Antam Gold Price Today, January 21, 2026

Jakarta, Pintu News – Antam’s gold price today, Wednesday, January 21, 2026, recorded another increase in line with the strengthening of world gold prices and the movement of the rupiah exchange rate against the US dollar. This increase continues the positive trend that has been seen since mid-January, driven by increased investor interest in hedging assets.

Based on the latest data, the world spot gold price is in the range of USD 4,831.60 per troy ounce, while the price of gold denominated in rupiah reaches around IDR 2,635,124 per gram. This movement indicates that global sentiment is still supportive of gold prices, especially amid economic uncertainty and financial market volatility.

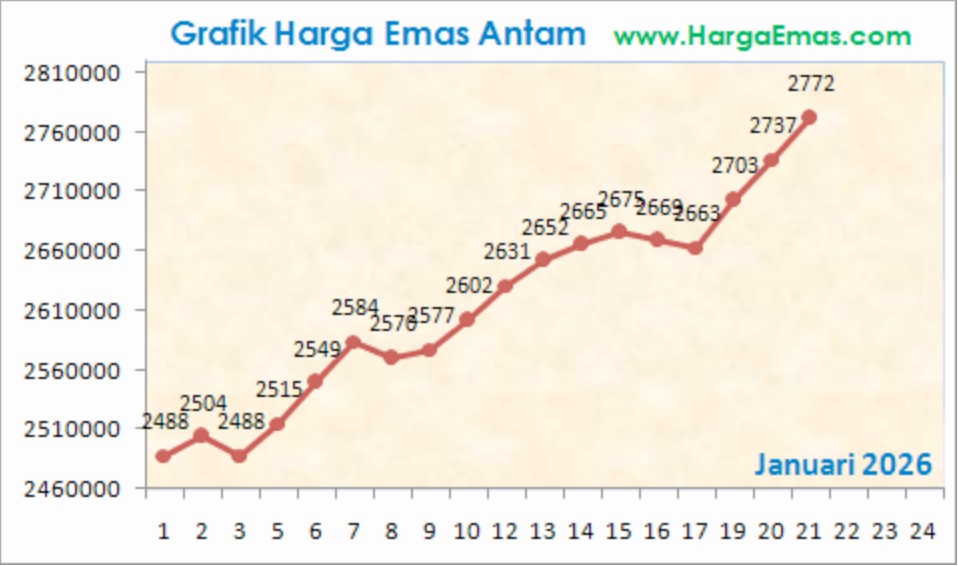

January 2026 Antam Gold Price Chart Movement

The Antam gold price chart throughout January 2026 shows a fairly consistent upward trend. Since the beginning of the month, the price of Antam gold has moved from the range of IDR 2.48 million per gram and gradually penetrated the level of IDR 2.6 million per gram. This increase was influenced by the surge in global gold prices and limited weakening of the rupiah exchange rate.

In the last few days, Antam’s gold price even scored a new high for January 2026. This relatively stable upward pattern indicates that selling pressure is still limited, while demand for physical gold is maintained, both for investment and hedging needs.

Also Read: 7 Trump Meme Coin Facts and Impact on US Crypto Policy

Factors Affecting the Antam Gold Price Today

One of the main factors driving Antam gold prices today is the increase in world gold prices. Geopolitical tensions, global interest rate policies, and high inflation expectations have made gold again seen as a safe asset. This condition has pushed international gold prices to move up in the last few sessions.

In addition, the movement of the USD/IDR exchange rate also plays an important role. Although the US dollar tends to be stable, fluctuations in the rupiah still affect domestic gold prices. When the rupiah weakens, the price of Antam gold in rupiah tends to rise faster than the global gold price movement.

Antam Gold Price Outlook Going Forward

Looking at the existing trends, Antam gold prices still have the potential to move volatile with a positive trend in the short term. As long as world gold prices remain at high levels and global risk sentiment has not subsided, gold is expected to remain the main choice of investors.

However, investors still need to pay close attention to global economic developments, the direction of central bank policy, and the movement of the US dollar. These factors could trigger a price correction in the short term, although the medium-term trend for gold is still considered relatively strong.

Conclusion

Antam’s gold price today, January 21, 2026, shows a significant increase in line with the strengthening of world gold prices and the dynamics of the rupiah exchange rate. The January 2026 chart confirms a consistent upward trend, although still accompanied by potential fluctuations. For investors, gold is still relevant as a hedging instrument, but still needs to consider the risk of short-term price movements.

Also Read: 7 Facts XRP Longs Liquidated $5 Million: Analysis of Impact and Crypto Market Direction

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- HargaEmas.com. Antam Gold Price Chart January 2026. Accessed January 21, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.