Bitcoin is on its way to the longest winning streak in the last 3 months!

Jakarta, Pintu News – Bitcoin (BTC) saw an increase of more than 1% during Monday’s Asian trading session, marking a potential fifth consecutive day of gains.

Introduction: Bitcoin’s Rise Promises

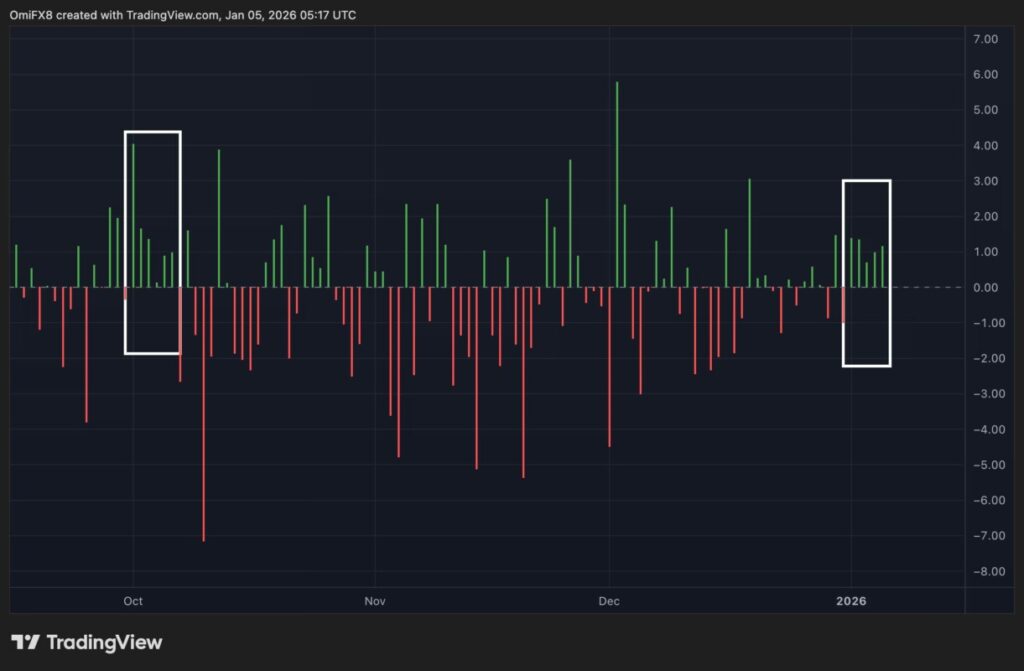

During the Asian trading session, Bitcoin (BTC) recorded a gain of over 1%, which puts it on track to achieve a five-day winning streak, which is the longest since early October. From CoinDesk data, Bitcoin (BTC) jumped from around $91,480 to $92,500. At one point, the price even reached over $93,000. Other major cryptos such as Ripple (XRP), Solana (SOL), and Ethereum (ETH) also saw gains of between 0.7% to 1%.

Also Read: Ethereum (ETH) Approaching Critical Moment, Is January 2026 Time to Surge?

Market Analysis and Investor Sentiment

Markus Thielen, founder of 10x Research who was recently voted as a top crypto analyst, conveyed via Telegram message to CoinDesk that market sentiment is improving. According to him, both Bitcoin (BTC) and Ethereum (ETH) are transitioning to a bullish trending regime. “We are being constructive after the expiration of late December maturing options, anticipating that tax loss selling will subside and trading desks will gain flexibility to apply risk in the new year,” Thielen added.

Geopolitics and the Demand for Safe Havens

Bitcoin’s (BTC) latest rise coincides with rising geopolitical tensions due to the US arrest of Venezuelan President Nicolás Maduro. This is increasingly seen as an indication that cryptocurrencies are attracting demand as a safe haven.

Ryan Lee, principal analyst at cryptocurrency exchange Bitget, stated via email that the simultaneous surge in various asset classes following the US military action in Venezuela is a classic example of flight to quality. “Safe havens like gold and silver saw sharp gains as investors priced in geopolitical risks that could persist or escalate,” Lee said.

Market Outlook and Predictions

Looking ahead, the market outlook remains bullish as long as Bitcoin (BTC) price holds above its 21-day exponential average. “Initial ETF inflows have been encouraging, and as long as Bitcoin (BTC) holds above its 21-day moving average, the short-term bias remains skewed to the upside,” Thielen said. On Friday, 11 Bitcoin (BTC) spot exchange-traded funds (ETFs) attracted more than $471 million, the largest amount in a single day since Nov. 11, according to data source SoSoValue.

Conclusion: A Bright Future for Bitcoin

With back-to-back gains not seen in recent months, Bitcoin (BTC) is showing strong signs of recovery. Investors and analysts alike are optimistic about the near-term outlook, driven by improving market conditions and global geopolitical dynamics.

Also Read: Bitcoin (BTC) Price Surges, Will it Continue to Rise in January 2026?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Bitcoin Eyes Longest Daily Winning Streak in 3 Months. Accessed on January 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.