2026 is the defining year for the crypto market, will it rise?

Jakarta, Pintu News – At the end of December, the Federal Open Market Committee (FOMC) announced that it is in no rush to lower interest rates until March 2026. This decision has had a significant impact on crypto market sentiment, especially Bitcoin (BTC), which has experienced price fluctuations in recent weeks.

The Effect of Interest Rate Policy on Crypto

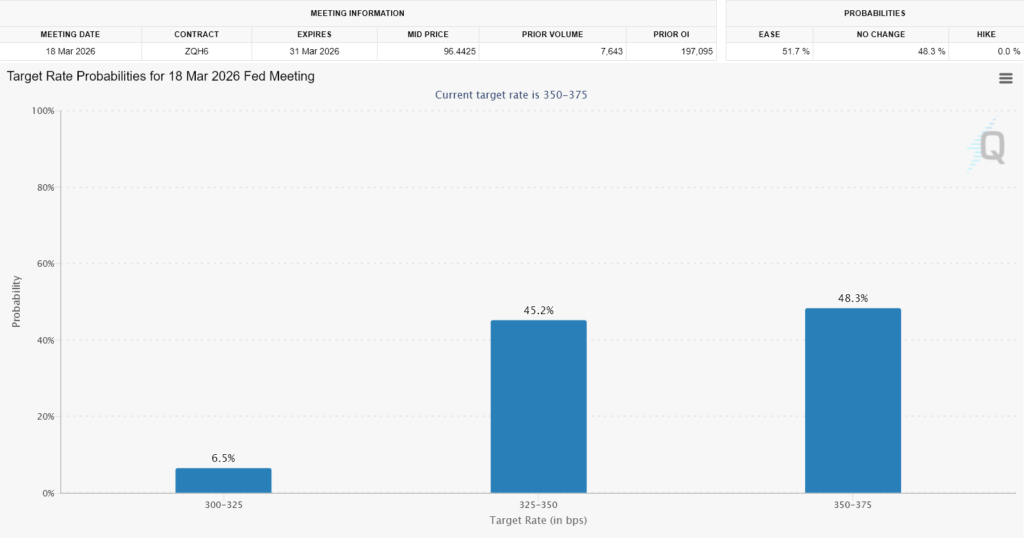

According to the minutes published on December 30, the FOMC decided to delay the rate cut after the 25 basis points cut in December. This boosted market expectations for the next cut towards March or even April 2026.

The market had anticipated that there would be no movement in January, and this latest statement reinforces that view. Bitcoin (BTC) has been trading in a fairly tight range, between roughly $85,000 to $90,000, indicating high uncertainty among investors.

The low daily trading volume and caution shown by sentiment indicators signaled that the recovery in risk appetite has yet to fully take place after the December downturn.

Also read: Bitcoin Price Prediction: Will BTC Reach a New Peak in 2026?

Inflation is still the main obstacle

The FOMC acknowledged that price pressures have not come close to the 2 percent target over the past year, although labor market conditions have softened. Imposed tariffs continue to be the main driver of stubborn goods inflation, while services inflation is showing gradual improvement.

On the other hand, the Fed also highlighted growing downside risks to employment. A slowdown in hiring, lackluster business plans, and growing concerns among low-income households were the main concerns. However, most participants preferred to wait for additional data before adjusting policy further.

Also read: Bitcoin (BTC) Strengthens: Will it Continue to Rise Until Early 2026?

Crypto Market: Between Hope and Reality

With high real yields and tight liquidity conditions, opportunities for price gains in the short term appear limited. Bitcoin’s (BTC) recent consolidation reflects such tensions, where investors are trying to balance hopes for future policy easing with the reality of high interest rates for a longer time.

March is now the first realistic window for the next rate cut, assuming inflation eases and labor market conditions weaken further. Until then, the crypto market will likely struggle to regain momentum. Prices may remain vulnerable to further declines if macroeconomic data disappoints early in 2026.

Conclusion

With high interest rate policies potentially lasting longer, crypto markets are faced with significant challenges. Investors and market participants should prepare themselves for a period of volatility and uncertainty that may continue into the next few years. Being prepared for these conditions will be key in navigating this challenging market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. FOMC Minutes: Crypto Impact 2026. Accessed on January 2, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.