Could Solana Hit $200 in January 2026? Here’s What Might Make It Happen

Jakarta, Pintu News – Solana (SOL) prices remained steady above $130 after recovering from the $120 level, recording a 4% gain on January 7, 2026. In recent days, SOL prices have surged more than 10%, driven by increasing bullish momentum.

The overall crypto market traded up 2% on the day and 10% on the week, reflecting positive sentiment from investors. This trend provides an opportunity for Solana to continue to profit.

As market confidence increases, analysts are optimistic that the Solana price could reach the $200 level this month. Here are the key factors that could drive Solana’s price surge towards $200.

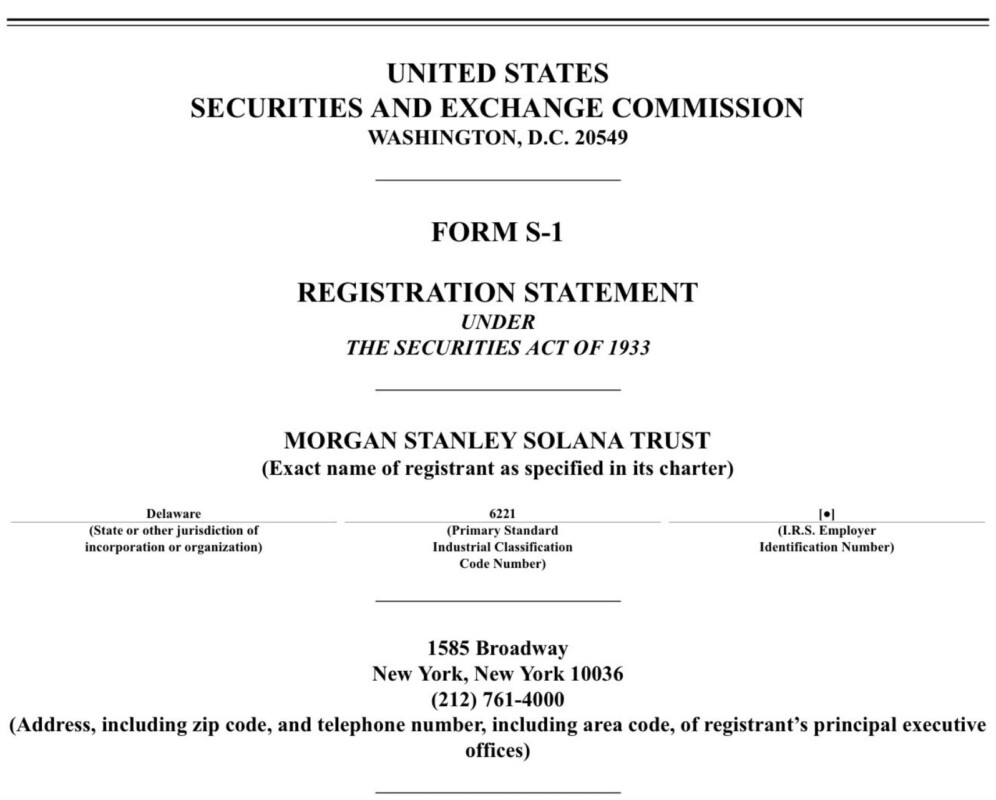

Morgan Stanley proposes Solana ETF, a sign of institutional push into crypto assets

Morgan Stanley has registered the Solana Trust ETF via S-1 form with the US Securities and Exchange Commission (SEC). The move is part of the investment firm’s expanding presence in the crypto world, with total assets under management reaching $6.4 trillion.

Read also: Ripple (XRP) 2026 Price Prediction: Can it Break $3?

If approved by the SEC, this would be a major milestone in the mainstream adoption of Solana and could have a significant impact on the price of Solana in the market.

Solana’s DEX Volume to Reach $451.2 Billion in 2025, Setting a New Record

In 2025, Solana recorded the highest annual volume in DEX perpetual trading at $451.2 billion – a record high in its history. This figure surpasses the total volume of all previous years since Solana was launched.

This surge was driven by heavy activity from decentralized exchanges such as Jupiter and Drift Trade. In comparison, in 2024 the volume was recorded at $238.4 billion, while in 2023 it was only $2.38 billion.

Solana Spot ETF Inflows Hit 20-Day High of $16.8 Million

The Solana spot ETF recorded the highest daily inflow of $16.8 million on Tuesday, becoming the highest record in the past two decades.

According to data from SolanaFloor, the Bitwise BSOL ETF led the way with $12.5 million, followed by Fidelity FSOL at $2 million.

Total Solana ETF funds have now risen to around $1.09 billion, reflecting renewed investor interest and increased trading volumes from major issuers.

Solana Price Touches 4-Month High, 42,000 Tokens Launched in 24 Hours

Developer activity on the Solana network peaked on January 5, 2026, with over 42,000 new SPL tokens launched in a single day – the highest daily figure in almost four months.

Read also: PEPE Price Soared 64% at the Start of the Year – Here’s What It Takes to Set a New Record High!

This spike signifies increased activity within the Solana ecosystem, which is likely driven by the growth trends of the DeFi, NFT, and memecoin sectors on the network.

Solana price holds at $137, bulls target breakout to $200

SOL prices stabilized around $137, with price action remaining within a limited range on the 4-hour chart in Tuesday’s early session. The MACD indicator is in the positive zone, and the momentum line is trending up – a sign of strong bullish pressure.

Meanwhile, the CMF (Chaikin Money Flow) also showed a positive value, signaling strong capital inflows in the short term.

The closest support is around $130, which was previously a point of defense from the price drop. If the price manages to break above $150, the next potential upside is towards the $180 and $200 levels, based on in-depth technical analysis.

Conversely, if the price drops below $130, there will likely be further consolidation before the uptrend resumes.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Here’s Why Solana Price Will Hit $200 This Month. Accessed on January 8, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.