Dogecoin Dips 7% as Massive 500 Million DOGE Whale Transfer Sparks Market Activity

Jakarta, Pintu News – The meme coin sector has once again demonstrated its highly speculative characteristics. After a strong start to 2026 and a market capitalization gain of around $10 billion, almost 85% of those gains have been wiped out in less than a week. This reaffirms the classic pattern of assets with high risk but high potential returns.

So, what is the price movement of one of the biggest meme coins in the crypto market, Dogecoin (DOGE), today?

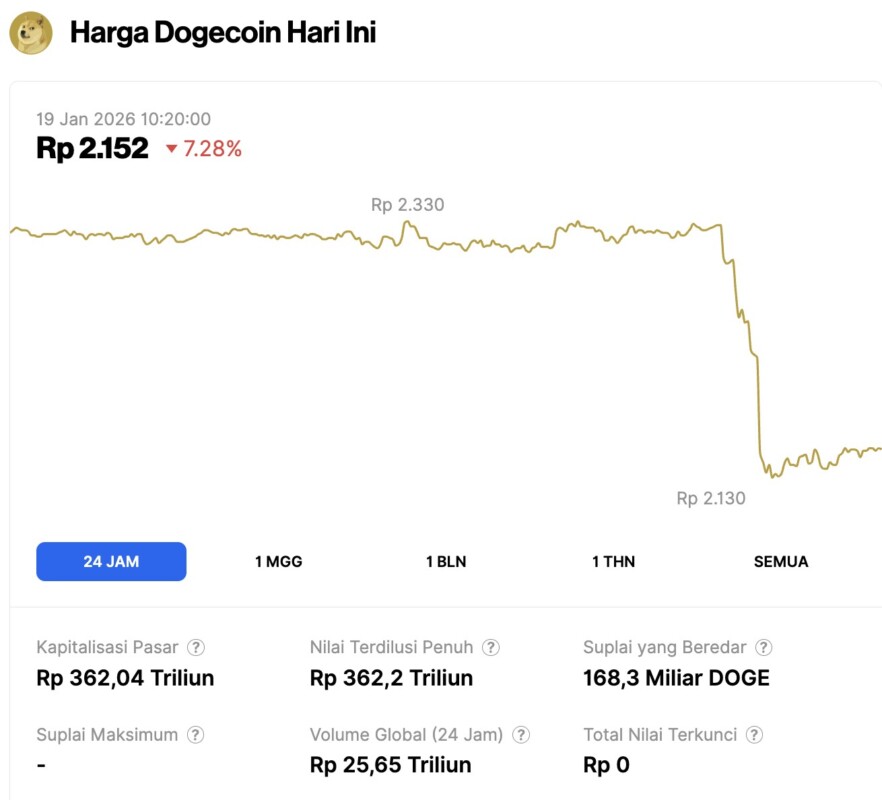

Dogecoin price drops 7.28% in 24 hours

On January 19, 2026, Dogecoin’s price dropped by 7.28% within 24 hours, falling to $0.1271, or approximately IDR 2,152. Over the past day, DOGE traded between IDR 2,330 and IDR 2,130.

At the time of writing, Dogecoin’s market capitalization is around IDR 362.04 trillion, with a 24-hour trading volume of approximately IDR 25.65 trillion.

Read also: Top 3 Coin Memes in the Spotlight this Week, Ready to Rally or Plummet?

Meme Coin sector shows its speculative nature again

Dogecoin has certainly not escaped the pressure. Its value has fallen 14% from its high this year of $0.15, evaporating around $5 billion of its market capitalization. This begs the question – is DOGE’s decline just part of a broader market correction?

From a technical perspective, there is a clear divergence. The $0.15 level is a strong resistance area. Since DOGE lost this level in mid-November 2025, it has tried to break it four times but has always failed, including the last attempt that occurred 10 days ago.

After that, DOGE had six consecutive days of being closed in the red, down almost 15%. But on the other hand, DOGE had a quick recovery with a gain of around 9%. So, the big question is – can the $0.13 level now be considered strong support?

DOGE’s $500 Million Outflow a Test of Market Confidence

Dogecoin’s position is currently testing the confidence of large investors or smart money. On January 14, DOGE tested the resistance level at $0.15, but then corrected 7% to $0.13.

Read also: Bitcoin Drops to $92,000 — Is This a New Buying Opportunity for BTC?

Technically, if smart money comes in and applies the classic “buy the dip” strategy, this could determine the direction of DOGE’s next move.

However, data from WhaleAlerts shows a different signal. One of the major wallets was observed transferring 500 million DOGE to Binance – a strong signal that there are doubts about the potential breakout from the current volatile price pattern.

More importantly, it also indicates a possible feedback loop.

As highlighted by AMBCrypto, since mid-November, DOGE has not managed to break out of the sideways movement pattern, despite rising 20% in early January. DOGE’s failure to break through major resistance remains a major concern.

In this context, the massive sell-off by whales cannot be considered a “coincidence”.

Conversely, when whales continue to offload assets near the resistance level and the price of DOGE moves erratically, it creates a classic pattern where smart money capitalizes on the fear (FUD) in the market, keeping the price stuck. Therefore, a true breakout seems unlikely unless there is strong conviction from the buyers’ side.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Dogecoin’s $500M whale outflows – A coincidence or smart money exit? Accessed on January 19, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.