Bitcoin (BTC) Price Surges, Will it Continue to Rise in January 2026?

Jakarta, Pintu News – After six weeks of decline, Bitcoin (BTC) price has finally shown a significant increase. Driven by renewed optimism and a strong influx of spot ETF funds, Bitcoin (BTC) managed to break the upper limit despite the geopolitical tensions created by the US attack on Venezuela. The market remained resilient, showing that investors are more concerned with liquidity trends and institutional demand than short-term macro uncertainties.

Changing Attitudes of Bitcoin Whales

The behavior of Bitcoin (BTC) whales has undergone a noticeable change in the past day. Addresses holding between 10,000 and 100,000 BTC have sold around 50,000 BTC between December 29 and January 3. This distribution phase reflects a cautious attitude as Bitcoin (BTC) consolidates below key resistances.

However, in the past 24 hours, the whale wallet took a different tack by accumulating around 10,000 BTC, worth $912 million, after Bitcoin (BTC) broke the $90,000 level. This renewed accumulation signals confidence among large holders and could help absorb short-term selling pressure.

Also Read: 2026, a Hopeful Year for Solana: Predictions and Challenges

Concerns Over Bitcoin Miners

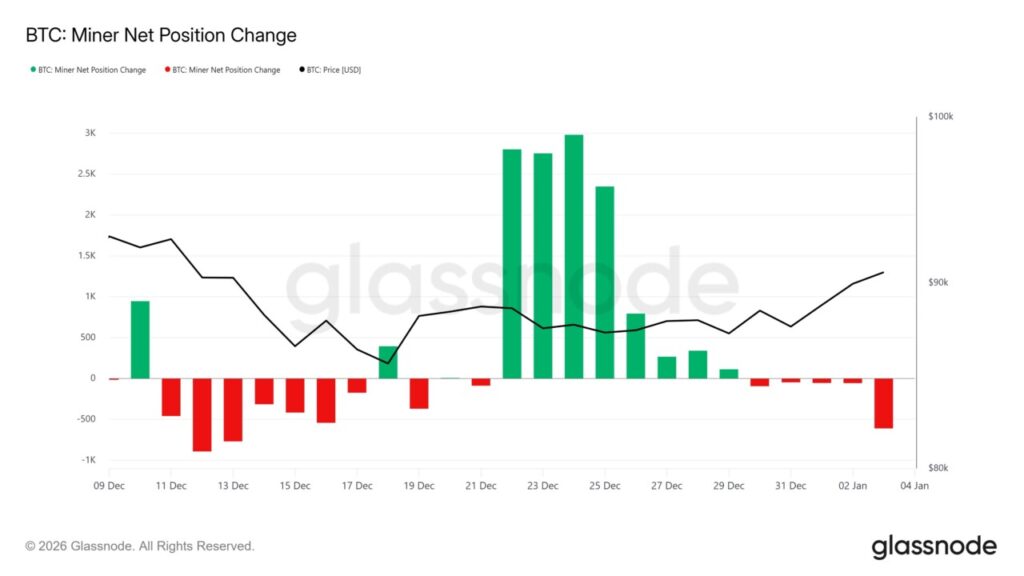

The behavior of Bitcoin (BTC) miners adds a balancing factor to the bullish sentiment. The change in miners’ net position shows a sharp increase in selling over the past 24 hours. Outflows increased from 55 BTC to 604 BTC, reflecting miners taking advantage of high prices to realize profits.

Although these volumes are still relatively small compared to the total market supply, sales by miners still affect the short-term dynamics. Increased supply coming into the market could dampen the upward momentum, especially if demand growth slows down.

BTC Price Break Confirmation

Bitcoin (BTC) managed to break out of a six-week downward pattern in the past 24 hours, trading near $91,327 at the time of writing. This technical breakout suggests increased momentum. To sustain this breakout, Bitcoin (BTC) will have to secure $92,031 as support, which will open a path towards $95,000.

Bullish confirmation requires recovery of key moving averages. The 50-day EMA near $91,554 and the 365-day EMA around $97,403 are currently acting as resistance. Turning these levels into support would signal a stronger trend reversal and increase the chances of returning above $100,000.

Conclusion

With the changing attitudes of whales and miners, as well as the recent technical breakout, the Bitcoin (BTC) market is exhibiting complex dynamics. Investors and market watchers should remain alert to macroeconomic influences and internal market behavior to anticipate further price movements. The performance of Bitcoin (BTC) at the beginning of this year will be an important indicator of the market trends that may form in the future.

Also Read: Ripple’s (XRP) Big Breakthrough in 2026, Are You Ready?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Price Breaks Free, But Confirmation Awaits. Accessed on January 5, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.