Ethereum (ETH) is approaching a critical moment, is January 2026 the time to surge?

Jakarta, Pintu News – The Ethereum (ETH) market is experiencing an important moment as the price approaches the upper boundary of the descending wedge pattern. This slow but steady price increase puts Ethereum (ETH) on the verge of a breakout opportunity. This momentum is widely attributed to the Fusaka upgrade launched on December 3, which aims to increase scalability and reduce Layer 2 fees, a long-standing challenge facing Ethereum (ETH).

Ethereum Holders Strengthen

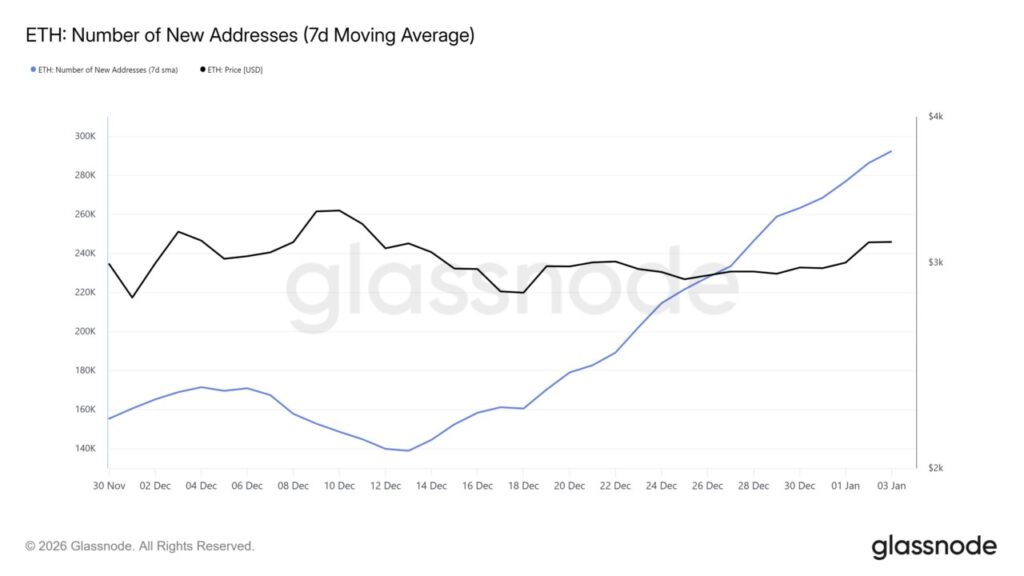

Ethereum (ETH) network activity has grown rapidly in the past three weeks. The data shows a sharp increase in new addresses, defined as wallets interacting with Ethereum (ETH) for the first time. This metric increased by about 110% during the period, signaling accelerating user adoption. Currently, Ethereum (ETH) adds around 292,000 new addresses every day.

This surge reflects a combination of seasonal factors and structural improvements. Christmas 2025 celebrations, New Year’s positioning, and optimism regarding Fusaka upgrades appear to be driving renewed engagement across the ecosystem. Increased address creation often precedes increased transaction demand.

While not every new address represents a long-term investor, continued growth at this scale indicates growing participation. Broader user inflation typically increases liquidity depth and strengthens price resilience during volatile market phases.

Also Read: 2026, a Hopeful Year for Solana: Predictions and Challenges

Advantages of HODL Policy

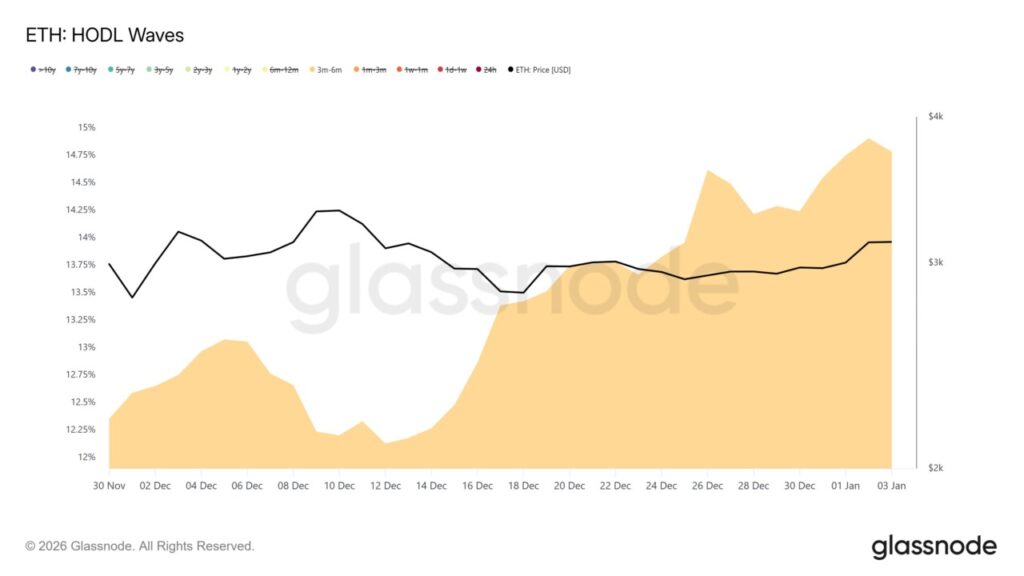

Macro indicators show a mixed but informative picture. HODL Waves showed growth among medium-term holders, defined as wallets holding Ethereum (ETH) for three to six months. These investors mostly entered positions between July and October 2025.

Early July buyers are currently in profit, while those who entered after mid-July are still losing money. This distribution creates forced holding behavior, as many holders wait for price recovery. Positions like this can provide temporary support by reducing selling pressure during drawdowns.

However, price increases may trigger distribution from this group. As Ethereum (ETH) approaches break-even levels for medium-term holders, the risk of selling increases. This dynamic could limit upside unless fresh capital offsets profit-taking from trapped supply.

Ethereum (ETH) on the Threshold of Breakout

Ethereum (ETH) price continues to trade within a descending wedge that formed in early November. Ethereum (ETH) is currently trading near $3,141, placing it close to a potential breakout. This structure suggests that momentum is compressing, which often precedes directional expansion.

This wedge projects a theoretical upside of about 29.5%, with a target of $4,061. While ambitious, such a move would require stronger buying pressure than currently observed. A more realistic scenario involves Ethereum (ETH) breaking out of the breakout and pushing past $3,287, opening a short-term path towards $3,447.

Downside risks remain if macro conditions worsen or the breakout fails. A rejection could send Ethereum (ETH) back below $3,000. In that case, Ethereum (ETH) might retest the $2,902 support level, invalidating the bullish thesis and reinforcing range-bound conditions.

Conclusion

With the increase in Fusaka and the increase in the number of holders, Ethereum (ETH) is on a promising path. However, investors should remain alert to market dynamics that could affect the price trend. The success of the upcoming breakout could be the key to determining Ethereum (ETH)’s long-term direction in the crypto market.

Also Read: Ripple’s (XRP) Big Breakthrough in 2026, Are You Ready?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ethereum: New Investors Surge, Price Impact. Accessed on January 5, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.