Urgent Update on Solana Network, Is it Safe?

Jakarta, Pintu News – This weekend, the Solana blockchain network faced a critical infrastructure test with the release of a security patch deemed “urgent” for its validators. The announcement was made by Solana Status on January 10, calling on validators to immediately update their validator clients to version v3.0.14.

Urgent Update for Network Stability

This abruptly released update, although described as a proactive step to improve stability, indicates a critical security intervention. Validators were asked to immediately update their systems to the latest version. However, the specific cause of this urgent need was not disclosed, leaving the market in a state of having to trust that the update would address any possible threats.

This update is particularly important as it contains a series of critical patches that should be applied to both stakeholder and non-stakeholder validators. However, data from Solanabeach shows that adoption of this update is still slow. Approximately 51.3% of network stakes are still managed by validators using the old v3.0.13 client, while only 18% of stakes have switched to the new, more secure v3.0.14.

Also Read: XRP 2026 Price Prediction: Is This Investment Still Promising?

Decrease in Number of Validators

In addition to software update issues, Solana is also facing a decline in the number of active validators. In the past year, the number of active validators has decreased by 42%, from a peak of 1,364 validators to just 783. This decline indicates a greater challenge in terms of infrastructure and may affect trust and network security.

This decline not only impacts the security of the network but also the speed and efficiency of processing transactions. In Proof-of-Stake systems, a slow response to “urgent” updates can open a larger window of vulnerability, which can be exploited by irresponsible parties.

Increased DEX Volume and Stablecoin Usage

Despite the challenges, Solana is still showing high adoption within the crypto industry. On-chain activity remains strong with decentralized exchange (DEX) volume increasing 23% this week, reaching over $35 billion. Solana continues to dominate by processing 8 times more daily transactions than any other blockchain over the past six months.

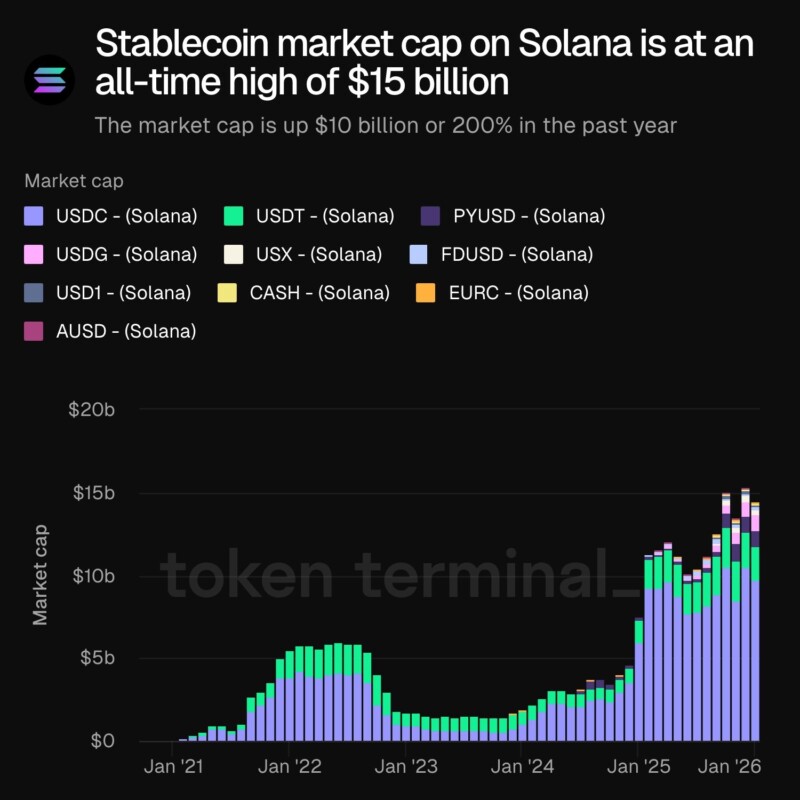

Stablecoin usage on the Solana network has also increased by around 200% over the past year, with stablecoin liquidity reaching a new record high of around $15 billion. This increase demonstrates the growing confidence in the Solana ecosystem despite the infrastructure challenges faced.

Conclusion

Despite infrastructure and security challenges, Solana continues to show significant growth in terms of transaction volume and stablecoin usage. Urgent software updates and a decrease in the number of validators demonstrate the importance of rapid response in the blockchain ecosystem to maintain network security and stability.

Also Read: Raydium Price Prediction 2026: Significant Upside Potential in the Solana Ecosystem

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Solana Urgent Patch Sluggish Validator Response. Accessed on January 12, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.