Bitcoin Breaks $94,000, While Crypto Volume Plummets to Lowest Level Since 2023

Jakarta, Pintu News – Bitcoin (BTC) reached a new record high in 2026 by touching $94,000, despite US economic data showing a slowdown. This rise comes amid volatile market conditions and demonstrates Bitcoin’s (BTC) resilience as an investment asset. This analysis will delve deeper into the factors influencing this price spike and its implications for the global market.

Bitcoin (BTC) Price Increase Analysis

Bitcoin (BTC) managed to reach a new high of $94,000, marking a significant moment for investors and the crypto market as a whole. This rise was driven by increased demand in the US market, where the Bitcoin (BTC) premium index on Coinbase showed a significant increase.

This suggests that there is a return of strong buying interest from US investors, which may be triggered by greater regulatory clarity and the development of policy frameworks in some countries.

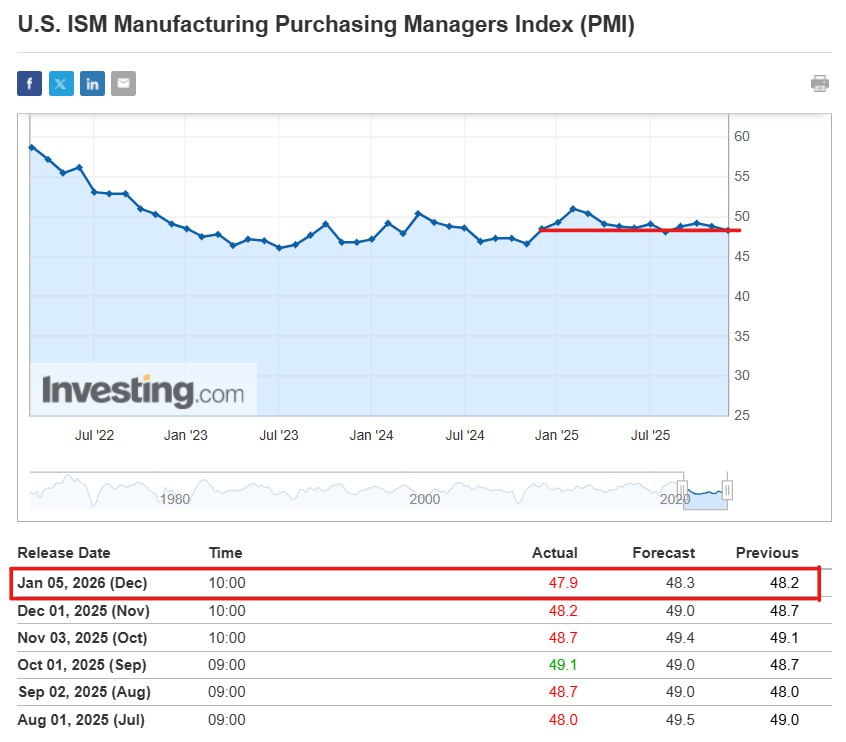

This rise in Bitcoin (BTC) price also came despite the Manufacturing ISM data that showed a continued contraction of the US economy. Although the manufacturing PMI index came in below market expectations, Bitcoin (BTC) still showed gains, signaling that investors may be looking at crypto as a safe haven asset amid economic uncertainty.

Also read: Will Bitcoin (BTC) Reach $100,000 This Week?

Impact on Global Market

The rising price of Bitcoin (BTC) has had a significant impact on global markets, especially in the context of risk assets. Despite concerns about macroeconomic conditions, Bitcoin (BTC) and other crypto assets continue to attract fund flows. This suggests that crypto markets may be starting to be viewed as a viable investment alternative amidst volatile market conditions.

In addition, the rise in Bitcoin (BTC) prices also impacted the precious metals market and stock indices, which also recorded gains. This shows that there is a correlation between crypto markets and traditional financial markets, which is getting closer over time. The rise has also attracted attention from various quarters, ranging from individual investors to large institutions.

Read also: Ripple (XRP) Price Determined by Large Institutions, Really?

Future Prospects and Challenges

Although Bitcoin (BTC) is showing strength in the market, there are still some challenges that need to be faced. The low trading volume during the holiday period could be an indicator that the current price increase may not last. Market analyst Willy Woo points out that these conditions may only provide a short-term boost.

However, the improving market structure and growing demand from the US provide some support for Bitcoin’s (BTC) long-term prospects. This rise may also affect the US Federal Reserve’s policy, especially if economic conditions continue to deteriorate. Investors and analysts should pay attention to these indicators to make informed investment decisions in the future.

Conclusion

Bitcoin’s (BTC) price rise to $94,000 marks a watershed moment in crypto history and has far-reaching implications for the global market. Despite some challenges, the long-term outlook seems to favor continued growth. Investors should remain alert to market dynamics to capitalize on emerging opportunities.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin Price Nears $94K, Crypto Volume Lowest Since Late 2023. Accessed on January 7, 2026

- Coingape. Bitcoin Rises to New 2026 High of $94K Despite Weak ISM Data. Accessed on January 7, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.