3 Reasons Why XRP Price Could Soar Above $3

Jakarta, Pintu News – The price of XRP (XRP) has broken back through the support level of $2.10 after a volatile start to the year. Although the cryptocurrency is currently undergoing a consolidation phase after a double-digit price spike, there are three main factors that indicate a potential rally that could push XRP over the $3 psychological barrier.

Here are three reasons why XRP is poised for a breakout. In this analysis, the CCN website also included a hidden but obvious “wild card”.

First of all, XRP Price Hasn’t Reached Its Peak Yet

The most noticeable factor driving XRP prices in early 2026 is the declining liquidity on centralized exchanges. According to a recent analysis from the CCN website, XRP balances on exchanges have plummeted to a seven-year low. This condition had pushed the price of the altcoin up to $2.41.

Read also: 5 Crypto Futures Suitable for Scalping During Bear Market

Inflows into XRP spot ETF products also contributed. However, after nearly reaching $2 billion in inflows, the ETF recently recorded its first outflows.

However, this does not necessarily mean that XRP is due for a major correction. In fact, the Market Value to Realized Value (MVRV) ratio shows that the token is still undervalued.

At the time of writing, XRP’s MVRV ratio stands at 1.04. This figure suggests that the average XRP holder has made very little profit, so the market has not shown any signs of large unrealized gains-which usually triggers a massive sell-off.

More importantly, this metric is still far from the “overheated” zone, which usually marks the peak of a price cycle. Such overheated zones usually appear when the MVRV is in the range of 4.36 to 12.28.

As long as the price of XRP has not approached that range, the data suggests there is still room for the price to rise before it reaches the peak valuation.

Focus on Liquidation Points

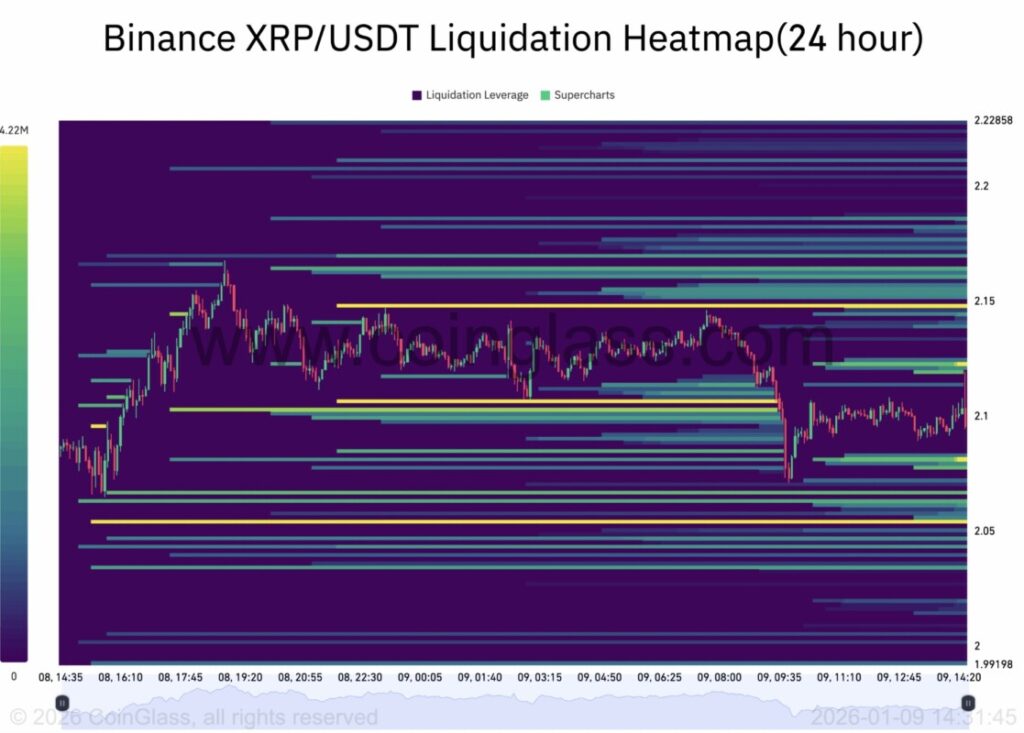

An analysis of XRP’s Liquidation Heatmap as of January 9, 2026 reveals a fierce “leverage battle” after a volatile start to the year.

Currently, traders are stuck in a narrow price range, with a large number of “liquidity magnets” sitting just above and below the current XRP price.

The recent 27% weekly price surge has left a trail of over-leveraged positions – and now the market is starting to “hunt” for them.

“Short Squeeze” Magnet ($2.40 – $2.60)

The area with the highest concentration of liquidity on the heat map is currently in the price range of $2.40 to $2.60.

Series of Events:

On January 5 to 6, the price of XRP briefly touched a local high of $2.41. This triggered the liquidation of over $4.4 million worth of short positions on Binance alone.

However, when the price corrected back to $2.20, bearish traders re-entered the market, opening short positions with stop loss levels slightly above the local peak.

Movement Objective:

If XRP manages to break and hold above $2.30, it is likely to trigger the “short squeeze” phenomenon in quick succession.

Read also: 3 Altcoins in the Spotlight for Crypto Traders in the First Week of January 2025

The heatmap shows a bright yellow area around the price of $2.49, which indicates a large pool of short positions ready to be liquidated. If the price enters this zone, there is potential for an accelerated price movement towards the Fibonacci extension target of $2.94.

“Long Squeeze” Danger Zone ($2.00 – $2.15)

Although the upside potential looks promising, there is huge liquidity on the downside that could be targeted by market makers to shake out the long positions of weakly capitalized traders.

Series of Events:

Many retail traders chased the price rally towards $2.40 and opened highly leveraged long positions. Their liquidation points are now concentrated just below the $2.20 psychological level.

Movement Objective:

There is a “Wall of Pain” between the $2.00 to $2.15 level. If the price of Bitcoin (BTC) drops below $90,000 again, the price of XRP could experience a sudden sharp drop into this zone.

A drop to $2.13 is expected to trigger the liquidation of long positions worth around $22 million to $25 million-similar to the “flush leverage” that occurred on January 8.

Third Reason Revealed: Will XRP Price Break $3?

From a technical point of view, XRP is currently showing signals that have not been present for the past few months.

On the daily chart, Holders’ Sentiment has broken the zero line for the first time since October 9. This signals a change in the market’s perception of this altcoin – from doubt to optimism.

If these conditions persist, demand for XRP could increase. Although the price recently experienced a decline, the drop occurred below the important support level of $2.

Nevertheless, the bulls will most likely continue to defend this key support level. If the trend holds, the XRP price could break above $2.49. In that scenario, the next target would be an increase towards the $3.26 range.

Conversely, if XRP fails to hold above $2, then this projection could be invalidated. If that happens, the price of XRP risks dropping to around $1.50 – and potentially wiping out all the gains made throughout 2026.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. 3 Reasons Why XRP Price Could Surge Above $3 – #2 Is the Wild Card Nobody’s Pricing In. Accessed on January 11, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.