6 facts about the impact of the US attack on Venezuela: BTC depressed, oil drops, crypto market shifts?

Jakarta, Pintu News – Geopolitical tensions have once again affected global markets after the United States launched a military attack on Venezuela in early January 2026. This event not only impacted oil prices, but also triggered reactions in the crypto and cryptocurrency markets, especially Bitcoin (BTC). According to Decrypt’s report, the market showed a measured response without extreme volatility, but still reflected the change in global risk sentiment.

1. Bitcoin Experiences Short-Term Pressure

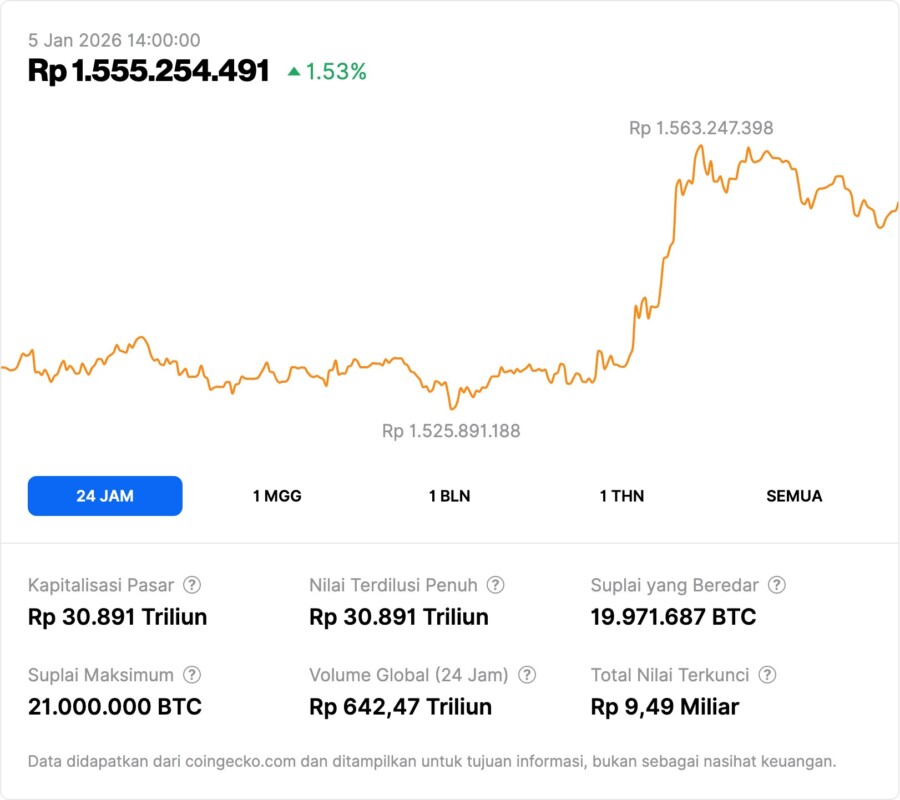

The price of Bitcoin (BTC) recorded a drop shortly after news of the US attack on Venezuela broke. According to Decrypt’s report, this reaction reflects the classic pattern of risk assets when geopolitical uncertainty increases. The data shows that the crypto market is still sensitive to large-scale global news.

Decrypt notes that this pressure was limited and did not develop into a massive sell-off. BTC’s price drop is seen as more of a short-term psychological response, suggesting that the cryptocurrency market structure is relatively more mature compared to previous periods of conflict.

Also Read: 2026, a Hopeful Year for Solana: Predictions and Challenges

2. Oil Drops and Affects Risk Sentiment

Global oil prices reportedly weakened after the attack, despite Venezuela being a country with large oil reserves. According to Decrypt, the market does not expect the supply disruption to be significant in the short term, and the decline in oil prices has affected sentiment on risky assets more broadly.

In a global context, weaker oil prices often reduce inflationary pressures. Decrypt mentions that this could have an indirect impact on the crypto market, as monetary policy expectations become looser. However, this relationship is still indirect and dependent on further developments.

3. Crypto Market Response Relatively Restrained

Unlike the major upheavals of the past, the crypto market has shown a more restrained response this time around. According to Decrypt, the volatility of Bitcoin and other major cryptocurrency assets remains within reasonable ranges. This suggests an increased resilience of the market to external shocks.

The data also indicated that market participants did not overreact. Investors appear to be waiting for clarity on conflict escalation before making further decisions. This approach reflects more rational market behavior.

