Will Hedera (HBAR) Continue to Decline in January 2026? Check out the latest prediction!

Jakarta, Pintu News – In recent months, Hedera (HBAR) has experienced a significant decline, with continuous selling pressure affecting the market structure. Recent data shows that sellers are still dominating, pushing HBAR to a critical support zone. This is causing concern among short-term traders and those using leverage.

Hedera Sales Increase

The Money Flow Index (MFI) indicator shows that the Hedera (HBAR) selling pressure continues, with the indicator value dropping below the neutral threshold of 50.0 and now in negative territory. This indicates that capital outflows are more dominant than inflows. This suggests that investors are still skeptical of a possible recovery in the near future.

When the MFI remains low, it reflects declining demand and reduced risk appetite. Such conditions often precede sustained price weakness, especially when momentum does not shift back to accumulation. Investors and market analysts should be wary of the potential for further downside if this situation persists.

Also Read: 5 Realistic Ways to Earn 2 Million in a Day, Here’s the Secret!

HBAR Still on a Downward Trend

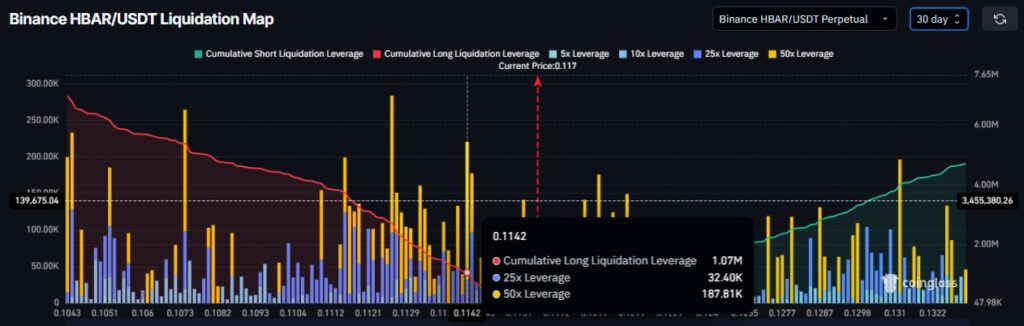

The price of Hedera (HBAR) has been in a clear downward trend for almost two months. Currently, the token is trading near $0.117, just slightly above the $0.114 support level which has been acting as a short-term defense against deeper losses. Given the prevailing bearish momentum, the probability of losing this support remains high.

If this support breaks, it will likely trigger the expected liquidation. This move could push HBAR towards $0.109, reinforcing the broader structure of the decline. However, a recovery scenario is still possible. If bullish momentum returns and selling pressure subsides, HBAR could move higher.

Opportunity for HBAR Price Recovery

Although current conditions seem bleak, there is a possibility of recovery for Hedera (HBAR) if market conditions change. A sustained push above $0.120 could improve market sentiment. Furthermore, breaking $0.125 would thwart the bearish thesis, signaling renewed strength and a short-term trend reversal. Investors should monitor key indicators such as MFI and important support levels to identify potential trend changes. A deep understanding of market dynamics and quick response to changing conditions can help in making informed investment decisions.

Conclusion

With continued selling pressure and a weak market structure, Hedera (HBAR) faces challenges to reverse the downward trend. However, opportunities for recovery still exist, depending on changes in momentum and market sentiment. Investors and traders should remain vigilant and be ready to adjust their strategies according to market developments.

Also Read: 10 Ways to Make Money from Games Quickly but Realistically (Online & Mobile)

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Hbar Price: Selling Pressure at Its Highest. Accessed on January 19, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.