Ethereum Slips to $2,900 as Whale and Institutional Activity Accelerates

Jakarta, Pintu News – Ethereum (ETH) experienced significant selling pressure in January 2026, as wallet whales and institutional players moved more than $110 million worth of ETH to major exchanges.

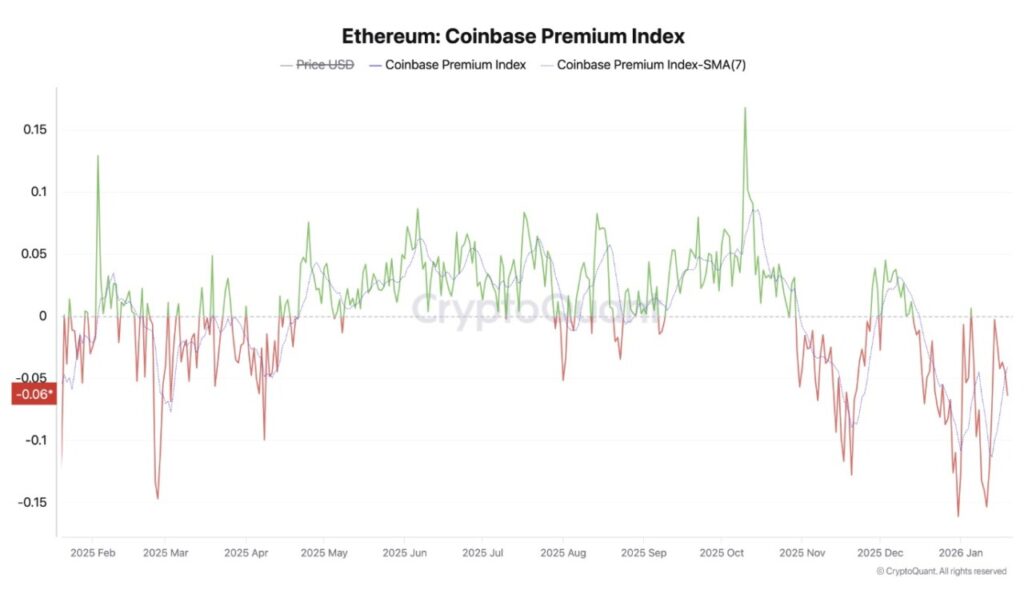

At the same time, the Coinbase Premium Index shows a decrease in demand in the US market. However, the growing demand for staking and favorable technical signals provide a fairly optimistic outlook for the asset.

Then, how will Ehereum price move today?

