These 3 Altcoins Could Face Major Liquidations in Early January 2026

Jakarta, Pintu News – Positive sentiment started to return to the market in the first week of January, pushing altcoins towards recovery. However, there are still doubts whether this rebound will last.

Reporting from BeInCrypto, some altcoins have the potential to trigger massive liquidations as their derivatives data approaches the danger zone that has previously caused liquidations. Which altcoins stand out?

Ethereum (ETH)

Many bullish factors favored long positions on Ethereum (ETH) this week. The number of new ETH holders has increased sharply in recent times. The entry queue for Ethereum staking now exceeds the exit queue. In addition, Ethereum’s on-chain transactions have reached their highest level in a decade.

Read also: Vitalik Buterin Claims Ethereum Solved the Blockchain Trilemma Problem!

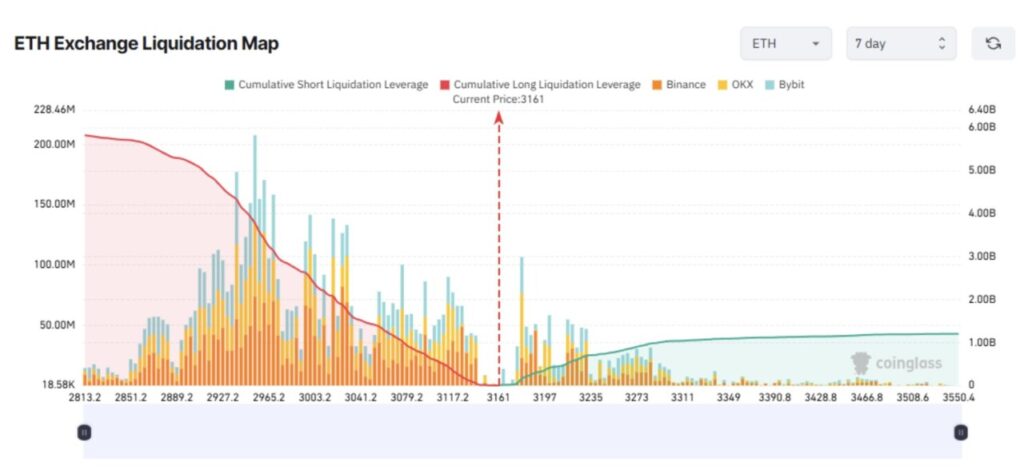

As a result, traders increase capital and leverage for their long positions. This drives the potential for long liquidation much higher than short liquidation.

