Ethereum Holds Above $3,100 Today as Technical Setup Signals Potential Move Toward $3,600

Jakarta, Pintu News – Ethereum (ETH) remains stable above the $3,130 level after successfully breaking out of the descending price channel. At the same time, Ethereum co-founder Vitalik Buterin announced a major roadmap that could potentially change the structure of the Ethereum blockchain in the next four years.

This combination of technical factors and network fundamentals suggests that Ethereum may be entering its most transformative phase since The Merge event. So, how will Ethereum price move today?

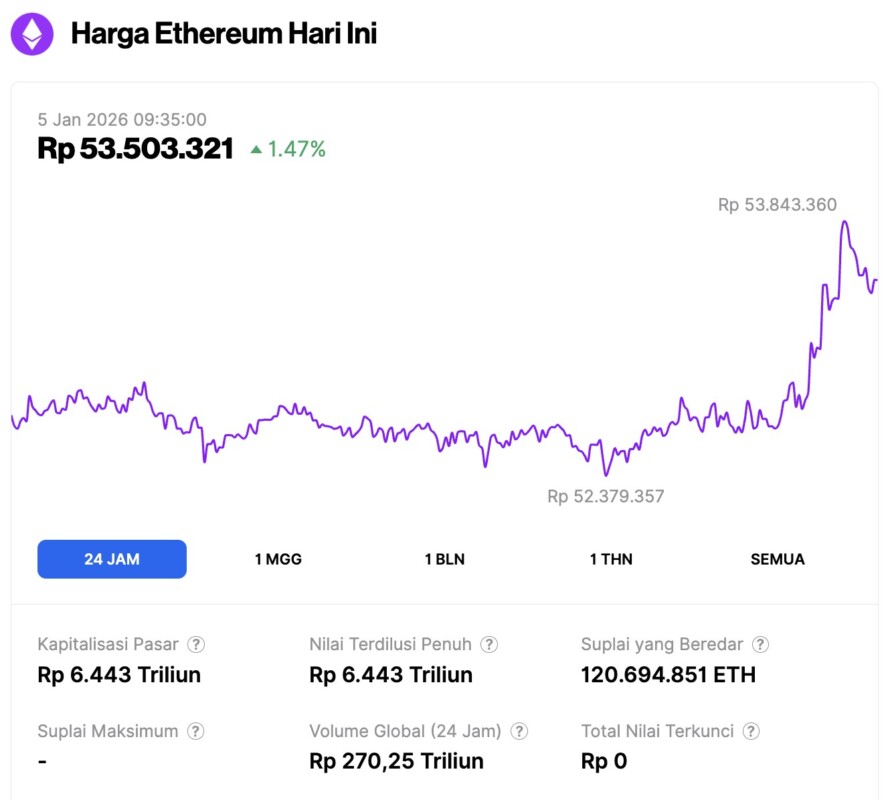

Ethereum Price Up 1.47% in 24 Hours

On January 5, 2026, Ethereum was trading at approximately $3,188, equivalent to IDR 53,503,321, marking a 1.47% gain over the past 24 hours. Within this period, ETH recorded an intraday low of IDR 52,379,357 and reached a high of IDR 53,843,360.

At the time of writing, Ethereum’s market capitalization stood at around IDR 6,443 trillion, while daily trading volume surged by 27% to IDR 270.25 trillion over the same 24-hour period.

Read also: Bitcoin Price Rises to $92,000 Today: How High Can BTC Soar?

Ethereum Reclaims Levels Above $3,100

Ethereum recorded a gain of 1.24% on January 4 and moved around $3,100, with a market capitalization of around $378 billion. After finally breaking out of the descending channel that had restricted price movements, ETH now appears to be ending its sideways consolidation phase – good news for market participants with a bullish short-term outlook.

On the 4-hour chart, we can see a pattern of higher lows and higher highs, signaling that buying pressure is coming back. This is also supported by the crossover of the 50-EMA which is now above the 100-EMA, a technical signal that shows the strength of the uptrend.

Meanwhile, the RSI indicator is slightly above the 70 mark, indicating a healthy uptrend with no signs of over-saturation. The nearest resistance target is around $3,305, and the next is at $3,432.

ZK-EVM and PeerDAS: Transforming the Ethereum Network

Vitalik Buterin stated that Ethereum has entered a new phase as a “fundamentally different decentralized network,” as ZK-EVM and PeerDAS transition from concept to real implementation.

He described this innovation as a major breakthrough that successfully overcomes the blockchain trilemma-that is,achieving decentralization, consensus, and high bandwidth simultaneously.

Some of the key milestones of the roadmap Buterin presented:

- 2026: ZK-EVM nodes started to be launched.

- 2027-2030: Increased gas limits and development of distributed block building systems that will increase network capacity.

In the long term, Ethereum is targeting the full implementation of distributed block construction, a system that ensures no single entity can monopolize the flow of transactions.

These innovations have great potential to lower transaction fees and accelerate adoption, strengthening Ethereum’s fundamental value far beyond mere market speculation.

Read also: 2 Altcoins Predicted to Dominate in 2026

Ethereum (ETH/USD) Technical Setup Suggests Target in $3,430-$3,600 Range

Ethereum price predictions are now pointing to a bullish trend, along with candlestick patterns that give strong signals.

The emergence of a bullish engulfing pattern successfully pushed ETH out of the descending channel, and was then followed by a spinning top formation, indicating the market might take a short pause before resuming its upward movement.

The measured movement of this pattern points to the next target around $3,430. If momentum is maintained, the upside potential towards $3,600 is wide open.

On the other hand, the current support level still stands at around $3,070. However, if the price drops below $3,010, then the breakout signal will be considered failed or invalid. For traders looking for entry opportunities, the area around $3,100 could be an attractive entry point, with targets between $3,300 and $3,430.

Long-term Outlook: Ethereum’s New Era

The combination of strong fundamentals, network innovation, and technical resilience provides a positive outlook for Ethereum heading into early 2026.

If Vitalik Buterin’s vision of distributed block building is realized, Ethereum could evolve into a faster, fairer, and more scalable blockchain – ready to support a new wave of decentralized finance (DeFi) and AI-based applications.

With momentum continuing to build, both on-chain and technically, ETH looks set to test the $3,600-$3,700 zone, before targeting the $4,000 level later in the year.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CryptoNews. Ethereum Price Prediction: Vitalik’s Network Upgrade and $3,600 Path Ahead. Accessed on January 5, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.