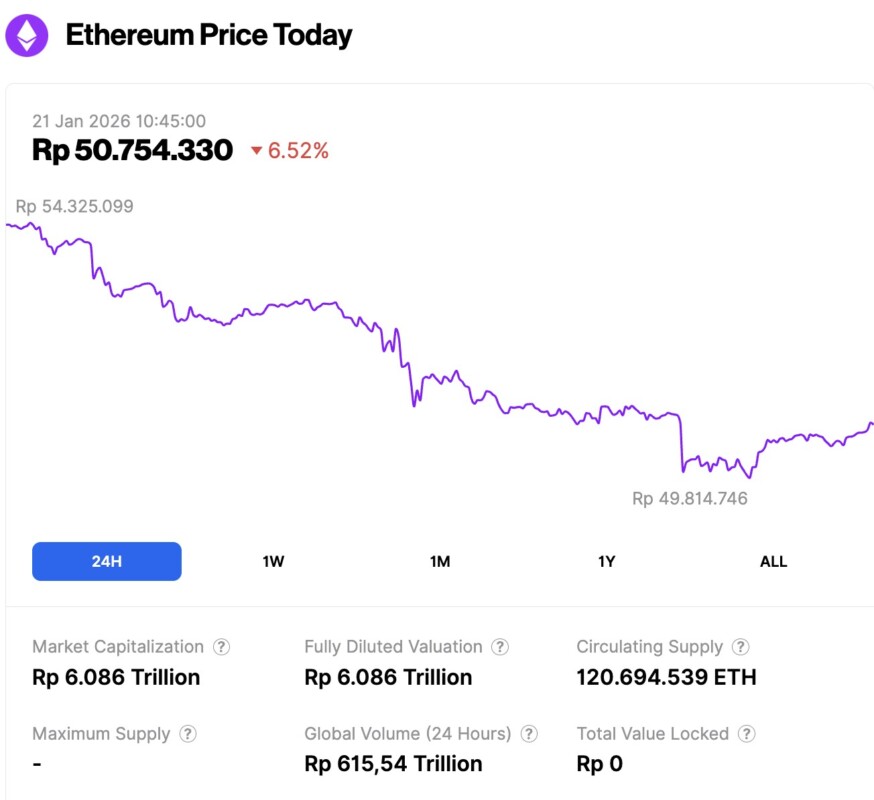

Ethereum Price Drops 6.52% in 24 Hours

On January 21, 2026, Ethereum was trading at approximately $2,978, or around IDR 50,754,330 — marking a 6.52% drop over the past 24 hours. During that period, ETH reached a low of IDR 49,814,746 and a high of IDR 54,325,099.

At the time of writing, Ethereum’s market capitalization is estimated at about IDR 6,086 trillion, while its 24-hour trading volume has surged by 91%, reaching IDR 615.54 trillion.

Read also: Bitcoin Drops to $89,000 – Is the Bull Run Coming to an End?

Whales Transfer Large Amounts of Ethereum

On-chain data shows a large spike in Ethereum transactions. Blockchain analytics firm Lookonchain reported that wallet 0xB3E8-which began trading ETH eight years ago-recently transferred 13,083 ETH worth approximately $43.35 million to the Gemini exchange last week.

Despite the large transfer, the wallet still holds 34,616 ETH, which is worth around $115 million.

Aside from whales, institutional players have also been active. Lookonchain notes that Ethereum treasury company FG Nexus has sold 2,500 ETH for about $8.04 million.

“Ethereum holding company FG Nexus today sold another 2,500 ETH ($8.04 million) and still holds 37,594 ETH ($119.7 million). Their last sale was in November 2025, when they transferred 10,975 ETH ($33.6 million) to Galaxy Digital on November 18 and 19,” the report reads.

High Ethereum Activity from Institutions

Furthermore, Lookonchain revealed that a wallet allegedly associated with venture capital firm Fenbushi Capital sent 7,798 ETH worth $25 million to Binance. These tokens had previously been staked for two years before returning to circulation.

It is important to note that inflows to exchanges are often viewed as an early signal of a potential sell-off, as assets are typically moved to centralized exchanges to obtain liquidity or conduct trades.

However, this movement does not necessarily mean that an outright sale will occur. The funds may also be allocated for internal purposes such as portfolio rebalancing, provision of collateral,hedging strategies, or settlement of over-the-counter (OTC) transactions.

Therefore, while a deposit to the exchange may increase the risk of selling in the short term, it does not automatically signal an imminent liquidation.

Along with this on-chain activity, market-based indicators also provide additional context regarding current conditions. The Coinbase Premium Index, which measures the price difference between Coinbase Pro (USD pair) and Binance (USDT pair), is currently in negative territory. This signals relatively weaker demand from US-based institutional investors.

Read also: As Ethereum Leads, Altcoins Rocket – Is this the Start of a New Trend?

Ethereum Staking and Technical Signals Show Market Resilience

Despite the selling pressure, the Ethereum staking ecosystem continues to show strong demand.

According to validator queue data, 2.7 million ETH are still waiting to enter the staking process, which currently has a waiting time of about 47 days. This backlog reflects the huge interest in validator participation and long-term support of the Ethereum network.

The comparison between the entry and exit queues is also a highlight. Currently, 36,960 ETH are waiting to exit staking. This imbalance indicates that while some large holders are selling, the majority of validators remain committed to earning returns from staking and helping keep the network safe.

In addition, market analysts have also highlighted technical signals that suggest further upside potential for ETH. An analyst named Crypto Gerla mentioned that Ethereum currently appears to be in a re-accumulation phase. He added that a move towards the $3,600 price could potentially happen.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Whales Make a $110 Million Move as Market Pressure Builds. Accessed on January 21, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.