Is Bitcoin a hedge against World War 3 fears?

Jakarta, Pintu News – In an atmosphere of heightened geopolitical tensions, speculation about a Third World War is increasingly real. Financial markets, including cryptocurrency markets such as Bitcoin (BTC), are facing great uncertainty. The big question that arises is, will Bitcoin (BTC) crash or become “digital gold” amid the escalating global conflict?

The Reality of Third World War Fear

The fear of a Third World War is no longer just speculation. With rising tensions between major powers, the world may be on the brink of a large-scale conflict that differs from previous world wars. This time around, the war may not involve conventional battles as we know them, but more economic and cyber warfare. This raises a big question about the role of cryptocurrencies in this scenario.

Also Read: 6 Robert Kiyosaki Prediction Facts: Silver to US$100 and New All-Time High in 2026?

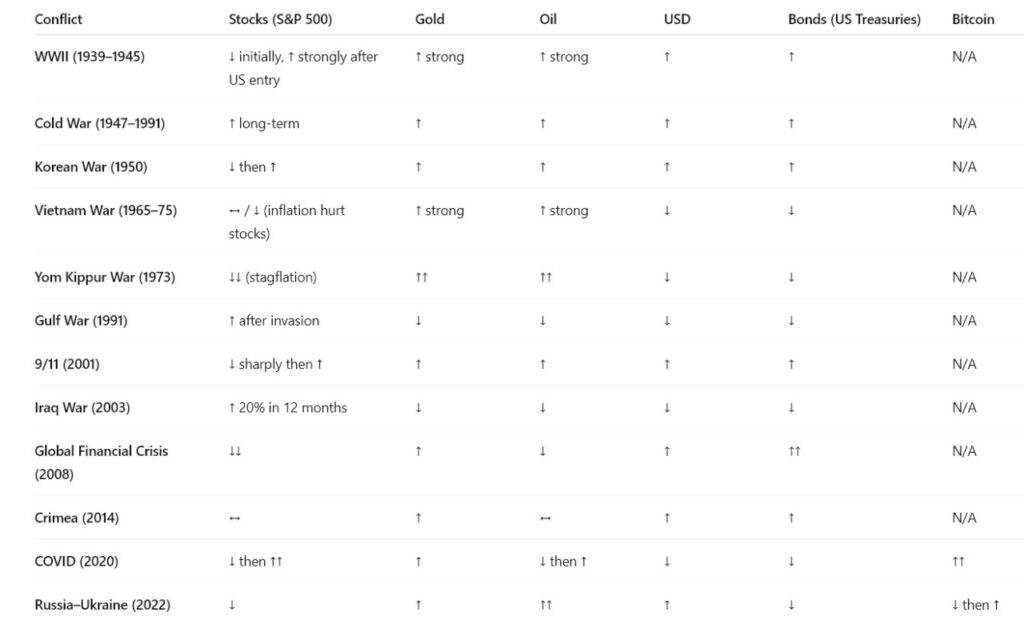

Key Asset Behavior at War

History has shown that markets tend to react to uncertainty by first selling assets and then readjusting the value of assets based on the policy response. In this context, assets like stocks and oil typically experience high volatility. Gold and silver are often considered safe havens, but what about Bitcoin (BTC)?

Bitcoin in a World War: Between Bull and Bear

Bitcoin (BTC) has two identities in a war scenario. Initially, in reaction to the shock, Bitcoin (BTC) may experience a drop in value as investors seek safety in the form of liquid and traditional assets such as gold. However, in a phase of stabilization and prolonged conflict, Bitcoin (BTC) may start to be seen as a safe alternative store of value, especially if fiat currencies are devalued.

Bitcoin Yield Determinants

Several factors will determine the fate of Bitcoin (BTC) in a war scenario. These include real interest rates, transaction infrastructure issues, capital controls and currency pressures, as well as the impact of energy shocks on economic growth. If the conflict is prolonged and the global financial system is disrupted, Bitcoin (BTC) may increasingly be seen as a hedge.

Conclusion

While Bitcoin (BTC) may not be immediately regarded as “digital gold” at the start of the conflict, there is great potential for the cryptocurrency to acquire that status if the war goes on for long. Investors and market watchers should pay attention to these dynamics and adjust their investment strategies accordingly as the global situation evolves.

Also Read: Monero Hits Record High, Investors Leave Zcash!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. World War 3: Bitcoin Crash or Safe Haven. Accessed on January 14, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.