5 “Brutal” Bitcoin (BTC) Predictions Q4 2026: Could Fall to USD 60,000 & Impact on Crypto

Jakarta, Pintu News – Bitcoin’s (BTC) price prediction for the fourth quarter (Q4) of 2026 has again caught the attention of the cryptocurrency market after early crypto investor Michael Terpin issued a bearish view of a possible price bottom. This statement sparked a discussion about the long-term direction of the major crypto asset. The following article summarizes five key points of the prediction based on international crypto media reports.

1. Bitcoin’s Lowest Prediction at USD 60,000

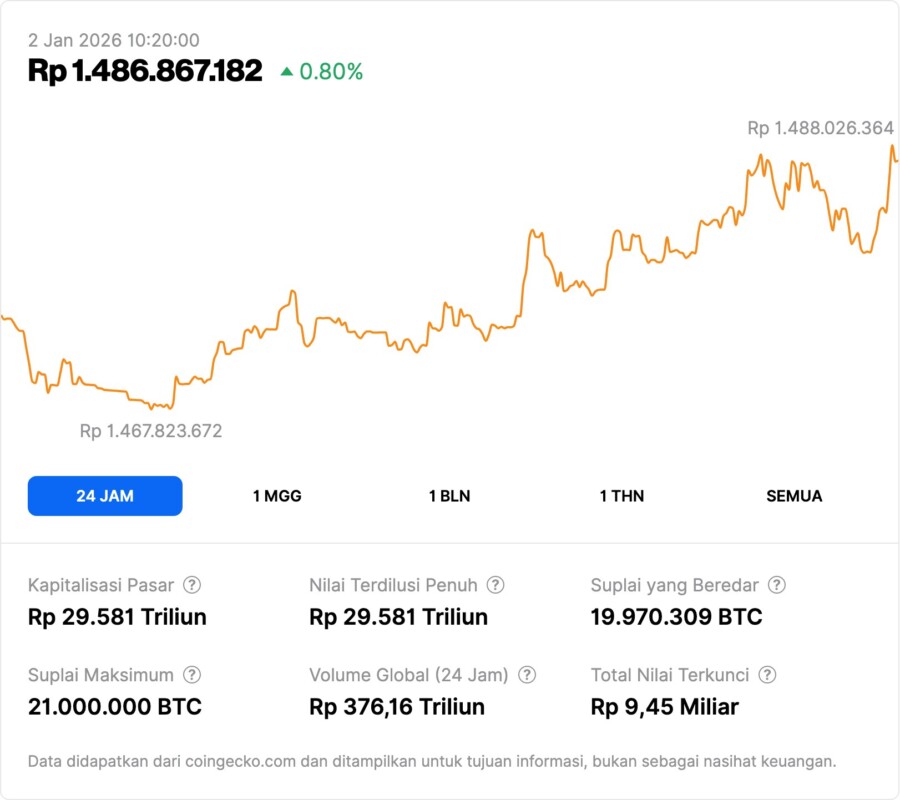

According to a U.Today report quoting Terpin’s statement, Bitcoin could reach a low of around USD 60,000 in Q4 2026. This level if converted is equivalent to around Rp1,002,480,000 based on an exchange rate of 1 USD = Rp16,708. This prediction is considered “brutal” because it reflects a drastic decline from the current historical price of Bitcoin.

The prediction comes amid high market volatility and suggests that downside risks still exist despite the long-term price often associated with bullish trends. Terpin stated that this downward phase could be a strategic accumulation point for long-term investors.

Also Read: 7 BTC Facts Predicted to Bottom at $37,500 in 2026 – Latest Crypto Market Analysis

2. Bitcoin Still Has Long-term Prospects

Despite the scenario of a drop to USD 60,000, Terpin emphasized that it is not the end of Bitcoin, but rather an opportunity for accumulation. According to U.Today, this view suggests that long-term investors can take advantage of such price corrections to add to positions.

He also highlighted that Bitcoin has long-term expansion potential as global adoption continues to increase, Bitcoin supply is tightening, and institutional demand is likely to rise in the following years. This indicates that after a period of major correction, Bitcoin still has a chance to recover and grow.

3. Accumulation Scenario Ahead of Next Bull Cycle

Terpin thinks that the fourth quarter of 2026 could be a major accumulation phase for retail and institutional investors ahead of the next bull cycle. U.Today notes that this accumulation phase is expected to last from 2026 to 2027, ahead of a potential big surge in 2028 or 2029.

An accumulation phase typically occurs when the price of an asset is perceived to be relatively low and buying interest increases, particularly from large market participants. This idea reflects the belief that Bitcoin remains attractive as a long-term asset despite short-term price declines.

4. Market Liquidity & Volatility Power Test

The prediction that Bitcoin could drop to USD 60,000 also reflects the market liquidity conditions and volatility which are still important factors in the crypto market. U.Today reported that high volatility and market dynamics can drive significant fluctuations, especially when market sentiment has yet to set a clear direction.

If selling pressure increases suddenly, psychological support levels such as USD 60,000 could be tested again. These conditions are important for traders and investors in planning short- and medium-term strategies.

5. Recovery Expected After Correction

Terpin is of the view that after the downturn, Bitcoin has the potential to recover as large investors accumulate more, including through market mechanisms such as Bitcoin ETFs. U.Today notes that this increased buying could absorb supply and tighten market liquidity.

Such price recovery triggered by institutional accumulation may become a new fundamental driver for Bitcoin in the following years. This reflects long-term optimism despite relatively bearish short-term predictions.

Also Read: 5 Veteran Analyst Insights Say 2026 Could Be Peak Gold & Silver

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Caroline Amosun/U.Today. Bitcoin at $60,000? Brutal BTC Prediction for Q4 2026 Issued. Accessed January 2, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.