7 XRP January 2026 Price Analysis: Selling Pressure, Key Zones & Crypto Scenarios

Jakarta, Pintu News – Price analysis of XRP (XRP) on January 1, 2026 shows a relatively mild start to the year with mild selling pressure but mixed technical signs in the cryptocurrency market. The latest data exposes price movements within a narrow range and the possibility of the sideways side still dominant in the short term. This article presents seven concise points based on price analysis reports from international crypto media to provide an objective overview of market conditions.

1. XRP Price Drop in the Last 24 Hours

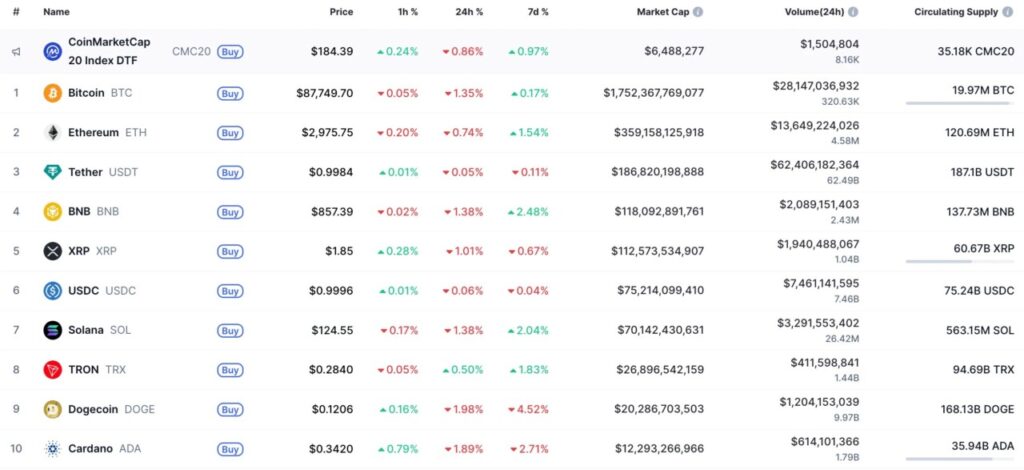

Recent reports suggest that the price of XRP fell by about 1 percent in the last 24 hours on January 1, 2026. This decline indicates the dominance of mild selling pressure in the early year trading session, reflecting the consolidating state of the crypto market. This data comes from the XRP Price Analysis for January 1 report on U.Today which looks at the XRP price chart.

Although the price drop was relatively small, it still reflected market participants’ caution in taking new positions at the beginning of the year. The selling pressure is not significant but it is enough to hold back a more aggressive upward momentum. Further price movement will depend on buyers’ ability to hold critical support.

Also Read: 7 BTC Facts Predicted to Bottom at $37,500 in 2026 – Latest Crypto Market Analysis

2. Bullish Scenes on the Hourly Timeframe

Despite the daily decline, technical analysis shows that on the hourly timeframe XRP price looks bullish if bulls can maintain position above local resistance. One of the levels mentioned is around USD 1.8558, which if broken could open up room for an advance towards the USD 1.88 zone. This suggests short-term upside potential if strong buying demand emerges.

This resistance zone is key for the bulls to maintain positive momentum in the next trading session. If the price is able to hold above this level, the selling pressure could ease and open up a small rebound opportunity. However, this is highly dependent on volume and overall market interest.

3. Larger Timeframe Overview

In the larger timeframe, analysis shows less bullish conditions for XRP as of January 1, 2026. The price of XRP is still far from the region of key technical levels that usually mark medium to long-term trends. This reflects that the price has yet to show strong trend signals beyond daily fluctuations.

The absence of major trend signals on the broader timeframe suggests that the crypto market, including XRP, is still in a consolidation phase at the beginning of the year. This kind of consolidation often occurs when markets wait for external catalysts or important macro data before determining a clearer direction.

4. Trade Volume Still Low

XRP’s trading volume remains low according to quoted market data, indicating that market interest is still not strong enough to drive sharp moves. Low volume generally signals that the market is waiting for a clearer direction before taking large positions.

Low volume also tends to keep prices ranging within narrow ranges without any meaningful breakouts in the near future. In the context of the cryptocurrency market, this phase usually continues until there is significant fundamental or technical news.

5. Movement in the Consolidation Range

Historical price data shows that XRP moved in a narrow range between support around USD 1.82 to resistance around USD 1.88 in early 2026. This narrow range indicates a strong sideways phase in the crypto market for XRP in that period.

Sideways trading reflects the dominance of the balance between buyers and sellers, where there is no momentum strong enough to push the price out of the range. This scenario is likely to continue until there is a significant technical or fundamental catalyst.

6. Breakout or Breakdown Risk

The technical scenario suggests that if XRP fails to hold the lower support level around USD 1.82, the price could experience further bearish pressure towards lower levels. Conversely, if the bulls are able to break the resistance above USD 1.88 with volume support, the price could test the next psychological level in the short term.

This breakout or breakdown risk is important for traders to monitor as it signals the next market action. Traders often wait for confirmation of a breakout from this kind of consolidation range to determine the direction of their positions.

7. Short-term Price Outlook Scenes

Overall, the price analysis of XRP on January 1, 2026 shows the possibility of moving sideways with a neutral bias in the short term. This reflects investor caution towards the formation of new trends in the broader crypto market.

For the medium-term outlook, the combination of narrow price ranges and low volume suggests that a breakout move is needed to define a clearer trend. Traders and investors usually observe these key technical levels to make positioning decisions.

Also Read: 5 Veteran Analyst Insights Say 2026 Could Be Peak Gold & Silver

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Denys Serhiichuk/U.Today. XRP Price Analysis for January 1. Accessed January 2, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.