Could the Crypto Market Be on the Brink of Collapse Ahead of U.S. Supreme Court Tariff Decision?

Jakarta, Pintu News – A leading crypto analyst warned that a potential crypto market crash could happen this coming Friday. This warning comes ahead of the US Supreme Court decision regarding Trump’s tariffs.

Crypto Market Crash Claims Related to Supreme Court Ruling on Trump Tariffs

Prominent opinion leader Wimar warned that Friday, January 9, could be a turning point for the market in 2026. According to him, if the Supreme Court rules that Trump’s tariffs are invalid, it could trigger chaos in the market.

Read also: Sui Surges 30% in a Week, Reclaims $2 Price Level

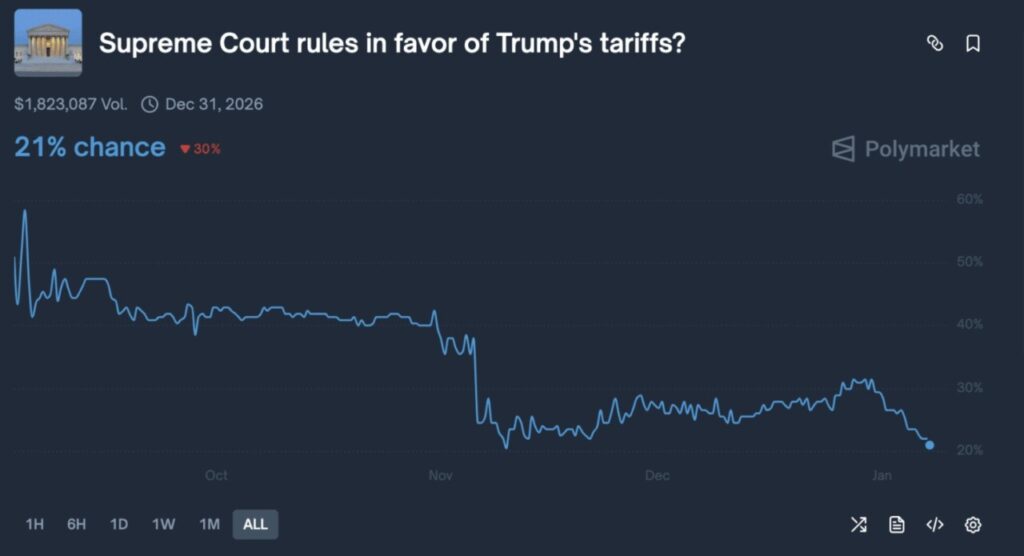

These concerns seem to be supported by prediction markets. Data from Polymarket suggests there is about a 79% chance that the court will overturn the tariffs.

If this were to happen, Wimar stated that the market would immediately factor in not only the refund obligation, but also the loss of government revenue. In his observation, it is conditions like this that often trigger massive liquidity withdrawals, including in bond and digital asset markets.

Trump himself has repeatedly stated that the tariffs generated nearly $600 billion. If the tariffs are canceled, investors will wonder how much money will have to be returned and how quickly it will be done.

Wimar warns that these kinds of questions rarely result in orderly price adjustments. Instead, traders usually re-rate the entire asset at once, which can lead to a crypto market crash.

The Supreme Court’s verdict in the case is expected to come out on Friday. In a hearing held last November, some of the judges appeared to have doubts about the arguments presented. In the case, policy advocates argued that the President has the authority under the 1977 emergency law to impose massive trade tariffs.

If the Supreme Court rules against this policy, it will be Trump’s biggest court defeat since he returned to office. Trump has publicly supported the tariffs.

“I hope they do what is best for our country. I hope they make the right decision. The president should be able to negotiate with tariffs,” he said.

Why are Investors Watching the Tariff Decision?

In early April 2025, Trump announced a 10% base tariff on imports from more than 50 countries. This policy immediately triggered a crypto market crash. The value of Bitcoin (BTC) plummeted by more than 10% in just one week.

Read also: Bitcoin Falls to $90,000 as Yen Carry Trade Strategy Puts Pressure on BTC

However, the market got a breath of fresh air when the White House announced a 90-day tariff pause. Shortly after, digital assets rallied again, as did crypto-related stocks.

Unfortunately, in October 2025, renewed tensions between the US and China caused the crypto market to take another hit. After warnings about imposing 100% tariffs on imports from China, the price of Bitcoin fell by more than $10,000 in just one hour.

More than $19 billion of long positions were liquidated in just 24 hours-the largest ever loss in the sector. Based on these previous events, market participants are now closely watching the Supreme Court ruling that will be announced on Friday.

In another post, the analyst also mentioned that Trump would not remain silent if the ruling was not in his favor.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Crypto Market May Crash Ahead of Court Tariff Ruling, Top Analyst Highlights. Accessed on January 8, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.