3 Early Signs of Altcoin Season Emerging in 2026

Jakarta, Pintu News – Talk of altcoin season is picking up steam in early 2026, and this time it’s driven more by real data than hype. From Ethereum (ETH) and Ripple (XRP) to Solana (SOL) and Binance Coin (BNB), several key indicators are starting to align.

Early Signs of Altcoin Season

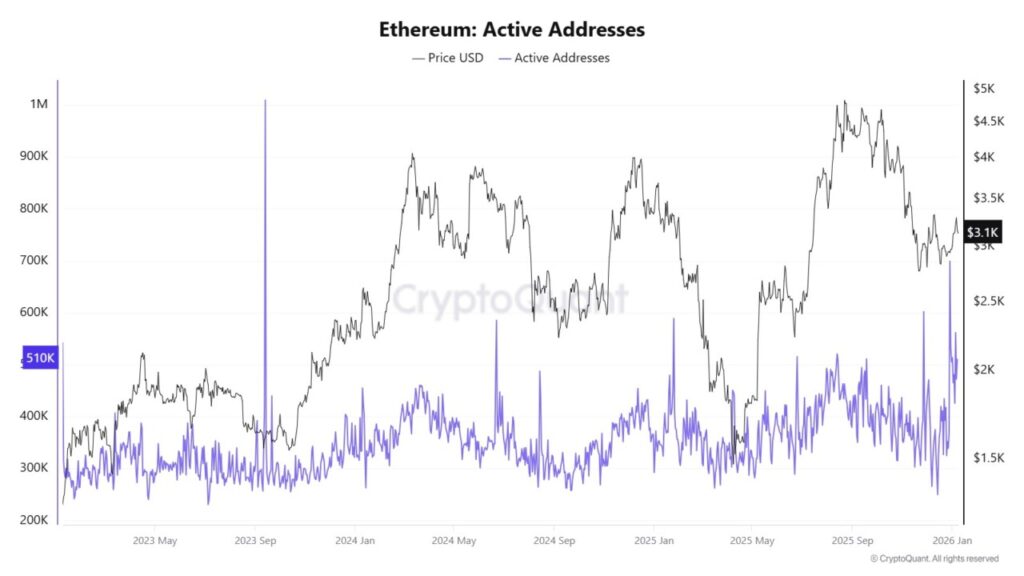

One of the strongest signals came from cryptos with top market capitalizations such as Ethereum (ETH), Ripple (XRP), Solana (SOL), and Binance Coin (BNB). Ethereum (ETH) is leading the way with the number of active addresses remaining high despite the price moving sideways.

This suggests there is real demand, not just short-term hype. Ripple (XRP) shows a similar story: large holders are not sending coins to exchanges, but they are maintaining their positions, which often precedes broader market movements.

Solana (SOL) is starting to get more interest from regular traders, but it’s still early days, just like in previous cycles when slow growth leads to bigger rallies. Binance Coin (BNB) is also quietly active, with steady transactions indicating real use, not speculation.

Read also: Vitalik Buterin’s Vision for Ethereum: BitTorrent Scalability to Linux Equivalent Adoption

Bitcoin Dominance Approaches Key Resistance Zone

Supporting the bullish view, Bitcoin’s (BTC) dominance stands at around 59%, despite the total crypto market capitalization approaching $3.2 trillion. On the weekly chart, dominance has been trading within an ascending channel and is now testing a strong resistance zone. In previous market cycles, when Bitcoin (BTC) dominance failed at this level, it quickly dropped.

Such declines often lead to strong rallies in altcoins, as money starts to flow out of Bitcoin (BTC) and into other cryptos. Additionally, renowned crypto analyst Dr. Whale stated that the dominance of altcoins has broken the long-term downtrend.

He believes that this breakthrough could lead to a 40x to 50x rally. Meanwhile, some altcoins have started to see big gains lately, surpassing Bitcoin’s (BTC) performance.

Also read: Has BTC Reached Its Lowest Point? Analysts Optimistic About Uptrend

When will the real altcoin season start?

Another long-term perspective comes from crypto analyst Moustache, who compared the current cycle with the past. His chart shows a clear recurring pattern. In previous cycles, years like 2016 and 2020 saw a breakout and a brief retest phase. This was then followed by a strong altcoin season the following year, which was 2017 and 2021.

Based on the same pattern, Moustache believes that 2025 could be another breakout and retest phase. If history repeats itself, this could push the next altcoin season to 2026. Interestingly, the altcoin seasonality index is currently at 57, indicating that Bitcoin (BTC) still holds a strong dominance, and altcoins have yet to fully take over.

Conclusion

With various indicators starting to show the potential of a new altcoin season, investors and market watchers should pay attention to these data. The combination of increased activity at the Ethereum (ETH) address, the stable position of large holder Ripple (XRP), growing interest in Solana (SOL), and real use of Binance Coin (BNB) provides a solid basis for optimism. In addition, a change in Bitcoin’s (BTC) dominance could be the catalyst that triggers a major shift in capital allocation in the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinpedia. Altcoin Season 2026: Analysts Spot Early Signs Across ETH, XRP, SOL, BNB. Accessed on January 9, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.