BNB Sets Sights on $1,000 as Derivatives Activity Surges — Is a Price Rally on the Horizon?

Jakarta, Pintu News – The price of BNB (BNB) has experienced prolonged consolidation due to overall price stagnation in the crypto market. While Bitcoin is still struggling to break the $100,000 level, a number of major altcoins – including Binance Coin – are facing pressure at psychologically important levels.

However, BNB’s derivatives data showing improvement as well as accumulation during the recent price decline, could be the trigger for a breakout. Currently, more and more traders are going long on BNB as the coin prepares to break the $1,000 price.

BNB Market Activity Increases

BNB’s price showed an increase in buying activity in the last 24 hours. Based on data from Coinglass, BNB position liquidations totaled $357,000, with approximately $236,000 coming from liquidated short positions.

Read also: Bitcoin and Ethereum Surge as 5 Cryptocurrencies Soar Up to 35% Today

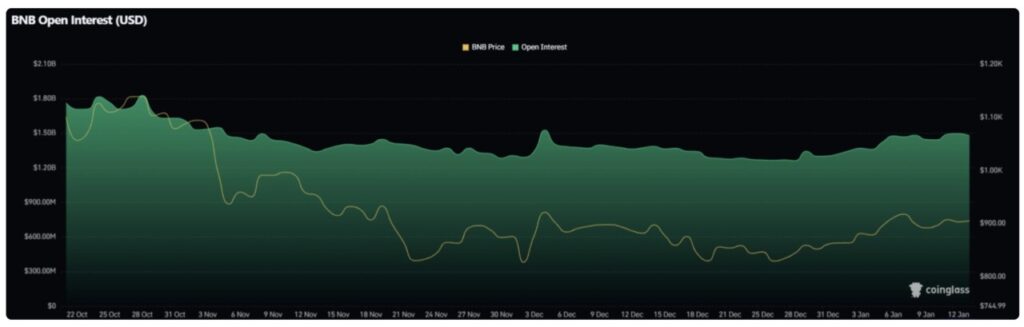

Despite this, market interest in BNB continues to grow, as seen by the increase in open interest following a number of important announcements.

This price increase comes after the Fermi hard fork was officially launched on the BNB Smart Chain network. This update speeds up block times from 0.75 seconds to 0.45 seconds, allowing the network to process and confirm transactions more quickly and efficiently.

With these improvements, the BNB network is now better equipped to handle more complex decentralized applications (dApps) and reduce congestion during periods of high activity.

Institutional Interest for BNB

In addition, interest from institutional investors also increased rapidly in early January. Grayscale recently applied for a BNB exchange-traded fund (ETF) product. If approved, this ETF could attract traditional investors who are more comfortable with conventional financial products than the direct use of crypto.

As a result, BNB open interest (OI) has surged in recent weeks. Data from CoinGlass noted that open interest in the BNB futures market across multiple exchanges rose to $1.50 billion from the previous $1.26 billion on December 27 – the highest level since early December.

This increase in open interest signals an influx of new capital into the market and increased speculation on BNB price movements, which could be the impetus for a price breakout.

Not only that, BNB’s long-to-short ratio also rose to 1.6 – the highest level in over a month. A ratio above one indicates that more traders are currently predicting a bullish trend on BNB.

What’s Next for BNB Price?

Currently, BNB is moving in a narrow range, stuck between the moving average and the resistance level around $925. As of today, the BNB price is trading at around $912, up more than 1.5% in the last 24 hours (13/1).

Read also: Following Trump and Melania, Former New York City Mayor Unveils the Latest Meme Coin

The 20-day exponential moving average (EMA) continues to rise and is around $906, and the RSI indicator remains in the positive zone at 58, indicating further upside potential.

If BNB manages to break the resistance at $925, it will confirm a bullishascending triangle pattern and potentially push the BNB/USDT pair past the key $1,000 level.

However, if the price reverses and drops below the moving average, this would indicate strong selling pressure around $925. In this scenario, BNB could drop back to the support line and potentially test the support level at $800.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. BNB Eyes $1000 Due to Surging Derivatives Activity, Will BNB Price Make a Comeback? Accessed on January 14, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.