Ethereum Price Prediction: Will ETH Rise or Fall in 2026?

Jakarta, Pintu News – Ethereum (ETH) closed 2025 at around $2,970 after a tumultuous quarter. The market is divided. Some analysts expect the next growth cycle to begin soon. However, others warn that the market structure is still unclear or mixed.

The reality is somewhere in the middle. The chart shows pressure, the seasonal track record is inconclusive, and the on-chain flow shows initial but not yet strong support.

Heading into 2026, market conditions are not ideal. The question is simple: is Ethereum preparing to recover, or will it go down again?

Bearish Price Structure and Historically Volatile Start of the Year

On the 3-day chart, ETH is moving inside an ascending channel that technically resembles a bear flag pattern. A downward breakout from this structure could potentially activate a measured move. If the scenario is confirmed, technical projections indicate a drop of around 44% from the breakdown level.

Read also: Ethereum Struggles to Break $3,000 — Could a 20% Rally Be Ahead?

It should be noted that the risk of a breakout will be significantly reduced if Ethereum is able to stay in the channel for some time. However, seasonal factors add to the complexity of the analysis.

Historically, January has often been a fairly positive month for Ethereum, with an average long-term performance close to +33%. However, the last January was disappointing.

The beginning of January 2025 was characterized by a price drop which was then followed by four consecutive red months. Should another bear flag breakout occur, the seasonal momentum that usually starts the year could potentially fizzle out again.

Seasonal Uncertainty and Analyst Outlook

The combination of bearish risks with a volatile historical phase is out of line with the optimistic projections of some who expect Ethereum to reach the $7,000 to $9,000 range by 2026, at least for now.

The weakening conditions are in line with the views of Ryan Lee, Chief Analyst at Bitget, who believes that for Ethereum to reach those levels, capital outflows need to stop, real usage needs to grow beyond the current trial stage, and supply needs to be locked in for a longer period of time.

He also emphasized that the current market environment is not yet supportive of breakout expectations, with the market picture remaining mixed.

Overall, the chart shows risks, seasonal factors reflect uncertainty, and analysts’ views point to a slow, conditional, recovery process that is highly dependent on external factors. The improvement may be starting to show in the on-chain data, but so far it is still relatively weak.

On-Chain Flows Show Hope, But No Strong Confidence Yet

A number of on-chain indicators are giving signals that contradict the scenario of a sharp decline completely. Long-term holders are finally back in the role of buyers.

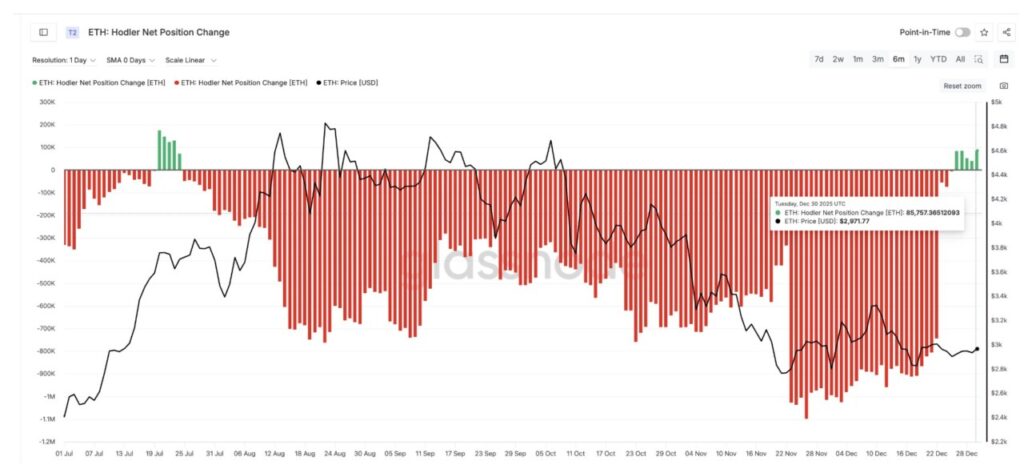

The Hodler Net Position Change metric, which reflects long-term investor wallet flows, turned positive on December 26 for the first time since July and stayed positive for several days. This indicates a patient inflow of capital at lower price levels, albeit with caution.

With Ethereum’s staking entry queue now surpassing the exit queue, there is a possibility that purchases by hodlers will be locked into the staking mechanism. This is in line with one of the prerequisites for an ETH price increase previously mentioned by Ryan Lee.

He added that more than 740K ETH is waiting to enter staking, while the amount queued to exit is only about half of that. In addition, nearly 30% of the total ETH supply is currently in staking.

The data indicates an accumulation process as well as an intention to lock in supply, but the scale is still not large enough to force a trend reversal. This pattern of behavior reflects initial interest rather than market leadership.

Read also: Crypto Whale Scoops Up $3.6 Billion in XRP as Bullish Signals Resurface

The Role of Whales and the Weakness of ETF Flows

Whale activity has also started to return. After off-exchange ETH holdings dropped to around 100.01 million ETH at the end of November, the number increased to 101.21 million ETH as of December 31.

