Is Venezuela’s Bitcoin the Next Target After Oil?

Jakarta, Pintu News – President Donald Trump’s announcement of the transfer of millions of barrels of Venezuelan oil to the United States has sparked speculation about other Venezuelan assets that may be the next target, including the country’s alleged Bitcoin (BTC) holdings.

Oil Takeover Sets Precedent

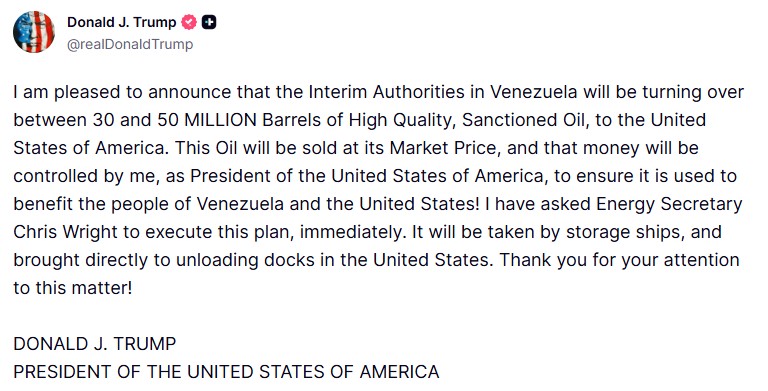

President Trump announced via Truth Social that the oil would be “sold at market prices” and the proceeds “controlled by me, as President of the United States.” At around $56 per barrel, this transaction could be worth up to $2.8 billion.

A meeting in the Oval Office has been scheduled for Friday with executives from Exxon, Chevron, and ConocoPhillips to discuss Venezuela’s oil sector, suggesting that Washington’s interest goes beyond one-off transfers. Venezuela has the world’s largest proven crude oil reserves. Energy Secretary Chris Wright has been ordered by Trump to implement the plan “immediately,” with storage vessels that would transport the oil directly to US ports.

Also Read: Ethereum (ETH) Keeps Going, Is 2026 the Right Time to Buy?

Bitcoin Speculation Increases

With physical assets starting to flow to Washington, attention is now turning to Venezuela’s alleged cryptocurrency holdings. Some reports claim that the Maduro regime has amassed a “shadow reserve” of Bitcoin (BTC) to evade international sanctions. Estimates of the amount vary widely.

Project Brazen reports that Venezuela may have around $60 billion in Bitcoin (BTC), citing unnamed sources. Bitcointreasuries.net puts the figure at just 240 BTC, worth about $22 million. Neither estimate has been verified through on-chain analysis.

Why Bitcoin is Different

Unlike oil tankers that can be diverted to US ports, Bitcoin (BTC) cannot be physically seized. To seize the cryptocurrency, a private key or the cooperation of a depositor in US jurisdiction is required. It is highly unlikely that Venezuela uses the custody services of America or its allies given their sanctioned status. Maduro’s inner circle has likely spread their holdings across multiple wallets, making it extremely difficult to trace.

However, the properties that make Bitcoin (BTC) difficult to confiscate also make it very easy to move – for anyone with the right information. Unlike gold bars or oil barrels that require physical logistics, anyone with a private key can move Bitcoin (BTC) anywhere in the world in minutes.

Conclusion

While Venezuelan oil heads to American ports, their Bitcoin (BTC), if any, remains locked behind unknown locks-out of reach of even the most aggressive enforcement actions. This speculation adds weight in light of Trump’s executive order to create a strategic reserve of Bitcoin (BTC) “at no cost to taxpayers.”

Also Read: New Strategy in the Crypto World: 680,000 BTC Acquisition by Strategy!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Trump Secures Venezuelan Oil, Bitcoin Next Target. Accessed on January 8, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.