5 Ethereum (ETH) Facts Recorded US$960 Million Inflow: End 5-Month Negative Trend

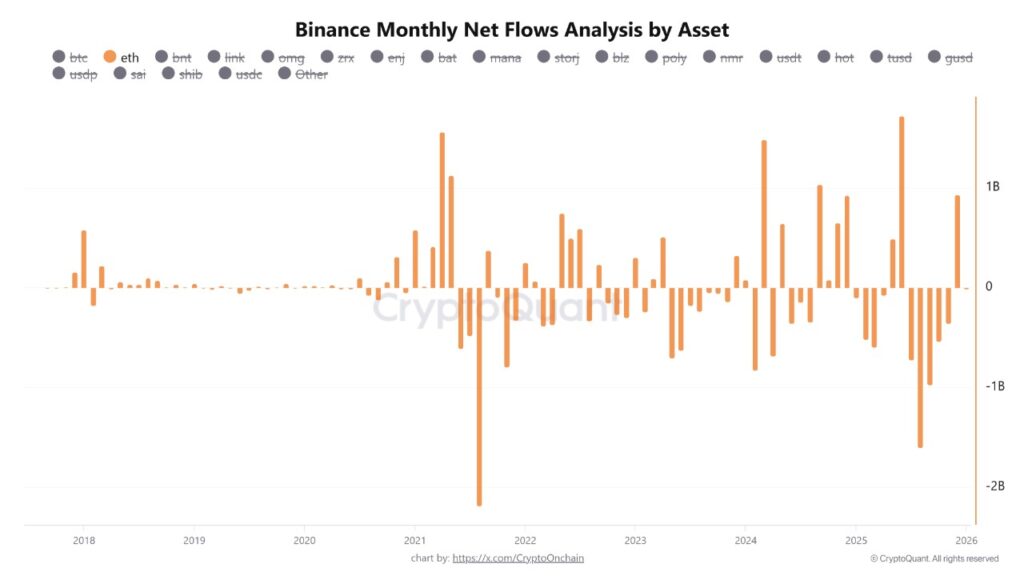

Jakarta, Pintu News – Ethereum (ETH), as one of the second largest cryptocurrencies after Bitcoin (BTC), showed a significant change in investor behavior at the end of last year. The latest on-chain data shows that ETH recorded a net inflow of US$960 million to the Binance exchange in December 2024, breaking the negative flow record that lasted since July 2025. The following information is summarized based on recent reports from NewsBTC that reflect market dynamics and investor sentiment towards ETH.

1. Huge US$960 Million Inflow to Binance

Ethereum’s net inflow to Binance reached around US$960 million in December 2024, according to NewsBTC which cited CryptoOnChain‘s analysis. This figure represents a sharp reversal after a long period in which more ETH exited the exchange than entered. This phenomenon marks a major shift in ETH investor activity that is significant compared to previous trends.

This change comes after five consecutive months of negative net flow records. When investors withdraw ETH from exchanges, it is often seen as a signal of accumulation or strong long-term demand. But the latest data shows the opposite.

Such large net inflows are rare in the crypto market and indicate a noteworthy change in market behavior by industry participants, especially traders and analysts who monitor exchange activity.

Also Read: 2026, a Hopeful Year for Solana: Predictions and Challenges

2. End 5-Month Negative Trend

Prior to this US$960 million inflow, Ethereum was in a position to record more withdrawals than deposits since July 2025. This negative trend reflects investors’ uncertainty towards ETH in recent months. NewsBTC data suggests that these changes indicate a potential turning point in ETH’s market dynamics.

During those periods of negative flows, investors tend to withdraw ETH from exchanges, a behavior often associated with long-term accumulation strategies. But this reversal signaled a change in market motivation.

The breaking of the negative trend after five months comes as important data as it could be an indicator of different market phases, both in terms of demand and trading activity.

3. Crypto Market Macro Implications

Large net inflows are often seen as a bearish signal, as they indicate a potential supply that is ready to be sold when the asset is on exchanges. CryptoOnChain quoted NewsBTC as saying that the flow of ETH to exchanges may reflect market preparation for potential selling pressure or major repositioning.

However, there is another interpretation that this reflects a sentiment reversal leading to accumulation at lower price levels. Investors or traders may be moving ETH to exchanges to capitalize on the increased volatility of trading activity.

As such, these large inflows show the complexity of market signals that are not entirely bearish or bullish, but can mean both conditions depending on the context of the investor’s strategy.

4. Market Sentiment and Trader Activity

Significant net inflows are often attributed by analysts as an indication that traders and institutions are repositioning their portfolios. NewsBTC mentions that some of the inflow may be used for active trading.

Traders tend to move assets to exchanges when they anticipate price volatility or arbitrage opportunities, reflecting the transformation from an accumulation phase to a more active trading phase.

This activity is also influenced by ETH’s overall technical condition, including the support and resistance levels that crypto technical analysts often focus on when determining entry and exit strategies.

5. Impact on ETH Price Movement

Despite the large inflow recorded in late 2024, the price of Ethereum remains below its historical peak reached in August 2021. According to NewsBTC, ETH was trading around US$3,100 in early 2026 with a significant drop in daily trading volume compared to the previous period.

This price position suggests that despite the capital inflow into the exchange, ETH’s price trend is still vulnerable to broader market pressures. This means that large inflows do not automatically guarantee short-term price increases without supportive market action.

However, this phenomenon remains important in risk/reward analysis as it shows that large investors and active traders think there is a decent opportunity to be positioned on ETH.

Also Read: Ripple’s (XRP) Big Breakthrough in 2026, Are You Ready?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Semilore Faleti/NewsBTC. Ethereum Records $960M Inflow To Break 5-Month Negative Streak – Details. Accessed January 5, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.