some cryptocurrencies weakens. This reaffirms gold’s role as a key hedging instrument amid global pressures.

Antam Gold Prices Jumped Sharply in the Domestic Market

Antam’s gold price jumped significantly to Rp2,590,000 per gram, making it the highest record in the history of domestic gold trading. This increase continued the positive trend after the day before the gold price also set a new record at IDR 2,561,000 per gram.

This data refers to the official price released through Antam’s Precious Metals website. The surge in prices reflects the high investor demand for hedging assets.

Also read: 3 Latest Analysis of Bitcoin (BTC) Price Last Week December 2025

Apart from the selling price, the buyback price of Antam gold also experienced a sharp increase. On the same day, the buyback price rose to the level of IDR 2,449,000 per gram.

This condition shows that gold market liquidity remains strong, both on the seller and buyer sides. For domestic investors, gold remains the top choice in maintaining asset value amid global market volatility.

Global Gold Prices Set New Records

The surge in domestic gold prices is in line with the gold rally in the global market. The February gold futures contract closed up 1.9 percent at $4,469.40 per ounce, equivalent to around Rp74.9 million per ounce at an exchange rate of Rp16,756 per US dollar. Spot gold prices also rose nearly 2 percent to $4,440.26 per ounce or around Rp74.4 million. On a year-to-date basis, global gold prices have surged nearly 70 percent.

Read also: Latest Updates: 3 Pi Network (PI) Latest News

Data from goldprice.org noted that gold was trading at $4,493.14 per ounce on December 22, New York time, or around Rp75.3 million. The daily increase reached 3.54 percent, signaling increased demand for safe havens. Global investors appear to be increasingly avoiding risky assets, including some volatile crypto and cryptocurrency assets. Gold has again become an anchor of portfolio stability.

Global Sentiment, Crypto, and Gold Price Projections

Pilarmas Investindo Sekuritas assesses that the gold rally was triggered by weakening risky assets even though the United States central bank has cut interest rates. Concerns about the global economic outlook, fiscal deficits, and medium-term inflationary pressures are strengthening interest in gold.

Gold is considered an effective hedge against currency weakness and geopolitical uncertainty. Amid the ups and downs of the cryptocurrency market such as Bitcoin (BTC) and Ethereum (ETH), gold is again being looked at as a risk-balancer.

Meanwhile, J.P. Morgan projects gold prices to potentially approach $5,055 per ounce by the end of 2026, equivalent to around Rp84.7 million. This projection is supported by strong demand from central banks, ETFs, and investor interest including the crypto community. The bank believes that gold remains attractive as a non-yielding asset amid the weakening US dollar. In the long run, gold and cryptocurrencies are expected to co-exist as global diversification alternatives.

Conclusion

The surge in Antam gold prices to record highs confirms gold’s role as the main safe haven asset amid global uncertainty. As the stock and crypto markets face pressure, gold is again a defensive choice for investors. Support from global factors, large institutional projections, and increasing interest in diversification strengthen gold’s prospects going forward. This shows that amidst the cryptocurrency era, gold still plays an important role in long-term investment strategies.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Jakarta Globe. Safe-Haven Rush Lifts Antam Gold to New All-Time High. Accessed on December 27, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.