Drastic Drop in Crypto Phishing Losses in 2025, Attacks on ‘Whales’ Declining?

Jakarta, Pintu News – Losses due to phishing attacks in the crypto world have significantly decreased by 83% by 2025, down to around $84 million from nearly $494 million the previous year. Despite the notable decline, the annual report from Web3 security firm Scam Sniffer reveals that this decline hides the darker reality of more sophisticated actors.

The Relationship Between Phishing Losses and Crypto Market Cycles

The annual report shows a strong correlation between fraud incidence and market volatility. Phishing activity peaked in the third quarter, with losses reaching $31 million. This increase coincided with the strongest rise in the price of Ethereum (ETH) during the year, with ETH prices rising close to $5,000 due to high institutional interest in the digital asset.

This supports the view that fraudulent behavior is a probability function of user activity, which increases with retail participation. Although the overall attack volume decreased, the ferocity of individual incidents increased towards the end of the year.

In November, the number of victims dropped by 42%, but the total financial loss jumped by 137%. This anomaly suggests that more sophisticated perpetrators are abandoning low-value targets to focus on high net worth individuals, with the average loss per victim rising sharply to $1,225 during the period.

This signals a split in the threat landscape, where criminal groups are moving from mass-market spam to “whale hunting”, implementing targeted and sophisticated attacks against wealthy individuals.

Also Read: Ethereum (ETH) Approaching Critical Moment, Is January 2026 Time to Surge?

Technology Upgrades and New Vulnerabilities

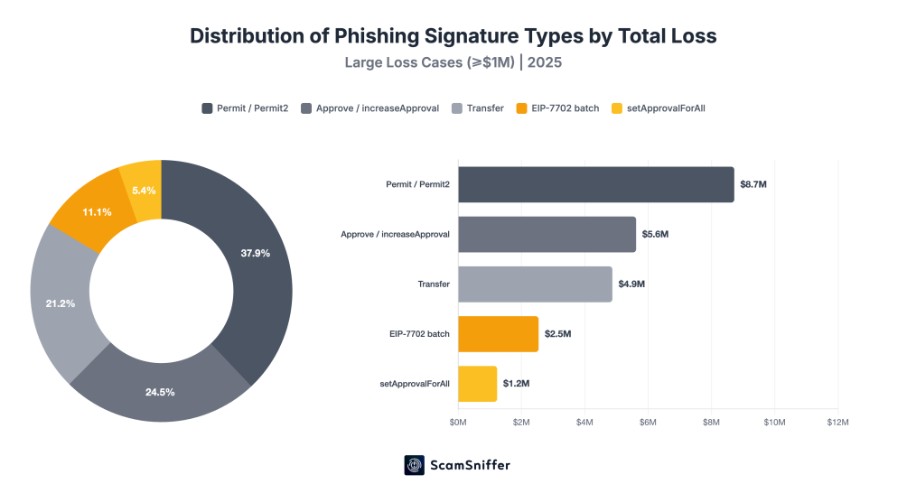

Technological improvements in the crypto industry have also introduced new vulnerabilities. For example, attackers were quick to capitalize on the “Pectra” update on Ethereum, specifically exploiting EIP-7702.

This feature, designed to improve user experience through account abstraction, was leveraged to combine multiple malicious operations into a single signature, resulting in losses of over $2.5 million in August alone.

Scam Sniffer also pointed out that the total losses from these attacks could be much higher, as the firm only tracks on-chain signature fraud and does not include losses from clipboard malware, social engineering, and direct private key compromise.

Phishers’ Strategy Changes

The change in phishers’ strategies shows their adaptation to evolving market conditions and technology. Leaving behind less effective mass attacks, they now prefer to target potential victims with greater returns.

This reflects the evolution in fraud tactics in the crypto space, where bad actors are constantly looking for new loopholes and techniques to maximize the impact and profit of their activities. This calls for a more dynamic and layered response from the crypto security community to protect users from greater losses.

Conclusion

The decrease in the number of phishing losses in 2025 does not fully reflect the overall picture of security in the crypto ecosystem. While the total numbers show a decrease, the shift in strategy by bad actors shows that the threat is still very real and requires continued attention and innovation in security strategies. The crypto industry must continue to adapt and strengthen defenses to deal with these increasingly sophisticated and targeted tactics.

Also Read: Bitcoin (BTC) Price Surges, Will it Continue to Rise in January 2026?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Crypto Phishing Losses Plunge, Whale Hunting Surges. Accessed on January 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.