Bitcoin (BTC) Prepares for a Surge: Potential Rise to $104,000 in the Near Future?

Jakarta, Pintu News – Bitcoin (BTC) has seen gains of around 3% in recent sessions, but the price dynamics are giving mixed signals. Although the overall market structure is still bullish, there appears to be a pause that may leave investors feeling frustrated in the short term. However, this pause may also complete a pattern that will trigger a larger price spike.

Bitcoin (BTC) Price Consolidation

The current structure of Bitcoin (BTC) resembles a rounded bottom, which is the “cup” part of the cup and handle pattern. This pattern forms when the price slowly recovers from a decline, stabilizes, and then pauses before resuming its rise. On-chain data suggests that this pause is highly likely.

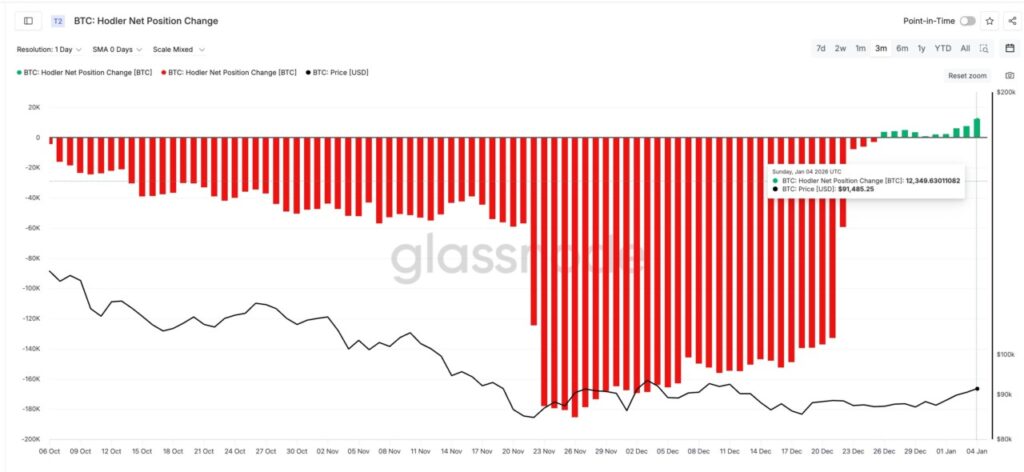

The Hodler Net Position Change, which tracks whether long-term holders are accumulating or selling Bitcoin (BTC), shows that buying has restarted but is still cautious in nature. Since December 26, hodlers have been consistently adding Bitcoin (BTC) to their portfolios.

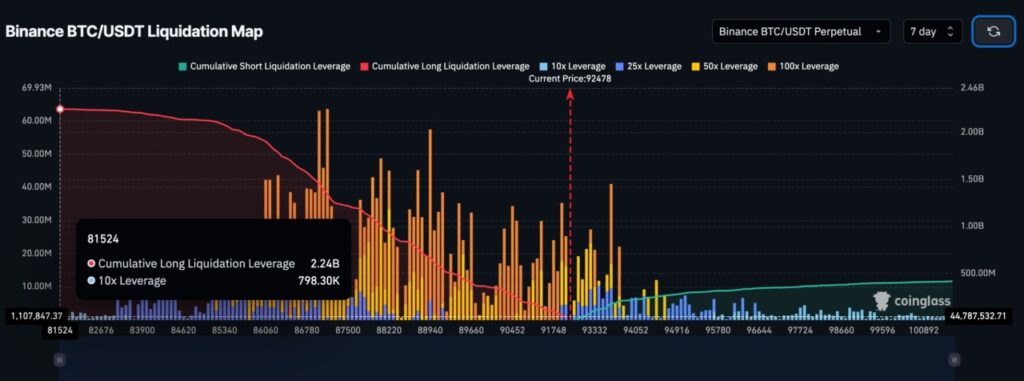

However, the most recent buying peak on January 4 was around 12,349 BTC, which is almost 93% lower than the late November selling peak of around 185,451 BTC. Derivative positions also support this consolidation theory. On the Bitcoin (BTC)/Tether (USDT) perpetual liquidation map on Binance, long liquidation leverage is near $2.24 billion, while short liquidation leverage is closer to $416 million.