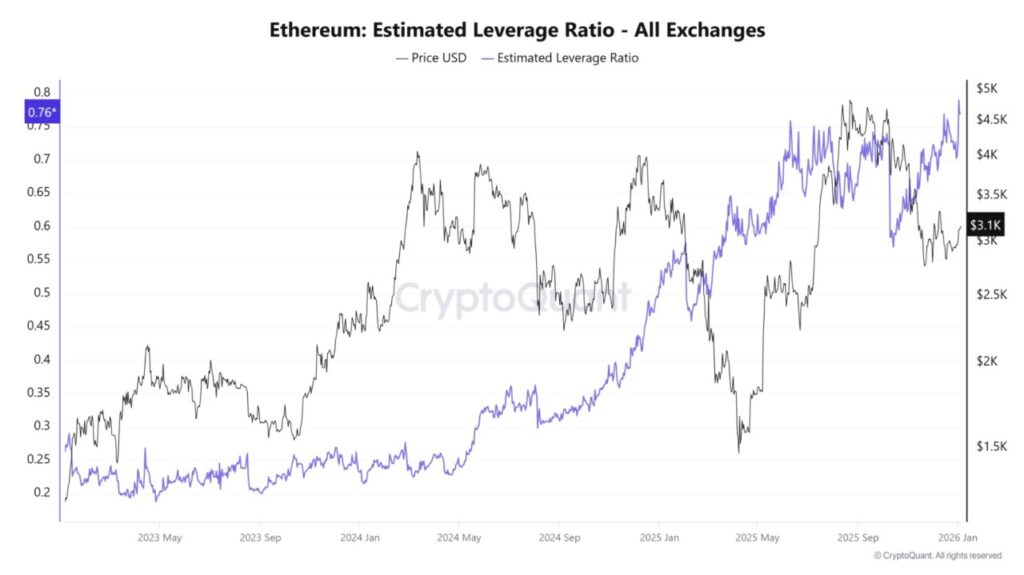

However, there is one metric that is quite alarming. ETH’s estimated leverage ratio is now at an all-time high.

This ratio is calculated as the total open interest on the exchange divided by the exchange’s coin reserves, and reflects the average leverage used by traders. An increase in the value of this ratio indicates that more investors are taking high risks through highly leveraged derivatives trading.

While long-term traders may see short-term profit opportunities as bullish factors emerge, this increase in leverage is a serious warning. A major liquidation event could happen at any time on ETH.

If the ETH price drops to the $2,800 range this week, the potential liquidation of longs is expected to exceed $5.8 billion.

Bitcoin Cash (BCH)

Seasoned investor Peter Brandt recently mentioned Bitcoin Cash (BCH) in his latest analysis. He stated that BCH is approaching a key resistance level of $650. If it manages to break this level, BCH has the potential to enter a higher price range.

A recent report from BeInCrypto also highlighted several factors that support further upside potential for BCH.

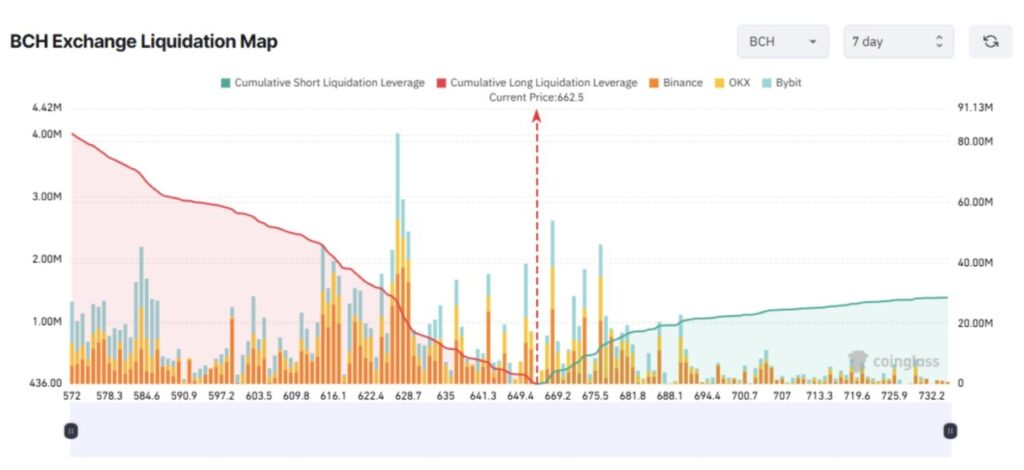

Derivatives traders seem to be in line with this optimistic view. They allocate more leveraged capital to long positions compared to short positions.

