Why Silver Could Surpass Gold and Bitcoin by 2026?

Jakarta, Pintu News – Silver is showing a very strong performance in 2025, surpassing gold and Bitcoin (BTC). The rise in silver prices is not only driven by speculation, but also by macroeconomic changes, industrial demand that may continue until 2026. Read the full prediction here!

Silver Performance Context in 2025

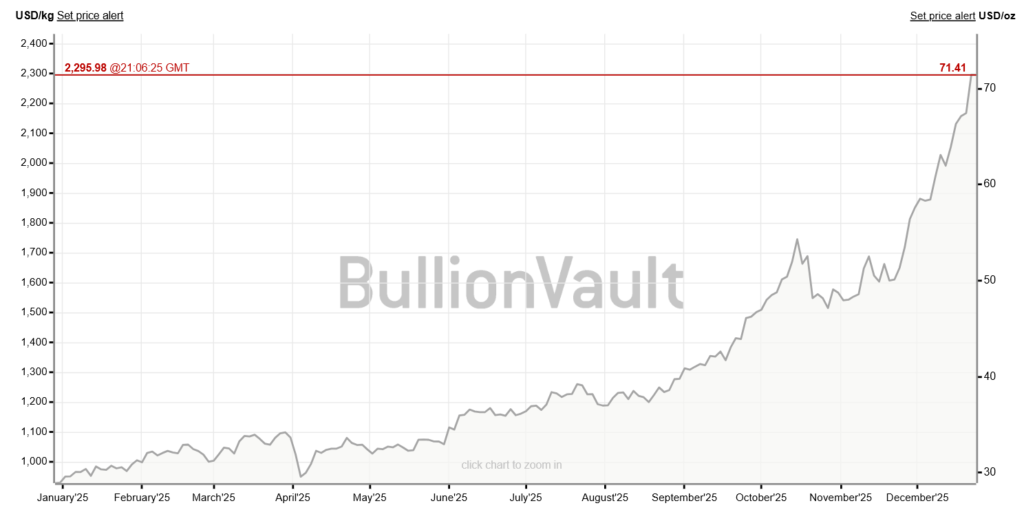

By the end of December 2025, the price of silver reached around $71 per ounce, up more than 120% over the year. Meanwhile, gold was only up about 60%, and Bitcoin (BTC) saw a decline after peaking in October.

Also read: 3 Latest Analysis of Bitcoin (BTC) Price Last Week December 2025

Silver started 2025 at around $29 per ounce and continued to rise throughout the year. The rise in silver prices sharpened in the second half of the year due to a widening supply deficit and unexpectedly increased industrial demand.

Macro Conditions Favoring Resilient Assets

Several macroeconomic forces favor a rise in silver prices in 2025. The most important one is that global monetary policy is turning looser. The US Federal Reserve made several interest rate cuts, which lowered real yields and weakened the dollar.

This combination has historically favored real assets, especially those with monetary and industrial value. Unlike gold, silver directly benefits from economic expansion.

Industrial Demand as the Main Driver

The rise in silver prices is increasingly driven by physical demand rather than investment flows. Industrial use accounts for about half of total silver consumption, and this share is growing.

Read also: Latest Updates: 3 Pi Network (PI) Latest News

Energy transition is the largest source of new demand, while electrification in the transportation and infrastructure sectors adds pressure to an already tight supply. The global silver market recorded its fifth consecutive annual deficit in 2025.

Electric Vehicle Usage Increases Structural Demand

Electric vehicles (EVs) significantly increase silver consumption by 2025. Each EV uses 25 to 50 grams of silver, about 70% more than conventional motor vehicles.

With global EV sales increasing at double-digit rates, silver demand from automotive rises to tens of millions of ounces every year. Charging infrastructure reinforces this trend, with the use of kilograms of silver in power electronics and connectors.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Silver Price Could Outperform Gold and Bitcoin by 2026. Accessed on December 28, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.