Also Read: Ethereum (ETH) Approaching Critical Moment, Is January 2026 Time to Surge?

Reasons the Bullish Case Stays True After the Pause

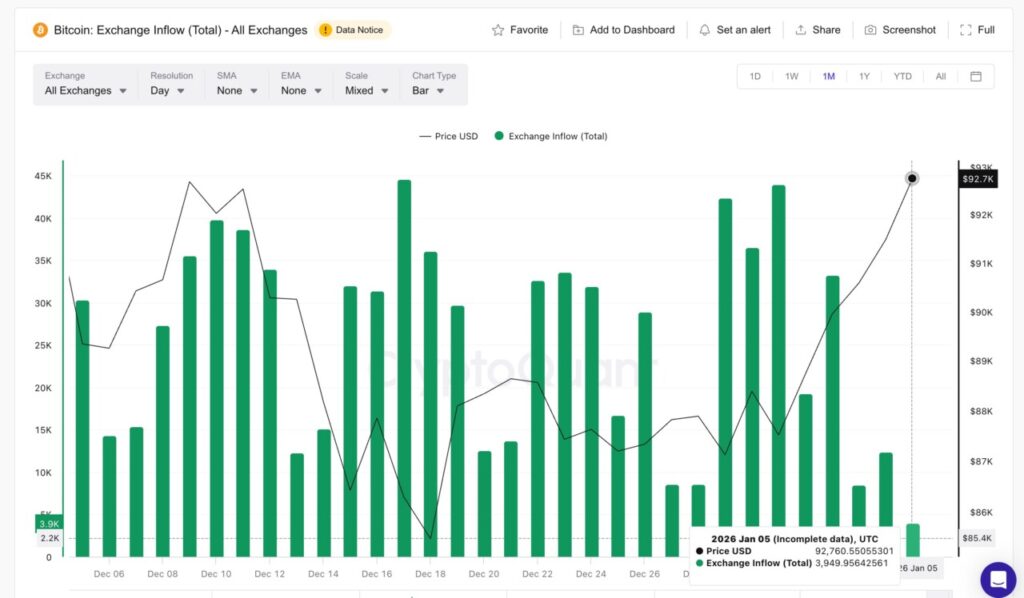

Despite the risk of price consolidation, the selling pressure below the surface continues to fade. One key signal comes from inflows to exchanges, which track how much Bitcoin (BTC) is sent to exchanges, often for sale. On December 31, total inflows to exchanges surged close to 43,940 BTC.

On January 5, the figure dropped to around 3,970 BTC. Another supporting signal comes from the Spent Coin Age Band, which measures how many coins of various ages are moving on-chain. A high value means more coins are spent. Low values mean holders are sticking around. This suggests that despite the consolidation, many Bitcoin (BTC) holders are choosing not to sell their assets.

Bitcoin (BTC) Price Levels that Determine Next Steps

If Bitcoin (BTC) price consolidation persists, structure will matter more than momentum. As long as Bitcoin (BTC) stays above $89,450, the overall bullish setup remains intact. A deeper drop below $84,320 will validate the pattern and open up further downside risks.

On the upside, the first level to watch is $93.560, located close to the neckline of the developing handle. Breaking this level would strengthen the bullish hypothesis. A clean daily close above $94,710 would strongly confirm the breakout. From the neckline itself, the measured movement of the cup projects a Bitcoin (BTC) price target near $104,000, about 12% higher. If the momentum continues further, $107,460 becomes possible as the next resistance.

Great Opportunities Await Post-Consolidation

Bitcoin (BTC) might frustrate investors with a sideways movement first. However, if this consolidation completes the hold, the breakout that follows could be very difficult for the bears to deal with.

Also Read: Bitcoin (BTC) Price Surges, Will it Continue to Rise in January 2026?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Price: $104K Breakout Pattern. Accessed on January 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.