Bitcoin Hits $91,000 — Is This Reversal a Sign of Further Decline Ahead?

Jakarta, Pintu News – Bitcoin’s (BTC) recent price rise proved to be short-lived, as the major cryptocurrency quickly returned to its early January levels after a brief rise. This sudden reversal has again raised concerns about the fragility of the market.

The failure to sustain higher price levels reflects the lingering uncertainty as to whether the surge truly marked the end of the previous bearish phase or was just a temporary rally within a larger downward trend.

Then, how will the Bitcoin price move today?

Bitcoin Price Up 0.76% in 24 Hours

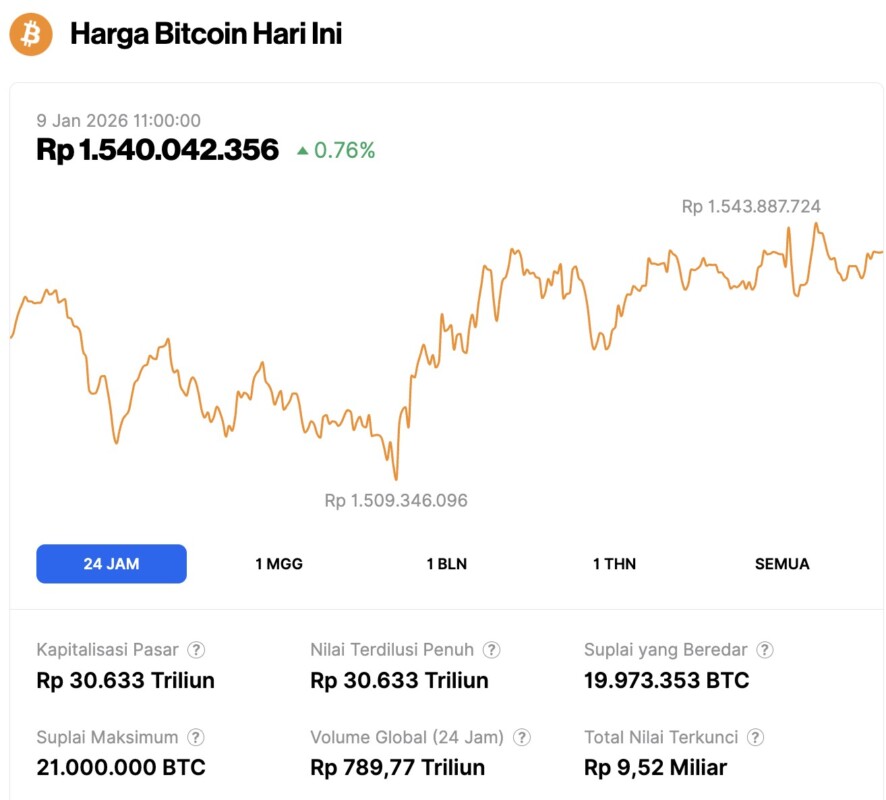

On January 9, 2026, Bitcoin was priced at $91,115, or approximately IDR 1,540,042,356 — a modest increase of 0.76% over the past 24 hours. During this time, BTC dipped to a low of IDR 1,509,346,096 and reached a high of IDR 1,543,887,724.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 30,633 trillion, while its 24-hour trading volume has risen by 6% to IDR 789.77 trillion.

Read also: XRP Is Gaining Momentum — Here’s Why It Could Challenge Bitcoin and Ethereum by 2026

Bitcoin Holders Lack Confidence

The Short-Term Holder Cost Basis model remains an important reference during market transition phases. In December, Bitcoin formed a fragile equilibrium near the lower boundary of this model, close to the -1 standard deviation band. This position reflects the high sensitivity to downside and weak conviction of new buyers.

The subsequent rebound briefly pushed the price back near the model’s average, which is in the Short-Term Holder Cost Basis range of around $99,100. Historically, a return to this zone signals increased confidence from new market participants and signals a shift towards healthier trend dynamics.

Currently, Bitcoin is still well below that threshold. As long as the price is unable to stay above the Short-Term Holder Cost Basis, the recovery signal cannot be considered valid. Without this confirmation, the market risks returning to a defensive position instead of entering an accumulation phase.

BTC Directional Reversal Could Signal Further Decline

Momentum indicators also suggest that a full recovery is likely a long way off. On a shorter time frame, Bitcoin reversals have historically often occurred when the Relative Strength Index (RSI) drops to 38.1 or lower. This usually reflects the resignation of weaker market participants.

Currently, the RSI level has not yet reached the zone. This indicates that the selling pressure may not have completely subsided. Without a deeper drop in momentum, the upside attempts risk weakening as sellers regain control of the market.

Read also: Crypto Market Potentially Collapsing Ahead of US Supreme Court Tariff Decision?

For Bitcoin to make a sharper recovery, historical patterns suggest that further declines may still be necessary. Such a move could clear any remaining leveraged positions and reset market sentiment. Until then, the price rally will likely struggle to last.

What are Bitcoin Traders Risking?

Data from the derivatives market reveals additional risks hidden behind price movements. The liquidation map shows a large concentration of long positions at risk of liquidation in the price range of around $86,200. Currently, there is around $2.13 billion in leveraged long positions located at that level.

If the price of Bitcoin drops close to this zone, forced liquidation could potentially trigger a chain sell-off. Such events usually accelerate the price drop, as leveraged positions are forced to close quickly and market sentiment deteriorates.

This dynamic increases vulnerability to downturns, especially when the market is weak. While liquidation areas often act as price magnets, they also mark regions of potential high volatility. If prices do break into these zones, fear in the market is likely to rise sharply.

BTC price at risk of breaking below this support

As of January 8, 2026, Bitcoin is trading at around $90,146, just slightly above the psychological level of $90,000. This support is crucial in the short-term. If the $90,000 level is decisively broken, BTC is likely to drop towards $89,241 and revive downward pressure.

If bearish conditions worsen due to macro uncertainty, weak demand, or resurgent selling pressure, Bitcoin could break below $89,241. In that scenario, attention would shift to $87,210 – a level that has been tested several times. The most critical support is around $86,247, the point where the previous sell-off was contained. Missing this level would open the risk of liquidating $2.13 billion worth of long positions.

However, a bullish scenario is still possible if buyers manage to take control. If Bitcoin bounces off $90,000 and is able to reclaim the $91,511 resistance level, the market momentum could change.

Holding above the level will open up opportunities towards $93,471, allowing BTC to recover from the recent decline and thwart the bearish scenario in the short-term.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Nears Losing $90,000: Deeper Sell-Off Could Be Coming Next. January 9, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.