Where will Ripple (XRP) Price Movement Go in 2026?

Jakarta, Pintu News – In late 2025, Ripple (XRP) experienced significant price pressure with several recovery attempts failing to gain momentum. Mild negative performance throughout the year and cautious retail participation have influenced price action. However, institutional interest emerged as a major stabilizing force for Ripple (XRP), preventing a deeper decline despite persistent selling.

Institutional Interest as a Key Driver

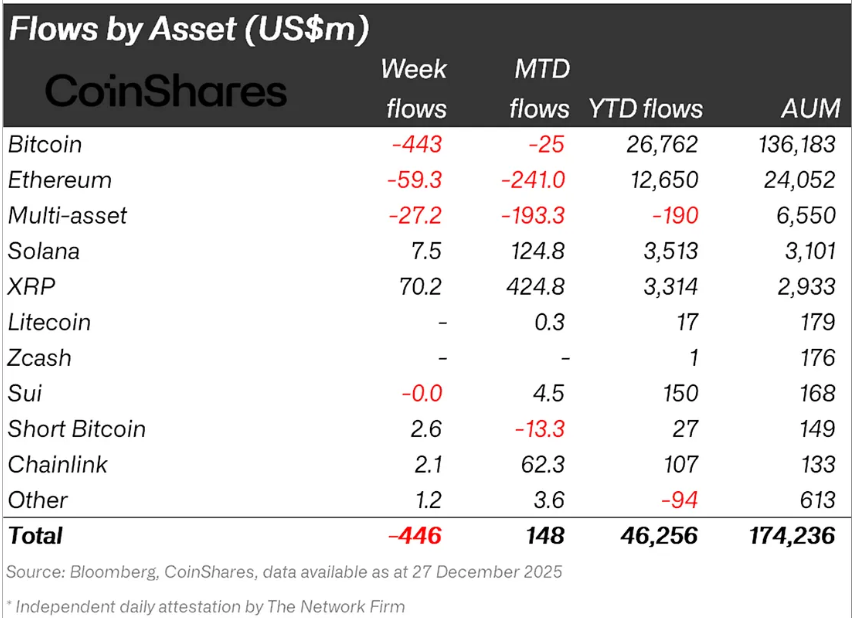

Throughout 2025, institutional investors have been the biggest backers of Ripple (XRP). Data from CoinShares shows that Ripple (XRP) recorded inflows of $70 million in the week ending December 27. This increased month-to-date inflows to $424 million, signaling steady capital allocation even during periods of price declines.

On an annualized basis, Ripple (XRP) attracted inflows of $3.3 billion, demonstrating continued institutional confidence despite the ongoing volatility and legal uncertainty surrounding the crypto market more broadly.

Also read: Shiba Inu Launches ‘Shib Owes You’, Hack Victim Repayment Plan with NFTs

Ripple (XRP) ETF Shows Strength

Institutional support has extended beyond traditional exchange-traded products with the launch of the Ripple (XRP) ETF earlier this year. Since its debut, the Ripple ETF (XRP) has not recorded a single day of net outflows. Only one trading session closed flat, with no inflows, reflecting the consistency of unusually strong demand.

Ray Youssef, CEO of crypto app NoOnes, emphasized that institutional investors are executing a structured long-term strategy. “The Ripple (XRP) accumulation action in early December was strategically positioned by market participants to capture the ETF’s profit momentum,” Youssef said.

Also read: Gold Jewelry Price Today, Tuesday, December 30, 2025

Ripple (XRP)’s Doubting Long-Term Holders

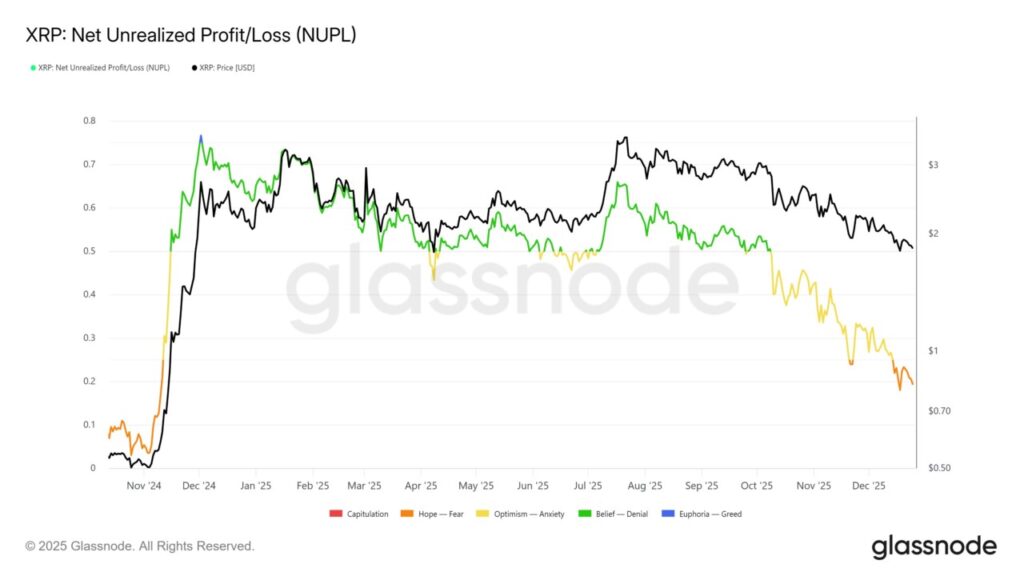

Long-term holders remain a critical group heading into 2026. Historically, this group has played a stabilizing role during market downturns. Over the past year, long-term holders alternated between accumulation and distribution, reflecting the uncertainty surrounding Ripple’s (XRP) medium-term outlook.

In the fourth quarter of 2025, selling activity dominated long-term holder behavior. This change indicates a decline in confidence among investors who usually persevere through volatility. If this lack of confidence continues into 2026, Ripple (XRP) could face higher downside risks.

Conclusion

Despite facing challenges, 2026 may bring an independent path for Ripple (XRP). With strong institutional support and potential recovery of recent losses, Ripple (XRP) may see a clearer trend emerge after the initial months. However, the downside scenario remains relevant if selling pressure increases. Continued consolidation combined with reduced demand could push Ripple (XRP) prices lower.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. XRP Price Prediction: What to Expect in 2026. Accessed on December 30, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.