FETs Soar: Is 2026 the Time to Invest?

Jakarta, Pintu News – FET (FET), one of the rising cryptocurrencies, recently recorded a significant rise of 16%, breaking the high previously recorded in November. This rise was driven by a significant increase in on-chain activity, as well as an increasing supply shortage that pushed prices to higher levels. With this strong momentum, many analysts and investors have started considering FET as a promising potential investment.

On-Chain Activity Increases

FET experienced a price spike driven by a significant increase in on-chain activity. According to data from Santiment, the divergence between price and daily adjusted activity (Price DAA Divergence) of FET has remained positive for seven consecutive days, signaling that network usage is increasing faster than price movements. This is a very constructive signal.

In addition, the number of active addresses in the past 24 hours reached a weekly peak of 1,100, which again confirms the increased use of the network. With increased interaction on the network supported by positive data from Price DAA, this is likely to favor future price appreciation, especially if this trend continues.

Also Read: Bitcoin (BTC) Prepares for a Surge: Potential Rise to $104,000 in the Near Future?

Supply Shortage Increases

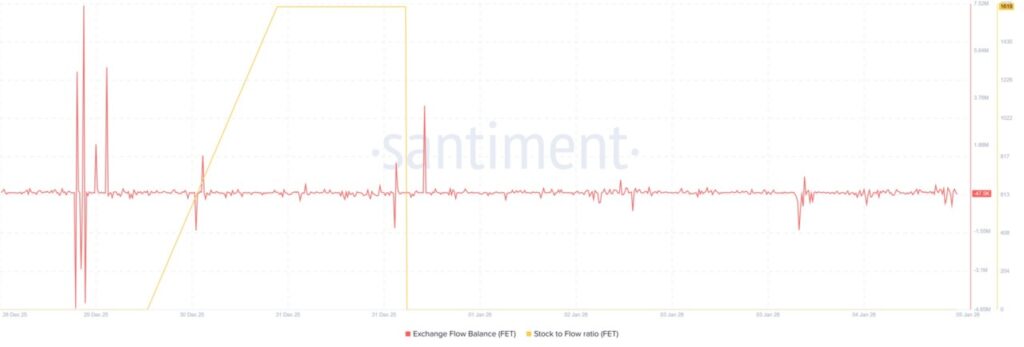

As on-chain activity increased, many users started to accumulate FET aggressively. This can be seen from FET’s exchange flow balance moving into negative territory, indicating that outflows from the exchange are greater than inflows. This is often an indicator of strong accumulation, which reduces supply and increases shortages.

FET’s stock-to-flow ratio also increased to 1,600, signaling a larger shortage. Historically, an increase in shortages often accelerates upward momentum, often being a precursor to higher prices.

FET Price Outlook

FET’s continued upward momentum was supported by an apparent increase in demand from market participants. FET’s Directional Movement Index (DMI) rose to 36 after forming a bullish crossover the previous day. This signals strong upside momentum, with the potential to continue if buyers persist.

If the shortage continues to increase, supported by higher on-chain activity, FET will face the next resistance at $0.31. If it manages to cross this level, FET will target the long-term EMA200 at $0.44. However, for this bullish outlook to remain valid, FET must stay above the EMA50 at $0.24; otherwise, it risks a drop to $0.22.

Conclusion

With all indicators showing positive trends, FET offers an attractive opportunity for investors looking for assets with growth potential. However, like all investments, risks remain and it is important for investors to do their own research before making an investment decision.

Also Read: New Record! Ethereum Records $8 Trillion Worth of Stablecoin Transactions

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. FET network activity surges, scarcity tightens, next test at $0.31. Accessed on January 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.