4. Venezuela’s Role in the Global Bitcoin Narrative

Venezuela is often associated with the adoption of Bitcoin (BTC) as an alternative to the traditional financial system. Decrypt highlights that the geopolitical conflict in the country has once again raised discussions about the role of crypto in situations of economic and political crisis. However, the report asserts that the direct impact on the Bitcoin network has been relatively minimal.

According to Decrypt, the narrative of cryptocurrency use in Venezuela is more long-term structural. These military events do not necessarily change the dynamics of crypto adoption at the local level. This demonstrates the separation between crypto utility and short-term political turmoil.

5. Other Asset Movements: Ethereum and Altcoins

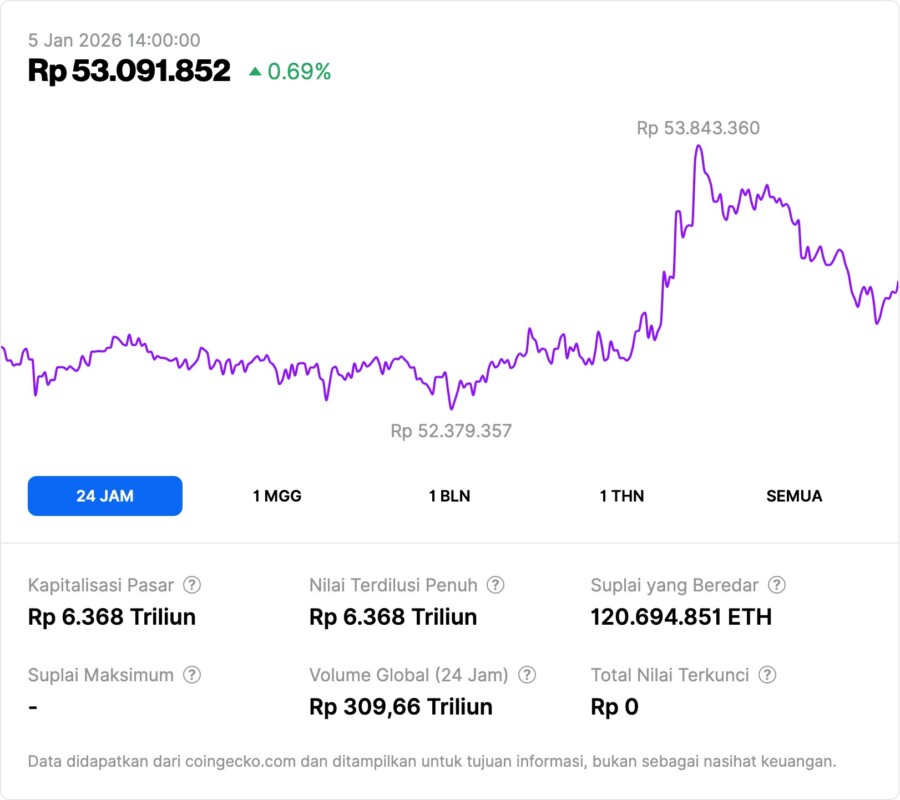

Apart from Bitcoin, Ethereum (ETH) and some altcoins also experienced mild fluctuations. Decrypt noted that ETH’s movement followed BTC’s direction with slightly lower volatility. This is consistent with historical patterns in the cryptocurrency market.

Small-cap altcoins show greater variation in response. But in aggregate, Decrypt assesses that there are no signs of systemic panic. The crypto market as a whole continued to function normally after the event.

6. Implications for Global Markets and Investors

Overall, Decrypt considers the US attack on Venezuela to be a sentiment test for global markets, including crypto. The relatively calm reaction suggests that markets have anticipated geopolitical risks as part of the global dynamic. This reinforces the view that cryptocurrencies are increasingly integrated into the global financial system.

In rupiah terms, Bitcoin’s price fluctuations of tens of thousands of US dollars-about hundreds of millions of rupiah at an exchange rate of 1 USD = Rp16,708-remain within its historical range. This data confirms that although sensitive to news, the crypto market is no longer easily shaken by a single event.

Also Read: Ripple’s (XRP) Big Breakthrough in 2026, Are You Ready?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Decrypt. US Strikes Venezuela as Bitcoin Slips and Oil Slides. Accessed January 5, 2026.

- Featured Image: Dagens.com

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.