Crypto Market Direction Signals: What Does Bitcoin, ETH, XRP, and SOL Max Pain Mean?

Jakarta, Pintu News – The crypto market is currently experiencing uncertainty with low liquidity, leaving investors and traders looking for clues on the next direction of the market.

Max pain prices for Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Solana (SOL) are in the spotlight as $2.2 billion worth of crypto options expire today. Rising long-term bond yields and gold prices also put selling pressure on Bitcoin (BTC) prices.

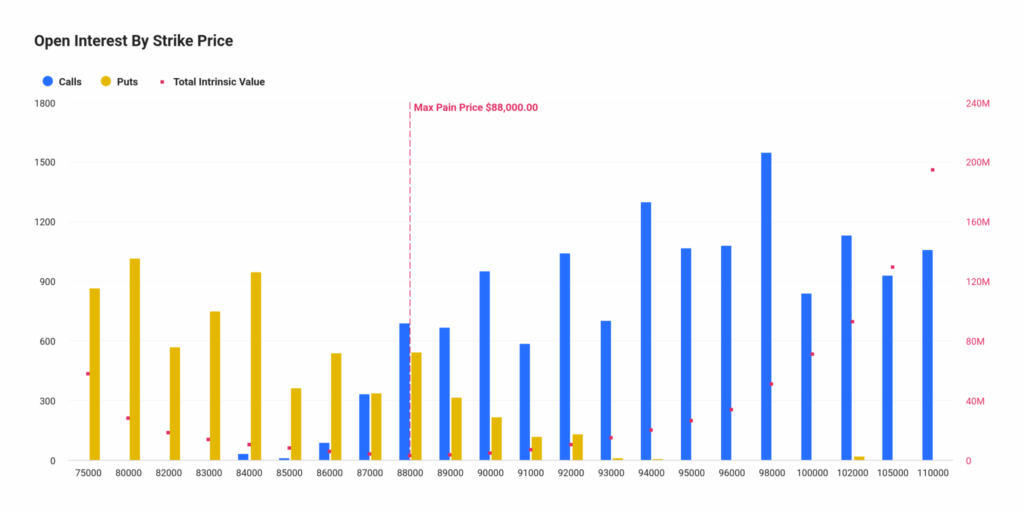

Bitcoin Options Expiration Today

Today, nearly 21,000 Bitcoin (BTC) options with a face value of $1.85 billion will expire on the largest crypto derivatives exchange, Deribit. The put-call ratio of 0.48 indicates bullish sentiment among traders. However, this is one of the lowest face value Bitcoin (BTC) options expiries, reflecting the thin liquidity of the crypto market at the moment.

This expiration occurs amidst a volatile market, where traders try to predict the next price movement. Despite the bullish sentiment, the market remains wary of potential sudden changes that could occur due to external factors such as changes in monetary policy by central banks.

Read also: Early 2026 is a bullish turning point for the crypto market, what could be the reason?

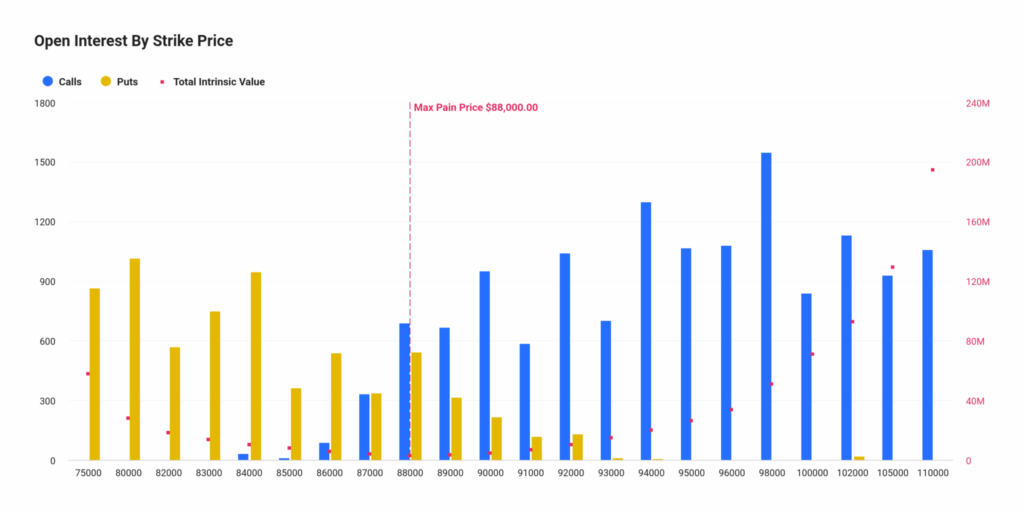

Max Pain Price Ethereum Signal

More than 129,000 Ethereum (ETH) options with a face value of $400 million will also expire on Deribit. The put-call ratio of 0.62 shows that call volume has almost doubled put volume in the past 24 hours, indicating bullish sentiment among Ethereum (ETH) traders.

