Why BNB’s Price Is Unlikely to Fall Sharply in 2026: 3 Strong Reasons Behind the Prediction

Jakarta, Pintu News – BNB (BNB) has been one of the best-performing layer-1 altcoins on the market over the past year. Thanks to its ecosystem that is closely linked to the large user base of the world’s largest crypto exchange, BNB will likely be able to maintain its performance.

Several on-chain indicators and trading data show that even in the event of a market correction, BNB is unlikely to experience a sharp decline.

Three Strong Demand Drivers Underpinning BNB Prices in 2026

Firstly, one of the most important indicators showing the price stability of BNB is the average size of spot orders.

Read also: Solana Mobile Is About to Launch the SKR Token — Here’s What You Should Know

Based on data from CryptoQuant, the average order size remains relatively large.

The chart shows that during most of the time, the price zone is dominated by orders that range from normal size to “whale” size. This reflects the consistent participation of large investors.

“The average size of spot orders remains quite large, which suggests steady participation from large or utility-oriented holders, rather than retail speculative flows,” said XWIN Research Japan analysts from CryptoQuant.

With this level of liquidity, BNB receives strong support from whale orders when prices decline. This makes BNB better able to maintain its value amidst fearful market conditions.

Retail investors may not be as dominant in the spot market data, but they remain active in the BNB Chain ecosystem. This activity helps BNB Chain maintain its position as the leader in the number of weekly active users.

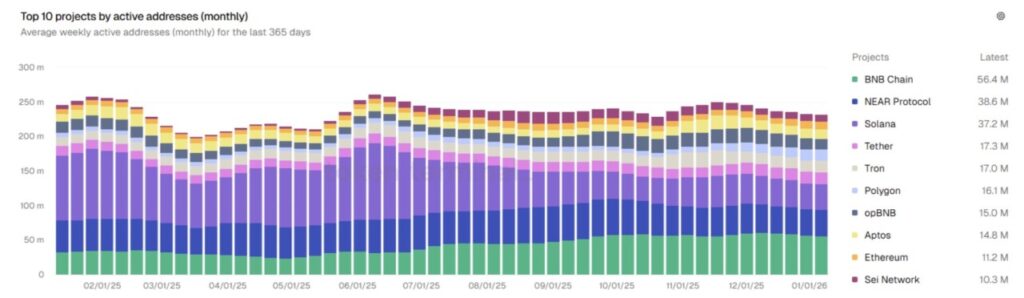

BNB records 56.4 million weekly active addresses

According to Token Terminal, in early 2026, BNB Chain recorded an average of 56.4 million weekly active addresses. This figure far surpasses competitors such as NEAR Protocol (38.6 million), Solana (37.2 million), and Ethereum (11.2 million).

The chart shows a steady upward trend since last year, marked in green. This trend shows that retail traders are increasingly looking for opportunities within the BNB ecosystem. This dynamic contributes to the stability of BNB prices and reduces the risk of deep price drops.

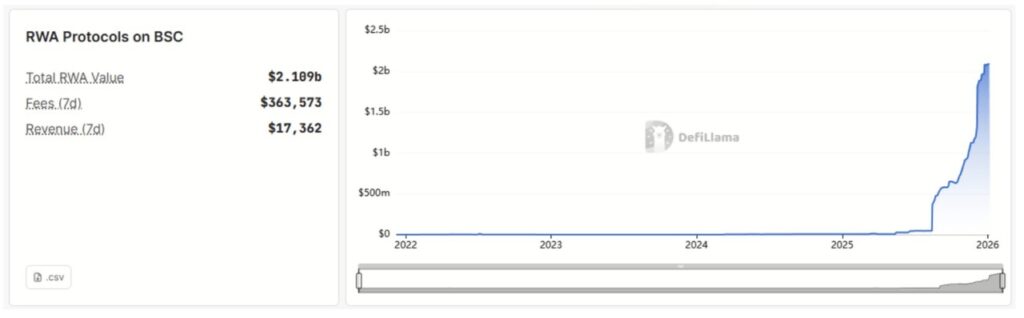

In addition, the growth of the Real World Asset (RWA) protocol on Binance Smart Chain (BSC) also reached a record high in terms of total value locked (TVL). This trend reflects the increasing demand from institutions.

Read also: XRP Targets 34% Rally, But Mixed Demand Clouds the Outlook

BNB has the potential to break the $1,000 level again

According to DeFiLlama, the TVL of RWAs in BSC has surpassed $2.1 billion. The chart shows a strong expansion since the middle of last year until now. Tokenized US Treasury assets from Hashnote, BlackRock, and VanEck account for most of this value.

With demand supported by whale trading activity, retail investor participation in BNB Chain, and institutional adoption of RWA, many analysts predict that BNB will break the $1,000 level again in the near future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. BNB Unlikely to See a Deep Decline in 2026. Accessed on January 9, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.