Big Moves of Crypto Whales to Binance, But Buyers Haven’t Showed Up: What’s Up?

Jakarta, Pintu News – In the past week, there has been an increase in the amount of crypto being sent to Binance. However, according to analysis from CryptoOnchain, there are no signs of a significant buyer presence in the market yet.

Increased Deposits by Whale

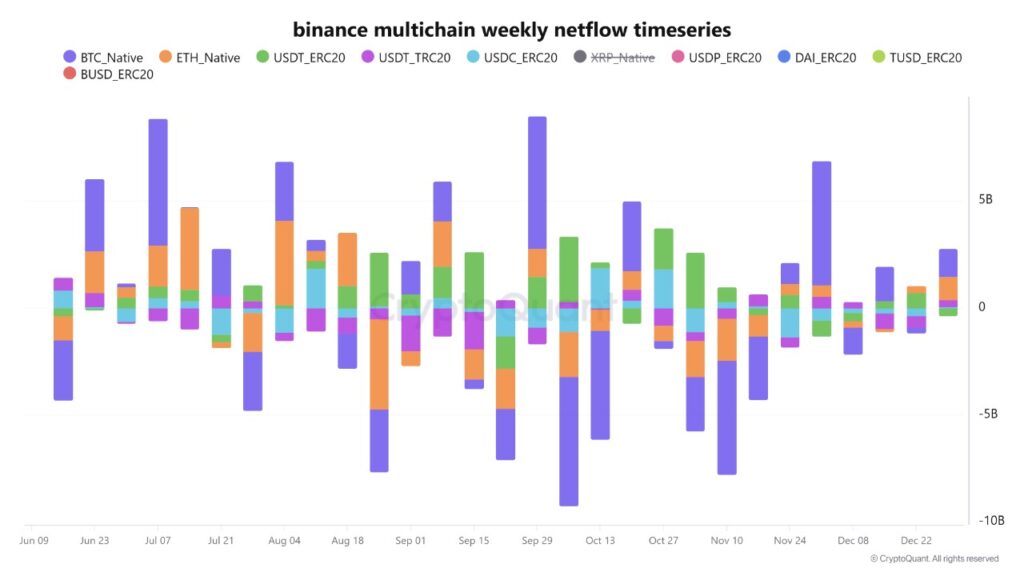

Market watcher CryptoOnchain noted that there was a significant increase in the number of deposits to Binance, indicating the potential sale or use of crypto assets as collateral in the derivatives market. The average size of transactions coming into Binance increased sharply, from around 8 to 10 Bitcoin (BTC) to 22 to 26 Bitcoin (BTC). This suggests that large holders, or “whales”, have moved substantial amounts onto the platform.

Meanwhile, withdrawals from Binance showed a sharp decline in transaction size. The average withdrawal ranged from 5.5 to 8.3 Bitcoin (BTC), signaling a decrease in large-scale accumulation activity and movement of Bitcoin (BTC) to cold storage by major holders.

Also Read: Ethereum (ETH) Approaching Critical Moment, Is January 2026 Time to Surge?

Bitcoin Accumulation Stagnation

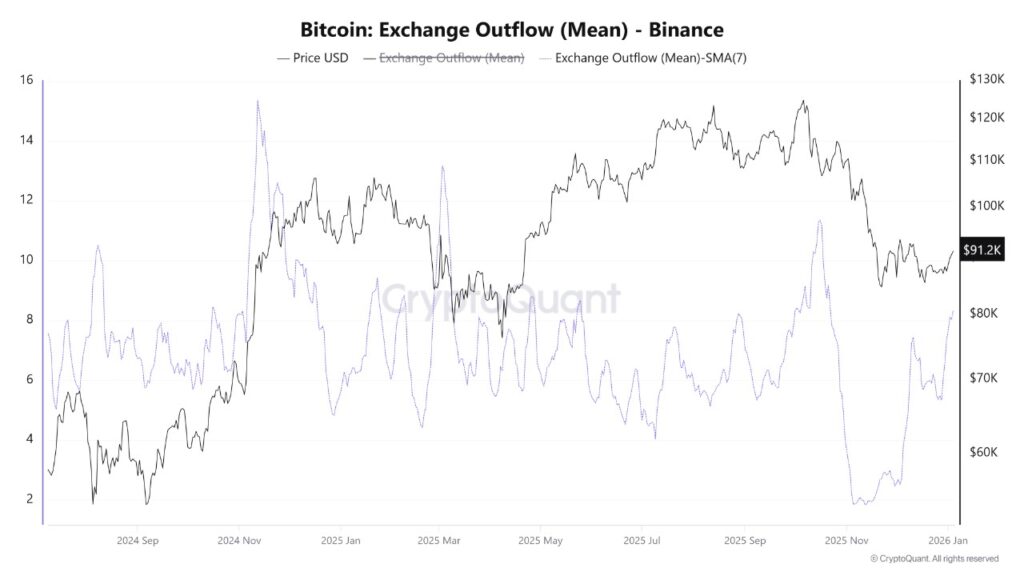

CryptoOnchain also revealed that since October, Bitcoin’s (BTC) accumulation rate has stagnated. This is considered a potentially worrying bearish signal. With reduced accumulation activity, this could be an indication that long-term interest in Bitcoin (BTC) is starting to wane among large investors.

This decline in accumulation may indicate that there is mounting selling pressure. This could be a significant obstacle to Bitcoin (BTC) price appreciation in the short to medium term, especially if this trend continues.

Market Outlook as the Holidays End

Despite bearish indications of whale activity, the price of Bitcoin (BTC) still showed a gain of 1.3% in the past day, with the price settling at $92,600 after hitting a 24-hour high of $93,170. This comes as the market begins to emerge from the doldrums of the holiday period. However, without a significant presence of buyers, it’s hard to see how this selling pressure will be resolved anytime soon. The market may need more stimulus, either from positive news or changes in macroeconomic conditions, to spark greater buying interest.

Conclusion

With the various dynamics at play in the crypto market today, investors and market watchers must remain vigilant to the changes that may occur. Constant monitoring of whale activity and the market’s response to it will be key in navigating possible price fluctuations.

Also Read: Bitcoin (BTC) Price Surges, Will it Continue to Rise in January 2026?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Crypto Whales Deposit Binance Buyers Missing Analyst. Accessed on January 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.