3 Altcoins That Could Trigger Major Liquidations This Week

Jakarta, Pintu News – At the start of the third week of January, total liquidations across markets reached nearly $900 million. This spike was due to negative volatility triggered by the impact of Trump’s tariffs on the European Union. The figure could potentially continue to rise as some altcoins are showing warning signs.

XRP (XRP), Axie Infinity (AXS), and Dusk (DUSK) are currently attracting capital and experiencing increased leverage activity for various reasons. However, these assets can be a trap for investors if not accompanied by a strict risk management plan.

XRP

On January 19, the price of XRP dropped to $1.85 before recovering back to $1.95. This drop wiped out most of the recovery efforts that took place since the beginning of the year.

Read also: XRP Slips Below $2, but Analysts Still See a 5X Rally Ahead

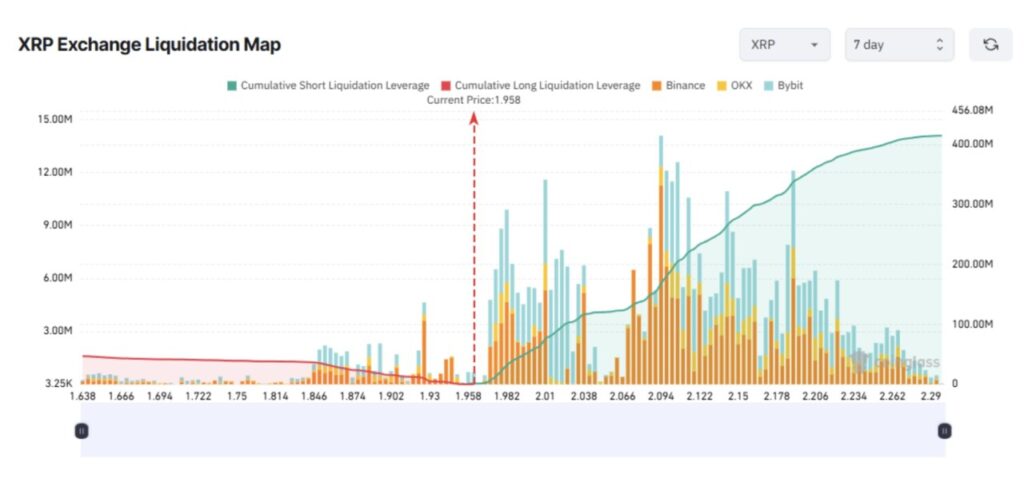

Short-term traders are looking increasingly pessimistic, with many of them placing short positions as they expect further declines. The 7-day liquidation map shows that the liquidation potential for Short positions is greater than Long positions.

Liquidation data shows that if XRP rises back to $2.29 this week, Short positions could see over $600 million worth of liquidation.

This scenario could happen if market concerns regarding new tariffs from Trump subside quickly. Strong buying demand in the $1.8 price range would also support a potential price recovery.

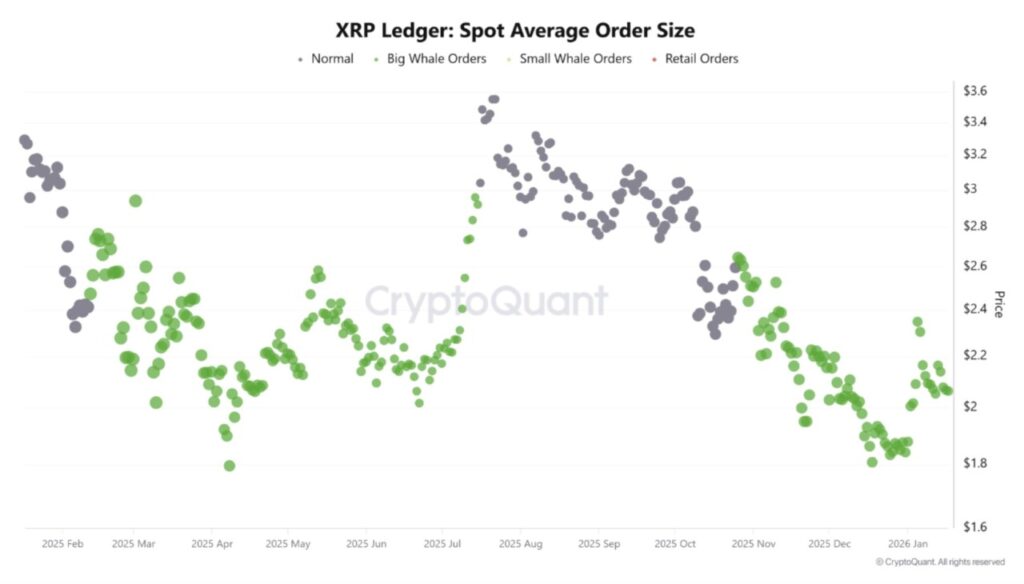

One other important metric is the average size of XRP spot orders. Data from CryptoQuant shows that when the price of XRP is below $2.4, there are many large orders from whales. This pattern reflects strong interest from large investors at lower price levels.

“Whale interest is at its highest in 2026. Large orders dominate the market, suggesting that ‘Smart Money’ is moving in early before the next price spike,” said an analyst from CryptoQuant.

If the accumulation by the whales surpasses the temporary fear in the market, XRP could potentially recover quickly. This could trigger a massive liquidation of traders who are short.

