MicroStrategy uses Bitcoin (BTC) to change the capital market in 2026!

Jakarta, Pintu News – MicroStrategy has changed the investment paradigm by leveraging Bitcoin (BTC) to create a sustainable and democratic funding model, challenging long-held norms in the private equity industry.

MicroStrategy and Perpetual Capital Innovation

MicroStrategy, now known as Strategy, has successfully raised capital from retail investors directly, establishing a permanent and sustainable funding structure. By using exchange-listed securities instead of closed-end private equity structures, Strategy has opened up access to alternative investment products to more people. This funding model does not rely on cyclical capital raising, providing greater stability and predictability in funding.

This approach is underpinned by so-called “Digital Equity” and “Digital Credit,” both guaranteed by Bitcoin (BTC). Bitcoin (BTC) is now considered an institutional-grade collateral, allowing Strategy to turn their Bitcoin (BTC) reserves into a sustainable capital engine, similar to a private equity continuation fund in the form of public equity.

Also Read: 2026, a Hopeful Year for Solana: Predictions and Challenges

Development and Impact on the Market

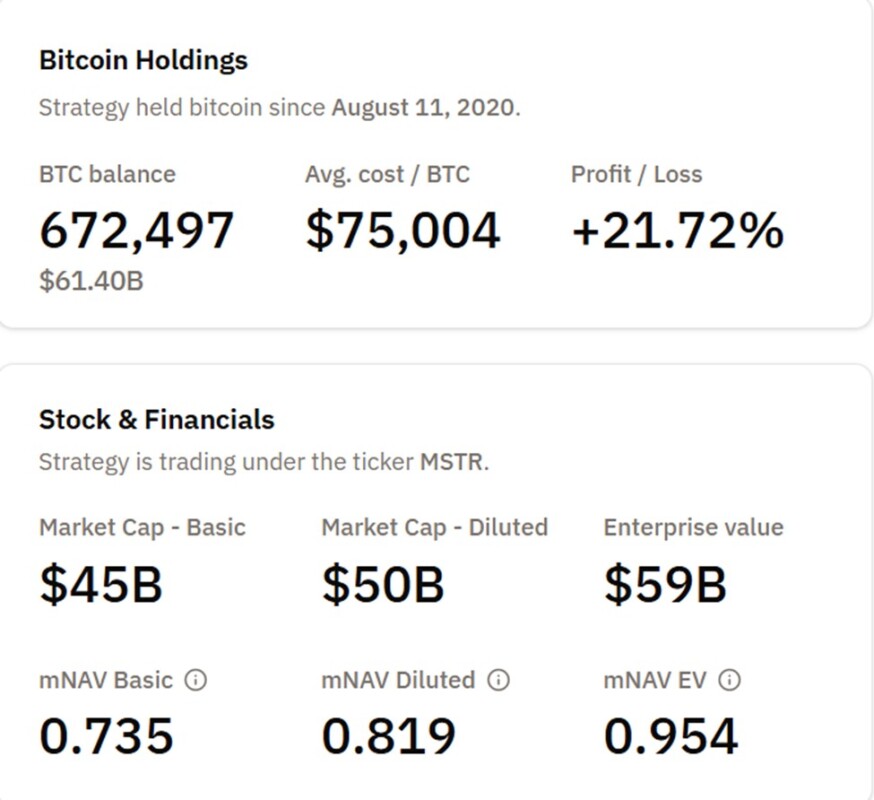

In 2025, Strategy raised approximately $21 billion through a combination of common stock issuance, preferred stock offerings, and convertible debt. These funds were used for aggressive purchases of Bitcoin (BTC). To date, Strategy owns 672,497 Bitcoin (BTC), with a total purchase cost of approximately $50.4 billion and a market value of approximately $61.4 billion, based on a Bitcoin (BTC) price close to $91,000.

The company uses significant leverage through debt and preferred stock, creating enormous exposure to Bitcoin (BTC). This makes Strategy either the largest corporate Bitcoin (BTC) cash holding company in the world, or a leveraged Bitcoin (BTC) investment vehicle. This model allows Strategy to continue accumulating Bitcoin (BTC) while offering investors varying levels of exposure to its performance.

Transition and Upcoming Challenges

According to Jain, 2026 will be “Year 1” for MicroStrategy, marking the transition from experimentation to full-scale deployment. This change reflects Bitcoin’s (BTC) increased liquidity, stronger market infrastructure, and increased investor familiarity with crypto-backed financial instruments.

By bridging the gap between retail access and permanent funding, MicroStrategy is challenging private equity orthodoxy and demonstrating how crypto can support a sustainable, institutional-grade investment model. However, even as the company enters its next phase, potential exclusion from MSCI remains a hanging concern. This shows that challenges remain, and Strategies must continue to innovate and adapt their strategies to ensure long-term sustainability.

Conclusion

With a bold and innovative approach, MicroStrategy has set a new standard in capital and investment management. The future will determine whether this sustainable and democratic model will become the new norm in the financial industry, or just a temporary phenomenon in the evolution of capital markets.

Also Read: Ripple’s (XRP) Big Breakthrough in 2026, Are You Ready?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. MicroStrategy to Launch Bitcoin-Backed Private Equity Fund. Accessed on January 5, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.