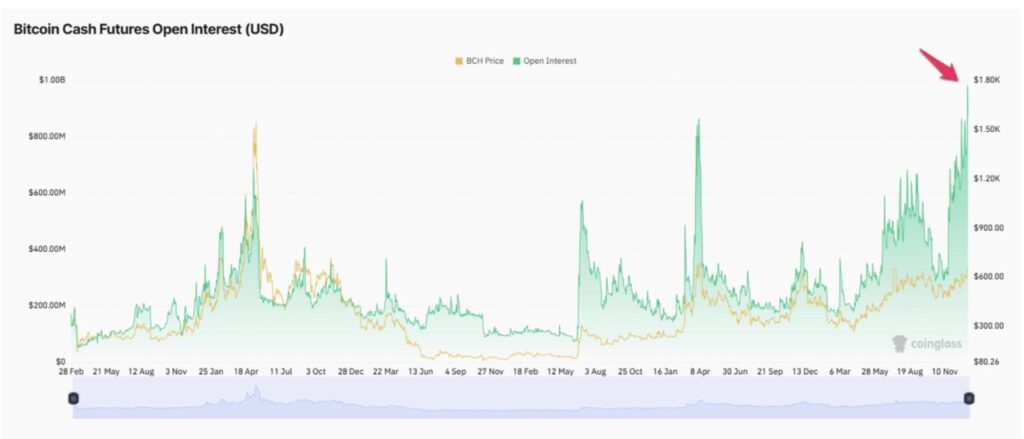

However, data from Coinglass reveals another major concern. BCH’s open interest has reached $980 million – the highest level in history.

Historically, whenever BCH open interest rises past the $600 million mark, it is usually followed by a sharp and long-lasting price correction. In addition, BCH is currently trading near a strong resistance level of $650, which increases the likelihood of profit-taking pressure at any time.

If the BCH price drops to the $570 level this week, the total potential liquidation of long positions is expected to exceed $80 million.

Read also: Spectacular Surge of Meme Coin Market in Early 2026: What’s Happening?

Pepe (PEPE)

Capital flows in early January showed a shift in investor interest towards meme coins. This has rekindled hopes for a new meme coin season.

The positive sentiment towards Pepe (PEPE) intensified after a prediction that PEPE’s market capitalization could reach $69 billion by 2026.

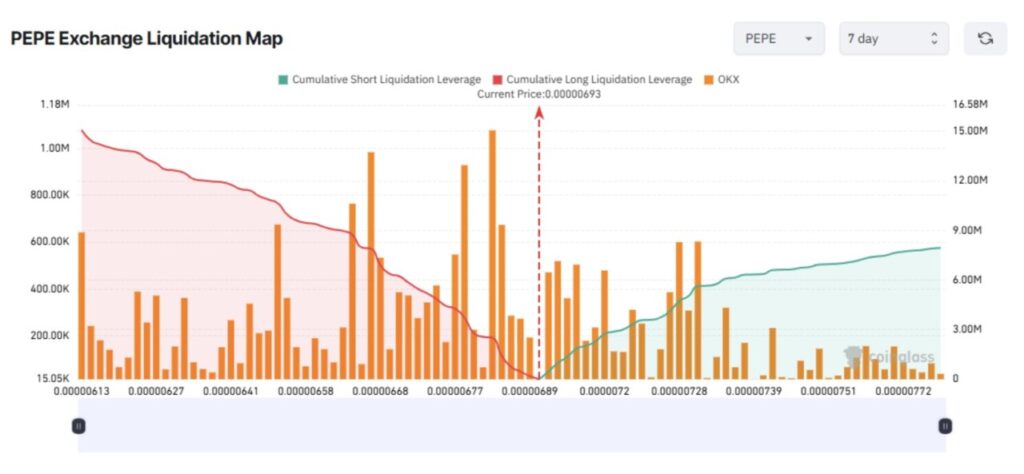

PEPE’s liquidation map shows that the potential liquidation of long positions could exceed $15 million if the price drops to $0.00000613 – a drop of about 10% from the current level.

This scenario is quite plausible, given that PEPE has surged more than 70% since the beginning of the year. Early buyers are now pocketing profits and may be tempted to realize profits, especially amid lingering market doubts.

In addition, a number of analysts warned of a possible correction based on the Elliott Wave pattern. They predict that PEPE may have completed its third wave of gains.

Crypto markets are likely to remain highly volatile over the next few days, especially as geopolitical tensions rise. Without learning from the mistakes that led to the liquidation of over $150 billion in 2025, similar losses could be repeated in 2026.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Facing Major Liquidation in 1st Week of January. Accessed on January 9, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.