Where is the Pi Network (PI) 2026 Price Movement headed?

Jakarta, Pintu News – Pi Coin (PI) enters 2026 with much doubt and speculation regarding its future. After a challenging year, the cryptocurrency is facing sustained selling pressure and a lack of significant recovery efforts. With market conditions yet to stabilize, many are wondering if Pi Coin can experience a recovery in 2026.

Pi Coin: A Tough First Year

Since its launch in February, Pi Coin has experienced a drop in value in most of its months. There have only been two periods that yielded positive results, indicating Pi Coin’s difficulty in maintaining momentum. The biggest drop occurred immediately after launch, where Pi Coin fell by 66.5% in March, erasing the initial optimism that surrounded this mobile mining network.

The historically weak monthly performance suggests that downside risks still outweigh hopes for upside. The decline in investor confidence in Pi Coin is evident from the capital flow indicator.

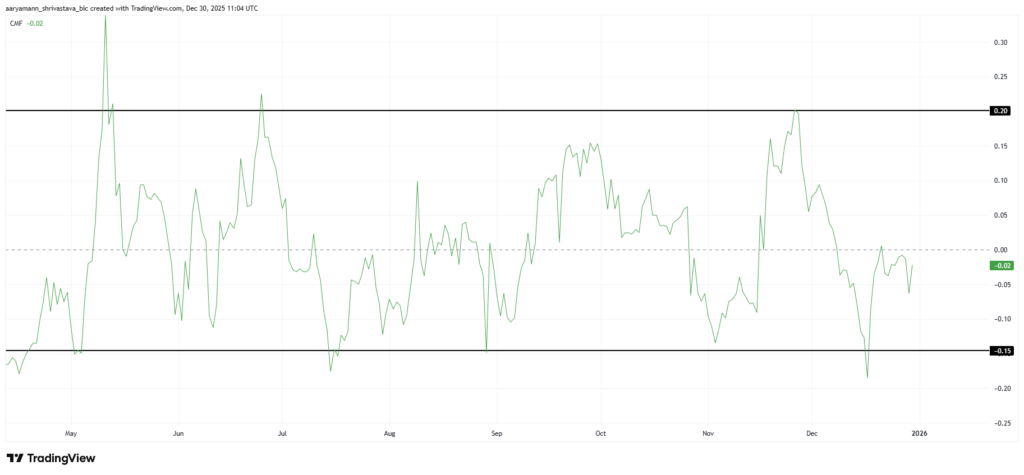

Over the past year, the asset has fluctuated between inflows and outflows without showing a clear trend. The persistent selling dominance is evident from the Chaikin Money Flow (CMF), which has reached the oversold threshold five times since launch.

Also read: Bitcoin Price Prediction: Will BTC Reach a New Peak in 2026?

Pi Coin Needs for Recovery

In order to return to its peak at $2,994, Pi Coin would need to experience a gain of approximately 1,376%. The first step that signals a recovery is if Pi Coin can turn the 23.6% Fibonacci Retracement level at $0.273 into support.

This level is the first technical threshold that separates consolidation from early recovery. However, stronger confirmation is still far away. A sustainable bullish structure requires Pi Coin to again hold $0.662 as support.

Also read: Bitcoin (BTC) Strengthens: Will it Continue to Rise Until Early 2026?

Pi Coin Price Outlook in 2026

In the short term, Pi Coin is showing positively trending strength by holding above the critical $0.199 support level. This level has been tested three times without a daily close below it, suggesting that buyers are still defending this zone. As long as $0.199 remains intact, downside risks are manageable.

However, volume confirmation remains crucial for the sustainability of this trend. Downside risks still exist if investor confidence deteriorates, and a break below $0.199 could invalidate this bullish thesis, possibly causing Pi Coin to drop to $0.188 or lower.

Conclusion

With existing challenges and unstable market conditions, Pi Coin enters 2026 with many unanswered questions. While there are some signs of short-term recovery, the road to full recovery is still long and fraught with uncertainty. Investors and market watchers will continue to keep a close eye on key indicators and market sentiment to assess the potential future of Pi Coin.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Pi Coin Price Prediction: What to Expect in 2026. Accessed on January 4, 2026

- Featured Image: Coin Trust

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.