Ethereum (ETH) price rebound predictions above $3,000 are a hot topic among investors. The max pain price recorded shows that traders are anticipating a price increase, even though the overall market is still shrouded in uncertainty.

Read also: Bitcoin Price 2025: Reviewing the Accuracy of Predictions by Big Names in the Crypto World

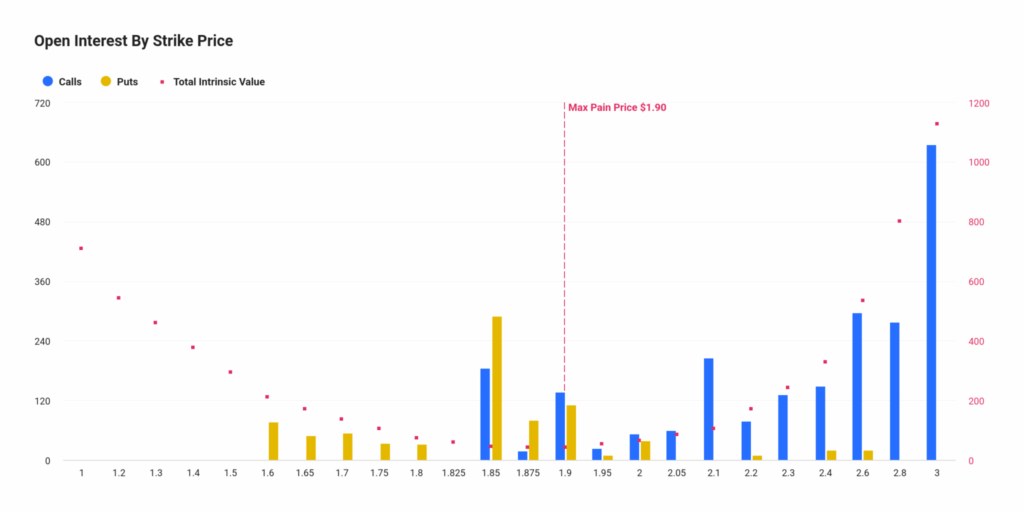

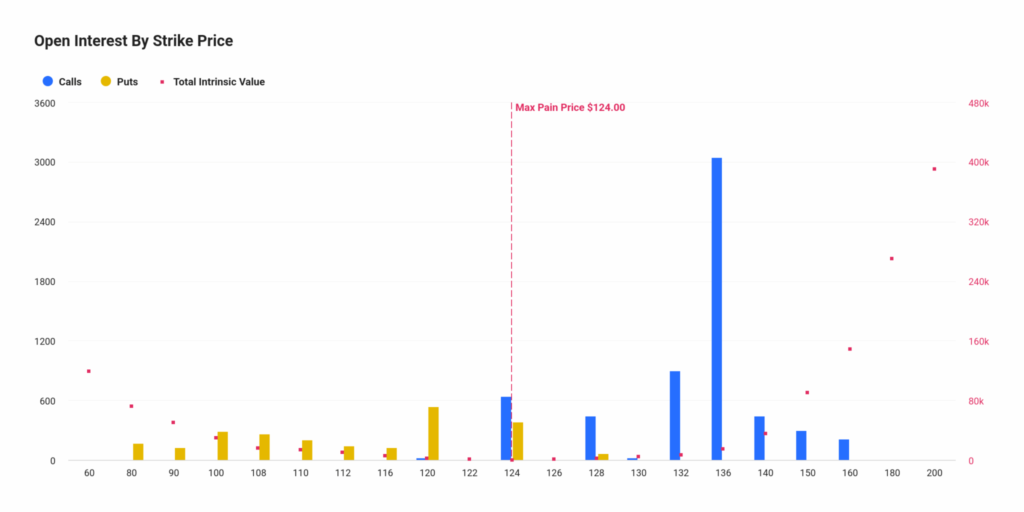

Max pain price of XRP and Solana

Ripple (XRP) options worth millions of dollars expire today with a put-call ratio of 0.78. The max pain price at $1.90 is in sharp focus, given the broader uncertainty in the crypto market. This suggests that traders may expect a price drop to this level.

Meanwhile, Solana (SOL) options worth millions of dollars will also expire with a put-call ratio of 0.52. The max pain price at $124, which is below the current market price, suggests that traders might trigger selling towards the max pain price due to the increased put volume in the past 24 hours.

Conclusion

With significant options expiry and changing market dynamics, investors and traders need to remain vigilant. Understanding the max pain price can provide valuable insights into potential price movements in the crypto market. Although there are some bullish signals, global uncertainty and external factors can still affect the market in unexpected ways.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Here’s What Bitcoin, ETH, XRP, SOL Max Pain Price Reveals About Upcoming Direction. Accessed on January 5, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.