Price of 1 Pi Network (PI) in Indonesia Today (1/5/26)

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia today, January 5, 2026, shows a relatively stable movement with a limited tendency to strengthen in the short term.

Nonetheless, the structure of the price movement on the technical chart indicates signals that need to be looked at more closely, particularly the emergence of a hidden bearish divergence pattern which is often an early warning of weakening upward momentum.

This puts Pi Coin in a crucial phase, where short-term market optimism is confronted with technical challenges that could potentially hold back further price appreciation.

How much is 1 PI in Indonesia today?

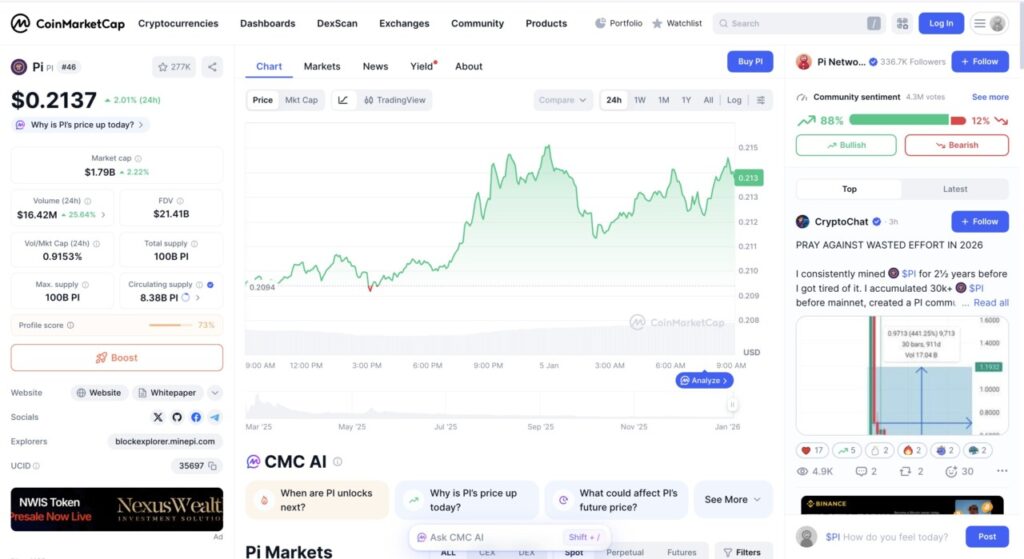

The chart shows the price movement of Pi Network (PI) within the last 24 hours on CoinMarketCap. At the time of data collection, the price of PI was around USD 0.2137, registering an increase of around 2.01% on a daily basis. In general, the price trend in this period has been moderate with an upward tendency, although accompanied by relatively reasonable intraday fluctuations for a crypto asset with limited liquidity.

In the early phase of the period, PI prices moved relatively flat in the range of USD 0.209-0.210, indicating a consolidation phase with balanced buying and selling pressure. Entering the second half of the period, a significant price acceleration was seen, characterized by a surge towards the USD 0.214-0.215 area before experiencing a mild correction. This pattern indicates an increase in short-term buying interest, followed by profit-taking that held back further gains.

Also read: XRP 2026 Outlook: Potential to Break $5?

Hidden Bearish Divergence Pattern on Pi Coin

Pi Coin is currently showing a hidden bearish divergence on its chart. Between December 19 and January 3, the price recorded lower peaks while the Relative Strength Index (RSI) reached higher peaks. This divergence signals that the upward price movement is not strongly supported. Hidden bearish divergences usually appear during corrective rallies in a downward trend. Despite short-term optimism, selling pressure still dominates below the surface.

This suggests that the major bearish trend will probably continue after buying interest temporarily weakens, increasing downside risks for Pi Coin. Macro indicators show a more balanced picture. The Chaikin Money Flow has risen above the zero line, reaching an almost month high.

Chaikin Money Flow measures volume-weighted capital flows, making it a reliable measure of investor commitment under uncertain conditions. An increase in Chaikin Money Flow indicates sustained accumulation rather than speculative surges.

Investors seem willing to invest despite mixed technical signals. This accumulation has supported recent price stability and limited deeper losses, providing a short-term cushion against broader market volatility.

Read also: Quietly Building, These 4 Micro-Cap Altcoins Are Said to Have the Potential to Explode in 2026

Pi Coin Price Challenge

Pi Coin’s immediate challenge is resistance at $0.214. This level aligns closely with the 23.6% Fibonacci retracement, which increases its significance. Multiple rejections near this zone highlight persistent selling pressure from traders defending higher cost basis levels. To break out of the bearish momentum, a decisive shift is required.

A sustained close above $0.214 would confirm a trendline breakout. Such a move could open up upside opportunities towards $0.226, with additional gains possible if volume expands and broader sentiment improves.

Failure to maintain bullish momentum could see Pi Coin experience another decline. A drop below $0.207 could trigger accelerated selling. In that scenario, the price could test critical support at $0.199, reinforcing the prevailing bearish view if buyers fail to defend that level.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Sees Strong Inflows. Accessed on January 5, 2026

- Featured Image: Bitcoin News

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.