Bitcoin (BTC) price drops below $90,000, BTC ETFs experience large withdrawals?

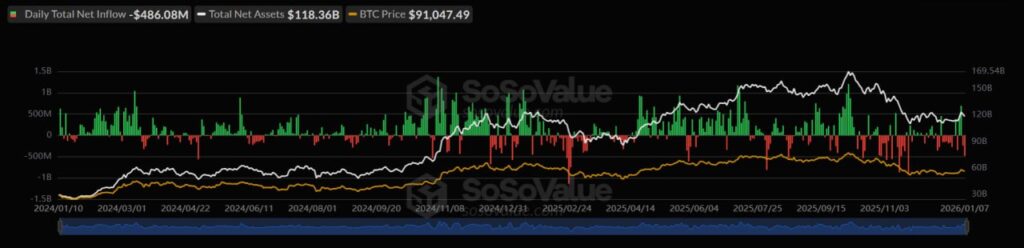

Jakarta, Pintu News – At the beginning of this year, the crypto market showed positive signs, but the trend seems to be losing momentum. The price of Bitcoin (BTC) fell back below $90,000, while a fund managed by a spot Bitcoin ETF in the US recorded its largest withdrawal this year.

Effect of ETF Fund Withdrawals on Bitcoin Price

Bitcoin (BTC) was seen below $90,000 in Thursday’s market trading, erasing some of the gains made in the first week of the new year. In the past 24 hours, the price of Bitcoin (BTC) fell by about 2%, although it still recorded a gain of more than 3% in the past week.

Withdrawals from spot Bitcoin ETFs in the US reached over $486 million, marking the second consecutive day of outflows, which is the first time since 2026. This is in contrast to the inflows that occurred a few days earlier.

Read also: 1 Pi Network (PI) Price in Indonesia Today (9/1/26)

Analysis of Investor Sentiment and Macroeconomic Data

Investor sentiment seems to be on the decline, as withdrawals from Bitcoin (BTC) ETFs have been recorded. Despite supportive macroeconomic data, such as JOLTS jobs data in the United States showing a decline in November, which usually favors a rise in crypto prices, this time this was not the case.

The data should have signaled a possible interest rate cut, which usually has a positive impact on Bitcoin (BTC) prices, but the market response was different this time.

Also read: Will Bitcoin (BTC) Hit a New Low of $88,000?

The Role of Financial Institutions and Corporate Activity

On the other hand, Morgan Stanley recently filed an S-1 application with the US SEC for a Bitcoin (BTC) ETF. Institutional investors’ involvement in regulated crypto investments should not necessarily be attributed to Bitcoin (BTC) price volatility. In addition, corporate treasury activity is also supportive of the market.

For example, Strategy acquisitions added 1,286 BTC to its portfolio this week. American Bitcoin linked to Trump also announced an increase in the total amount of Bitcoin (BTC) they hold, and is now among the top 20 publicly listed treasuries.

Conclusion

Despite some bullish signals emerging from macroeconomic data and institutional activity, the Bitcoin (BTC) market is still experiencing significant selling pressure. The withdrawal of funds from Bitcoin (BTC) ETFs suggests that investors may be taking a cautious stance in the face of market uncertainty. However, the involvement of large corporations and financial institutions could be an indicator that the sector still has long-term growth potential.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Bitcoin Price Falls Below $90K Again as BTC ETF Sees $480M in Outflows. Accessed on January 9, 2026

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.