Axie Infinity (AXS)

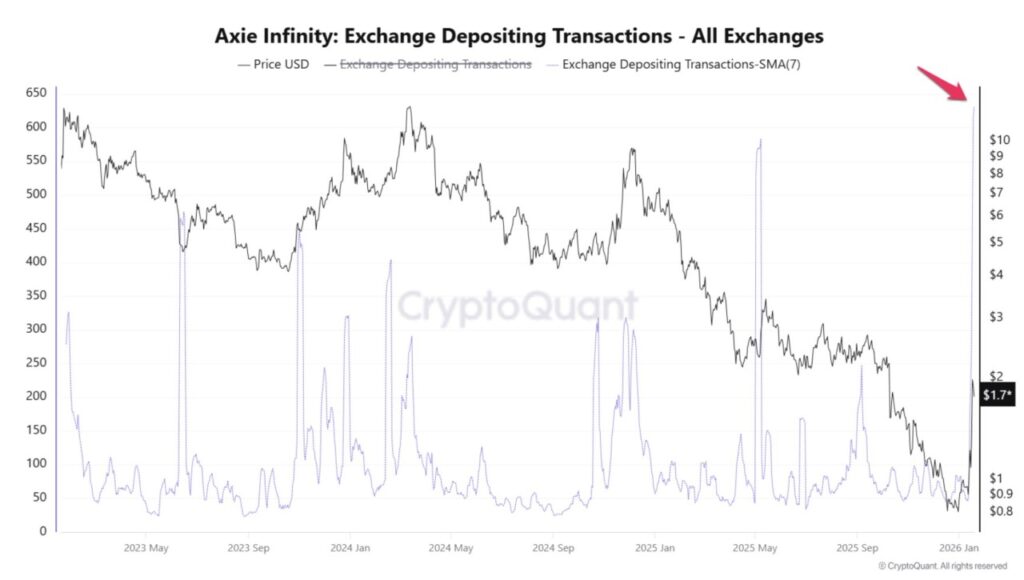

Axie Infinity (AXS) unexpectedly became one of the most talked about tokens in the third week of January. The token has recorded a gain of over 120% since the beginning of the year.

The price increase in January was driven by the Axie founders’ plan to change the reward system to a new utility token called bAXS. This change is part of the tokenomics restructuring planned for 2026.

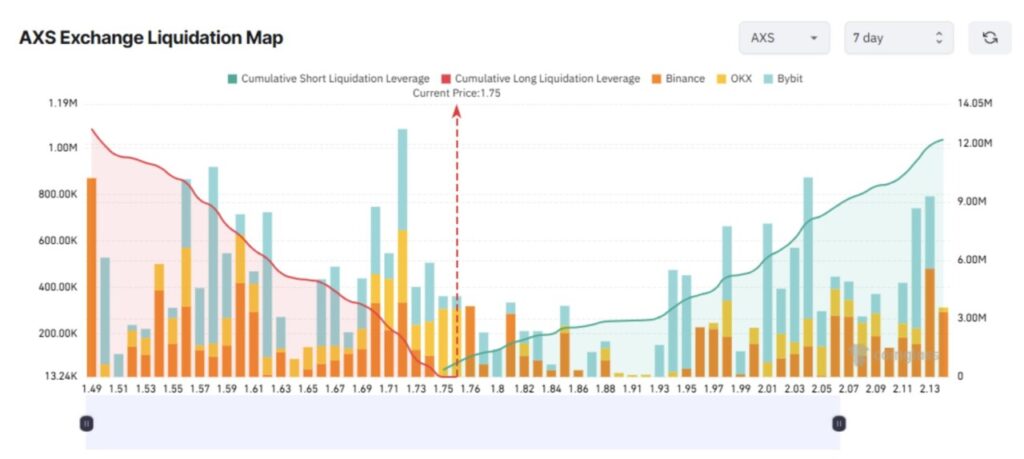

The 7-day liquidation map for AXS shows a potential liquidation of around $12 million. However, the price range required to liquidate a Long position is narrower than a Short position. This suggests that many traders are still optimistic about price increases in the short term.

However, the data also showed a sharp spike in the number of AXS deposits to the exchange during January. The 7-day average of deposit transactions reached a three-year high.

This trend indicates that many investors are planning to exit as prices rise, potentially creating selling pressure at any time. If that happens, long positions could be at great risk.

Read also: Altcoin Season Fades, Bitcoin Resurges as Market Ruler?

Dusk (DUSK)

Dusk is emerging as a new highlight amid growing interest in privacy coins. The rise in DUSK’s price reflects capital shifting from large-cap privacy coins to smaller-cap alternatives.

Despite having risen nearly six-fold since the start of the year, DUSK has already caused major liquidation of Short positions in the past four days. Short-term traders continue to put in capital and increase leverage on bullish positions.

The DUSK liquidation map shows that the biggest potential for liquidation is in Long positions. If prices correct this week, Long positions will be at serious risk.

A recent report from BeInCrypto noted increasing inflows of DUSK to exchanges. This reflects potential selling pressure due to profit-taking. In addition, the DUSK rally comes amid growing market concerns over Trump’s new tariffs against Europe, which could threaten the sustainability of the upward price trend.

In October last year, DASH briefly rose six-fold after a capital rotation from ZEC to small-cap privacy coins, but then fell 60% in the following week. DUSK faces the risk of a similar scenario.

If the market euphoria (FOMO) towards DUSK subsides and the price drops below $0.13, the total liquidation of Long positions could reach $12 million.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins Could Trigger Liquidations in 3rd Week of Jan. Accessed on January 23, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.