Analyst Peter Brandt Sees Potential for Monero (XMR) to Mirror Silver’s Explosive “God Candle” Move

Jakarta, Pintu News – Monero (XMR) has officially reached a new record high after hitting the $598 mark. Its market capitalization also surpassed $10 billion for the first time. Many analysts remain optimistic and believe that this bull run has only just begun.

Veteran trader Peter Brandt also added to the positive sentiment by comparing the price movement of XMR with the price movement of silver.

Could Monero Be the “Silver” in the Crypto Market?

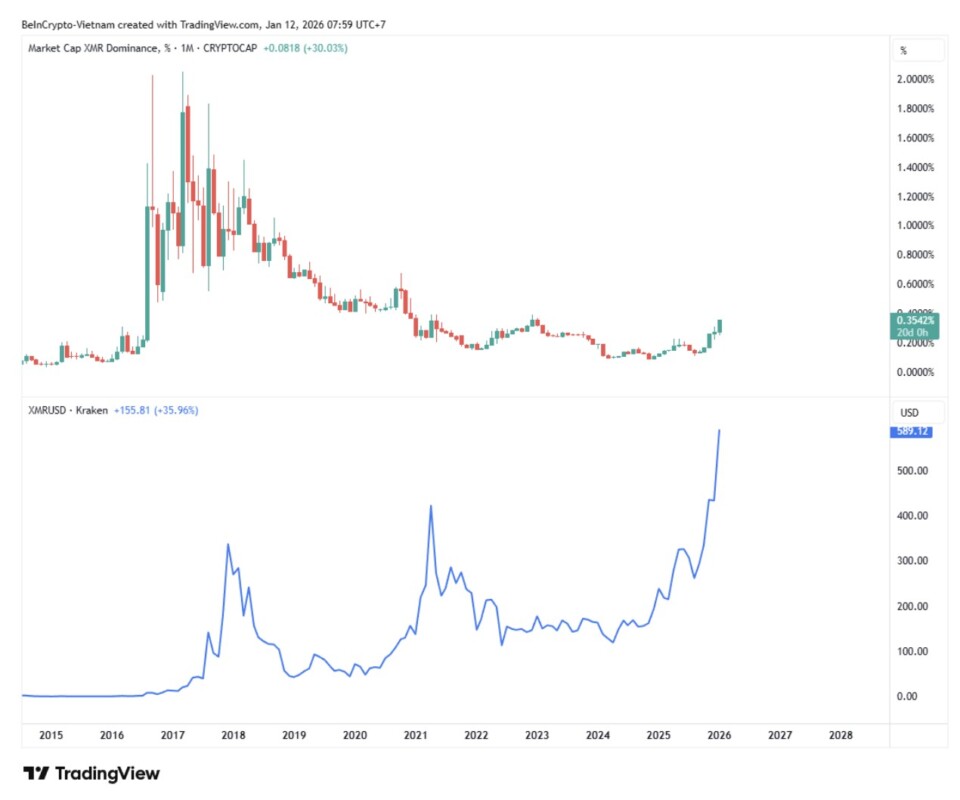

By January 12, Monero (XMR) had surged more than 30% since the previous Saturday. At that time, XMR was trading above $585 with a market capitalization that exceeded $10.7 billion.

Read also: Ethereum Steadies Around $3,100 — With Strong Support From Long-Term Holders

Trading volume also rose to above $300 million, the highest level in the past month. This rise pushed the price of XMR past the previous cycle peak of $515. Analysts believe this rally still has the potential to continue.

“The price movement is still showing an aggressive upward trend. Prices broke through previous resistance levels with strong momentum and minimal correction. The market structure remains very bullish. Buyers continue to enter every time the price drops, and there are no clear signs of distribution,” said analyst 0xMarioNawfal.

Veteran trader Peter Brandt compared the price movement of XMR with the historical movement of silver prices. He analyzed the monthly chart of XMR and the quarterly chart of silver.

Both showed two large peaks in the past that formed a long-term resistance trend line. Silver then broke through that trend line and printed what is referred to as a “god candle” – a very sharp price spike.

XMR Market Dominance Increases

As usual, Brandt did not provide a specific price target for XMR. However, this comparison shows that a similar spike (“god candle”) could have appeared on XMR’s monthly chart if it managed to break its trend line.

XMR’s market dominance also increased to its highest level since 2023. This metric measures XMR’s market share versus the total crypto market capitalization.

XMR’s price touching an all-time high, while its dominance is still relatively low, suggests further upside potential. This could be a signal that capital flows from other altcoins are starting to shift to XMR.

Monero could get more attention amid geopolitical tensions

Monero is expected to have a number of strong reasons to perform better in 2026. In a recent report from the BeInCrypto page, there are at least three main factors that support this.

Read also: Dogecoin Dips 2% Today, But Strategic Japan Partnerships Could Spark a Turnaround

These include the growing demand for privacy as tax enforcement tightens, as well as a shift in investor confidence after the Zcash team let its token holders down.

Moreover, geopolitical tensions could be a significant additional driver.

Recently, Tether (USDT) froze over $182 million in USDT across five Tron (TRX) wallets that were linked to illegal financial activity. A report from TRM Labs revealed that Tron-based USDT had been used in a funding stream connected to Iran’s Islamic Revolutionary Guard Corps (IRGC). More than $1 billion has moved through UK-listed companies.

Iran has also reportedly used more than $2 billion in crypto to fund proxy militias and evade international sanctions.

When stablecoins and altcoins that lack privacy features can be tracked and frozen, capital tends to seek a more secure path. In such a situation, Monero is likely to become the top choice for users who prioritize anonymity and transaction security.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XMR Could Print a God Candle Like Silver. Accessed on January 13, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.