Dogecoin Climbs 3% Today as Early 2026 Reversal Signals Surface

Jakarta, Pintu News – Dogecoin (DOGE) price enters 2026 with renewed technical interest, as signals from earlier in the year, long-term structure, and market sentiment begin to take shape.

Analysts monitoring daily momentum, Fibonacci levels, and multi-year consolidation patterns think that DOGE may be approaching a volatility expansion phase. If key resistance levels are broken, the potential for price increases could be wide open with new targets coming into view.

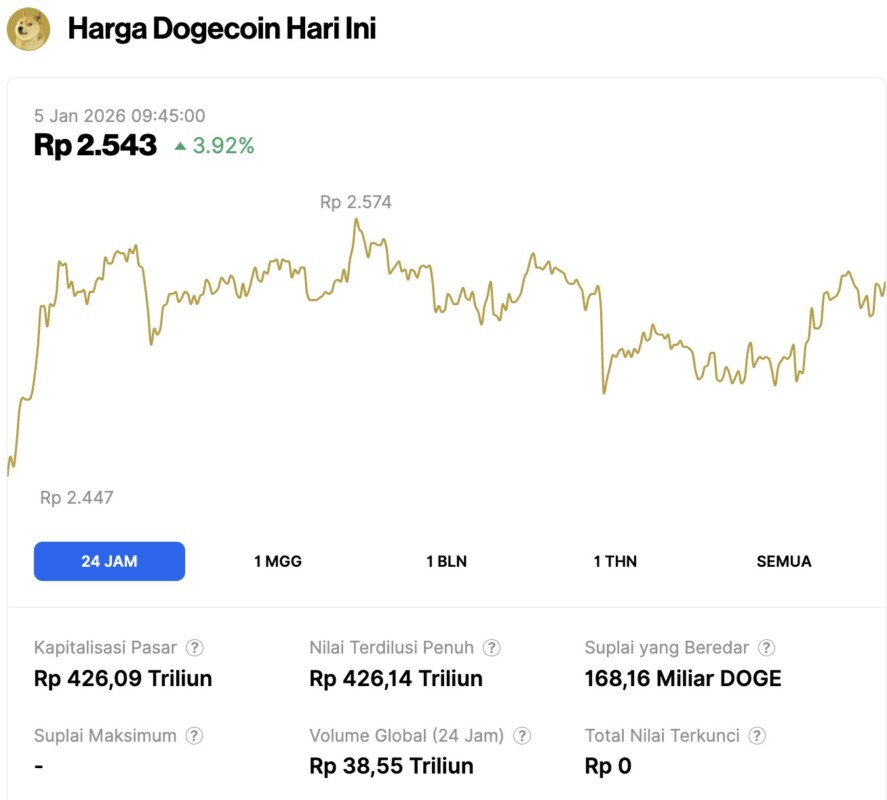

Dogecoin Price Rises 3.92% in 24 Hours

As of January 5, 2026, Dogecoin (DOGE) has risen by 3.92% over the past 24 hours, trading at $0.1517, or approximately IDR 2,543. During this period, DOGE fluctuated between IDR 2,447 and IDR 2,574, reflecting moderate intraday volatility.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 426.09 trillion, with 24-hour trading volume reaching approximately IDR 38.55 trillion — signaling steady market activity and renewed investor interest.

Read also: Ethereum Holds Above $3,100 Today as Technical Setup Signals Potential Move Toward $3,600

Dogecoin Price Prints Bullish Reversal Signal Early 2026

According to Tardigrade Trader technical analysts, Dogecoin’s daily chart kicked off 2026 with two striking bullish candles.

The first candle showed strong resistance to selling pressure in the $0.122 area, while the second candle closed higher steadily around $0.126. This combination indicates a return of buying strength after a period of consolidation that lasted for several months.

Dogecoin’s price is also currently testing the downtrend line drawn from the mid-2025 price peak around $0.16. While that trendline is still holding at around $0.128, continued price pressure approaching resistance like this is often an early signal of a larger directional move. The return of market liquidity after the year-end holiday also reinforces the potential for this scenario.

If Dogecoin manages to print a close above the short-term resistance level, then the potential upside towards $0.13 to $0.14 could be open. However, if it fails to break upwards, the price will likely return to test support at $0.12.

Overall, the current price structure reflects cautious optimism, but has yet to confirm a technical breakout.

Fibonacci structure points to further upside potential for Dogecoin

Meanwhile, Surf analysts highlighted a weekly chart of Dogecoin against USD, which charts price movements against long-term Fibonacci retracement levels. During 2023 and 2024, the DOGE price is seen consistently holding above the important support level at the 0.236 retracement, before finally rising towards the 0.618 level at around $0.122 in 2025.

Currently, the price of DOGE moving around $0.126 indicates stabilization above that zone.

The chart also shows a decrease in downward momentum, which usually occurs in the transitional phase between accumulation and price expansion. From a technical point of view, if the price is able to hold above the intermediate support area, then a move towards the 0.786 retracement in the $0.15 range becomes a plausible scenario – and this would mark a significant change in trend.

In addition, the Fibonacci structure also reflects the cyclicality of Dogecoin’s price movements. Each historical rally usually starts from a higher base level than the previous one. A weekly price close above $0.13 would strengthen bullish sentiment, while a drop below $0.095 could weaken market confidence and reopen the risk to lower price levels.

Read also: 5 Coin Memes that Soared to Double Digits Today

Long-term Wedge Pattern and Market Narratives Drive Dogecoin Volatility Outlook

Crypto Bull analysts display a logarithmic chart showing that the Dogecoin price is still within a long-term descending wedge pattern formed since 2021. Over the past few years, the price has continued to compress between the descending resistance line and the strong support above $0.08.

Going into early 2026, DOGE was trading near the apex of the wedge – an area that has historically been associated with volatility expansion.

Technically speaking, a descending wedge pattern usually ends with an upward breakout after a prolonged period of compression, especially if it is supported by the market narrative coming back stronger.

One potential trigger is the DOGE-1 mission, a satellite funded with Dogecoin and scheduled to launch in the first half of 2026. While still speculative, this kind of narrative has previously driven sentiment and significant price movements in DOGE.

To confirm the potential breakout, the price needs to break convincingly above $0.13, which could pave the way towards the next resistance zone around $0.20. Conversely, failure to sustain the price above $0.11 will likely delay this bullish scenario. The current technical structure emphasizes the importance of patience, given that the price is approaching its tipping point.

Overall, Dogecoin is now showing compression patterns across multiple time frames, while short-term bullish signals are starting to align with the long-term technical structure.

While confirmation of the move is still awaited, the combination of daily momentum, Fibonacci positions and the wedge pattern indicates that DOGE is entering an important phase that could determine its direction throughout 2026.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinCentral. Dogecoin Price Analysis: DOGE Compression Points to Volatile Upside. Accessed on January 5, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.