This accumulation of around $3.6 billion is significant, but still below the early November peak of 101.90 million ETH. As long as that peak level has not been surpassed, whale demand is supportive, but not yet decisive for market direction.

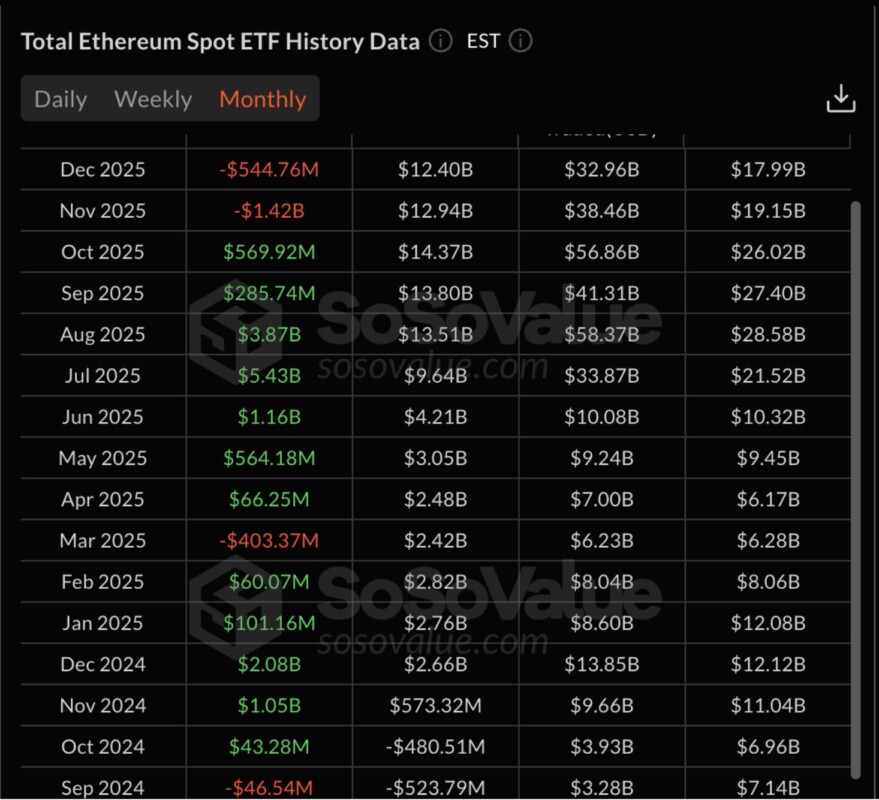

On the other hand, ETF fund flows are still the biggest gap in the bullish argument. ETH spot ETFs recorded outflows of around $1.97 billion, with November and December both performing negatively. Ryan Lee thinks that this condition severely limits the potential price movement, as large capital is leaving the ecosystem.

Overall, the on-chain narrative suggests improvement without full conviction. The situation resembles more the initial phase of price base formation than a clear trend change.

2026 Roadmap Depends on Ethereum’s Key Price Levels

At this point, technical chart analysis converges with Ryan Lee’s outlook framework. ETH needs to hold above the $2,760 level to keep the bear flag structure valid. Missing this level will weaken the structure and open up room for a drop to the $2,650 and $2,400 area.

A deeper drop towards $2,140 to $1,780 would confirm the breakdown. If the bear flag pattern is fully realized, technical projections suggest a potential drop to around $1,320, in line with the 44% correction estimate from the breakout point.

For a bullish scenario, ETH price needs to break the $3,470 level to challenge the upper limit of the structure. A move above $3,670 would technically reverse the structure. However, a true upside breakout is only considered to happen when ETH is able to reclaim the $4,770 level, which is the starting point of the flagpole and the area that resets the trend.

Only after this zone is crossed, the price target in the range of $7,000 to $9,000 has a strong structural basis. However, Ryan still considers this potential to be conditional.

He emphasized that the baseline scenario is a slow recovery that depends on the fulfillment of a number of preconditions, where price increases are more likely to be gradual rather than aggressive.

Bitcoin’s Role and Ethereum’s Trend-Setting Conditions

Ryan also explained the dynamics of market leadership when macroeconomic policy easing, such as the expectation of interest rate cuts, increases liquidity. Under such conditions, Bitcoin (BTC) is expected to react first, while Ethereum is likely to follow once staking becomes more dominant, the volume of tokenized assets increases, and ETF flows begin to stabilize.

If global liquidity improves in 2026, Bitcoin will most likely lead the market movement. Ethereum price will only follow convincingly when ETF outflows stop, whale supply surpasses the November peak, and staking demand becomes sustainable and driven by consistent hodler accumulation.

As long as these conditions are not aligned, Ethereum’s trend remains in the neutral to bearish spectrum.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price 2026: Bearish vs Bullish. Accessed on January 2, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.